How to invest in gold and silver with cryptos

Gold and silver are ancestral safe havens, highly valued by investors for diversify and secure their portfolio. Until recently, investing in gold and silver was quite restrictive for the individual. If only by their tangible side requiring purchase and physical storage.

Fortunately, the arrival of cryptocurrencies changes the situation and today opens up a whole range of new ways to invest in gold and silver, either directly or indirectly. But how to proceed concretely to invest optimally ?

Ready to diversify smartly your portfolio with a new generation exposure to gold and silver thanks to cryptos? In this complete article, you will know everything.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Let's go !

🌿 5 ways to invest in gold

If you want to start investing in gold, it's simple. Finance de Demain offers you 5 ways to get started as soon as now to invest. Read until the end

🚀 Gold-backed stablecoins

It's here easy way to invest in the yellow metal through blockchain and cryptocurrencies. The principle ? Each token of this type of cryptocurrency is guaranteed by a physical quantity of fine gold stored in secure vaults with specialized companies.

Several projects offer this kind of stablecoins indexed to the price of an ounce of gold. We have for example, Tether Gold (XAUT), PAX Gold (PAXG), DigixDAO (DGD) or even OneGram. When you buy these cryptocurrencies, you somehow become the owner of an underlying gold fraction.

These cryptos have the advantage of offering direct exposure to physical gold without requiring the burdensome purchase and storage of bullion. But simply in holding digital tokens representative of the precious metal stored in professional vaults.

Gold-backed stablecoins also allow for flexible transfers thanks to the blockchain. Their security relies on the certification and public auditability of the gold reserves held as collateral. Brief, a promising innovation !

✔️ Benefits:

- Allow you to invest in gold without physically holding it

- Provide secure exposure backed to the spot rate

- Significant liquidity thanks to blockchain and exchanges

- Investment Accessibility, low entry ticket

❌ Disadvantages:

- Counterparty risk if backing to the metal is not sufficiently guaranteed

- Intrinsic Gold and Silver Price Volatility

- No direct return, only the evolution of the price varies the value

- Existing transaction fees but generally limited

🚀 Platforms for investing in gold

Beyond stablecoins, more and more platforms offer to invest in gold in a dematerialized way through blockchain technology. One can cite for example Kinesis Money, GoldMint, OneGram, Anthem Gold or Aurus.

The general principle is as follows: you buy via these platforms digital tokens representative of a certain amount of gold. These tokens are backed by physical gold stored in high security vaults around the world.

They can be exchanged at any time for fine gold (ingots or coins) if you wish it. The major advantage of these digitalized gold investment solutions is that they allow exposure to the precious metal in a fractional way.

Get to gold thus becomes possible from just a few euros!

✔️Advantages:

- They allow a fractional investment in the precious metal

- Tokens are backed by physical gold/silver auditably stored

- Possibility to get gold or silver physical at any time

- Some distribute dividends to enhance the attractiveness

❌ Disadvantages:

- Transaction fees existing ones that eat away at yields

- Counterparty risk, need to trust platforms

- Absence of guaranteed return, spot rate dependent

- Relative technological complexity

🚀 Gold mining by NFTs

Among the most innovative applications is investing in gold mining via NFTs (non-fungible tokens). By purchasing this type of gold-backed NFT, you finance real mining operations, and can receive part of the production in the form of physical bullion or stable cryptocurrencies.

For example, the company NFT Metal proposes to acquire NFT symbolizing mining land. Holders receive monthly part of the gold extracted from these mines. THE AnRKey X project works similarly but pays out revenue in gold-backed stablecoins.

✔️ Benefits:

- Direct production financing real precious metal

- Strengthening the tangible nature of the investment

- Return on contractual investment via cryptos mined and distributed

- Investment splitting, accessibility

❌ Disadvantages:

- Technological and legal complexity of assembly

- Lack of track record and decline in the sector

- Risk of fraud or exaggeration of returns

- No real return guarantee provided

🚀 Invest in mining companies

Other option: invest in mining companies specializing in the extraction of gold and other precious metals.

La KR1 platform has for example developed a crypto fund investing in companies related to mining resources. By buying his tokens, you expose indirectly to this sector.

Another example is the MetalStream marketplace, which allows you to invest in gold or silver mines, listed or not, by purchasing their shares digitally via the blockchain. The interest is clear: these innovations democratize investment mine with an accessible entry ticket.

✔️ Benefits

- Allows diversify your exposure on different metals and many mines

- Opens access to unlisted mining companies

- Return on investment linked to the real financial health of the companies

❌ Disadvantages

- Inherent high risk to the mining sector, particularly on small caps

- Requires a drastic selection of the strongest companies

- Performance dependent on external factors difficult to predict

- Mining investment is part of the very long term

🚀 Gold/crypto trading using leverage

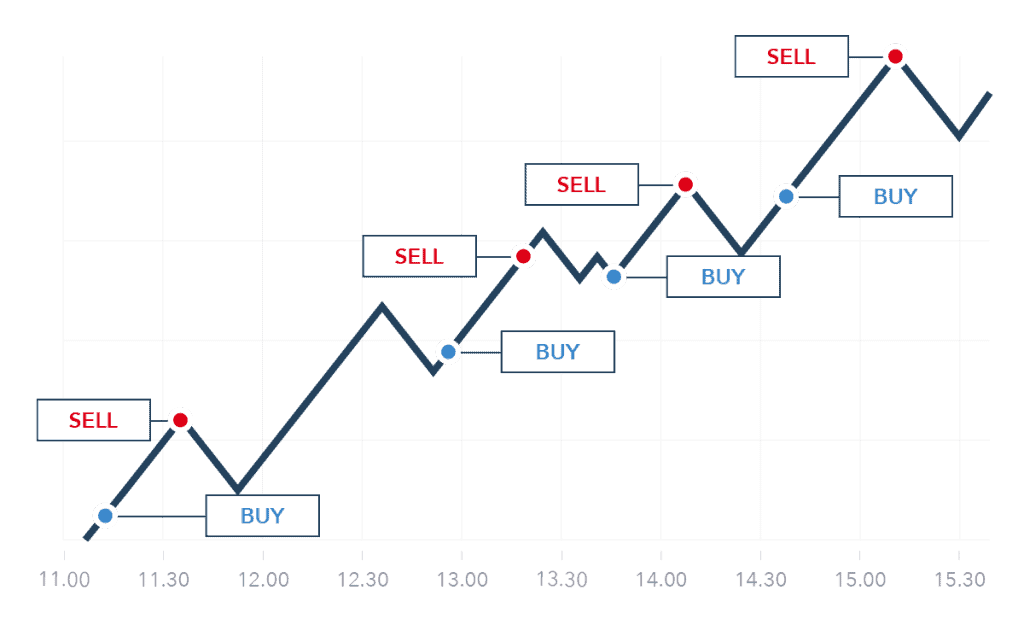

Crypto trading platforms open up the possibility of speculating on the evolution of the price of gold and silver.

Brokers like Bitfinex, Binance ou Coinbase offer futures contracts between cryptocurrencies and precious metals. These contracts have a strong effect of leverage up to 1:100.

Concretely, the trader who anticipates a rise in gold will, for example, buy a Gold/Bitcoin contract by betting on an increase in the price of an ounce of gold in dollars compared to the price of BTC in dollars.

If indeed gold increases in value, compared to Bitcoin over the period, the trader will be able to resell his contract with a profit.

This allows us to speculate on gold without owning it. But beware, trading with leverage is very risky and involves rigorous management. For experienced traders only!

✔️Advantages:

- Lets speculate on precious metals without buying backed assets

- Powerful leverage allowing to open important positions with little

- Accessible to everyone via online trading platforms

- Reduced fees compared to trading on ETF trackers for example

❌ Disadvantages:

- Very high risk related to price volatility and leverage

- Requires rigorous risk management

- Significant possibility of capital losses in the event of an adverse movement

- The frequent transaction fees can eat away at the profits

- So are cryptocurrencies, hence a increased volatility effect

- Reserved for traders experienced and disciplined in their risk management

🌿 Conclusion: how to invest in gold

Cryptocurrencies have undeniably opened up new opportunities for investing in precious metals such as gold or silver. Whether of direct or indirect way.

Between backed crypto-assets, dedicated investment platforms, speculative trading solutions or even the tokenized purchase of mining company shares, the possibilities are endless.

It now remains to choose the strategy that best suits your objectives, your budget and your risk appetite. Whatever your approach, bet above all on diversification between several media so as not to “put all your eggs in one basket".

Keep in mind that both gold and silver are part of a logic long term investment, to intelligently secure and diversify your portfolio over the long term. Under no circumstances should they constitute your only investment.

Thanks to cryptocurrencies, invest in precious metals becomes more flexible and accessible. It is now up to you to wisely seize these new opportunities to consolidate your savings in the face of potential economic or geopolitical upheavals to come. But before leaving YOU, here is How to get out of debt?

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Leave comments