How to withdraw PayPal money without a card in Africa?

Many people have had difficulty withdrawing their money from PayPal for years. In fact, after making a sale on the internet, PayPal customers who have not linked a bank card to their Paypal account may have problems collecting their money. Even worse if you live in Africa. If you reside in Africa and experience these difficulties in withdrawing your money on PayPal, Do not worry anymore. Today I come with a solution to your problem.

In this article, I show you how to withdraw your PayPal money by Orange money, MTN Money, etc. In short, I show you how to withdraw your PayPal money by Mobile Money. You will just need a mobile phone and the Xoom app.

But before, if you want to earn money with 1XBET without investing, click here to create your account and benefit from 50 FCFA to start. Promo code: argent2035

Get 200% Bonus after your first deposit. Use this promo code: argent2035

What is Xoom?

Xoom, a PayPal service for transferring money worldwide. It is perhaps the most awaited PayPal solution for transferring funds to other parts of the world especially Africa.

While this does not solve the problem of African freelancers and digital entrepreneurs receiving online payments from service platforms, it does allow them to receive money from family and friends.

PayPal's Xoom allows someone in the US, Canada, Europe, etc., with a valid PayPal account, to transfer money from PayPal to Nigeria, Cameroon and other third world countries. Funds can be transferred directly to a bank account or by direct withdrawal through partner agencies.

Xoom is an alternative to Western Union and MoneyGram. It first entered the money transfer scene in 2001. Acquired by PayPal in 2015, the international transfer service enables customers to send money online to 158 countries around the world, including Italy, Germany, France, Australia, Philippines, India, Canada, United Kingdom, Mexico, Argentina and Brazil.

Xoom Money Transfer Payment Options

Three payment options are available for Xoomers:

- Bank account

- Debit card

- PayPal Balance

Xoom is a PayPal service, so you can use your PayPal balance to make payments. According to their website, “Your PayPal balance will appear as a payment option if you have enough available balance to pay for your entire Xoom transaction.

How useful is Xoom for Africans?

PayPal has been and remains the most secure online payment processor. However, many African countries and online entrepreneurs are being harmed. The ease and security of PayPal makes it quite widely used. I think Xoom is their effort to safely expand into Africa and other third world countries in the money transfer industry.

As a freelancer who earns commissions on job platforms like UpWork, Fiverr, Freelancer, or as an author who sells products online, you will need a valid overseas PayPal account to receive your funds. Xoom will help you transfer funds to Africa at a very competitive rate.

But if you have someone who wants to send you funds via credit card, bank deposit, or PayPal, this is arguably the most affordable method.

How do I link my PayPal and Xoom accounts?

When you send money to the United States or certain countries, PayPal handles your transaction and you'll normally see the payment details in your PayPal account.

However, if you send an international payment for one of the reasons below, your payment is processed by Xoom, a PayPal service that offers worldwide money transfers. You will be asked to sign in to your Xoom account to be able to:

- Send money to a recipient's bank account.

- Send money for cash pickup or home delivery.

- Top up a prepaid mobile phone.

- Pay an international bill.

How to transfer PayPal funds

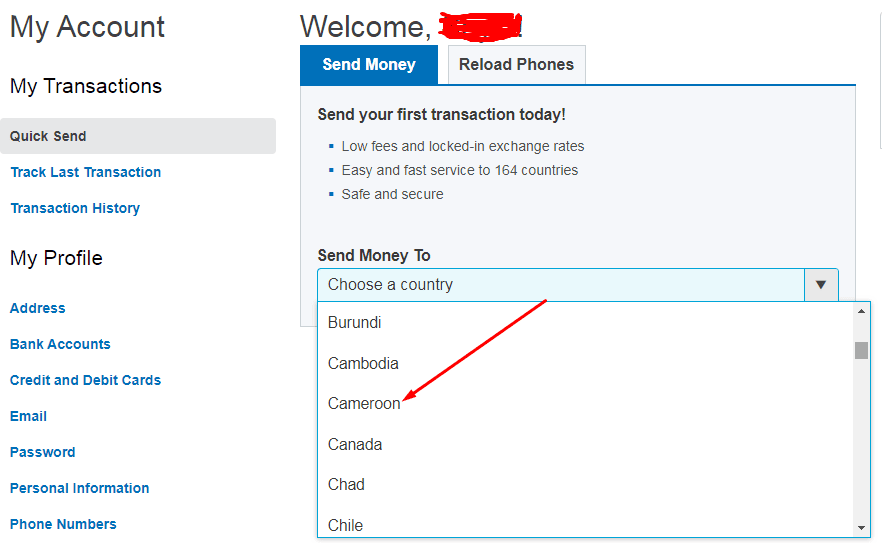

If you're outside Cameroon and want to make a secure money transfer to Cameroon (from your PayPal balance) without risking your card data being compromised, you need to give Xoom a try. This is valid for the majority of African countries.

The advantages are many:

- Low fees

- The recipient can pick up anywhere in Cameroon

- You can make a direct bank deposit in all banks in Cameroon

- The transfer is fast and secure

Here are the different steps to send money from your PayPal account to your Country

Step 1:

Sign up for a free account

Step 2:

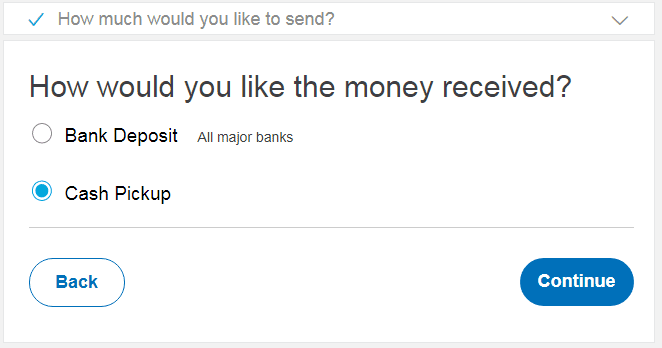

Select money transfer options, including the name and country of the recipient, the amount and the method of delivery (bank deposit, cash pickup or home delivery).

Step 3

Enter the recipient's information, including full name, address, name of bank and account number.

Step 4:

Enter terms of sale. Customers can choose to pay from their checking account, debit card or credit card. (Xoom does not accept cash as a source of funding.)

Step 5:

Check the details and confirm the transfer.

Once they have a Xoom account, customers can log in and quickly send money to friends and family from their mobile phone, tablet or computer. When you transfer money through Xoom, your recipient can receive the transfer in local currency or US dollars.

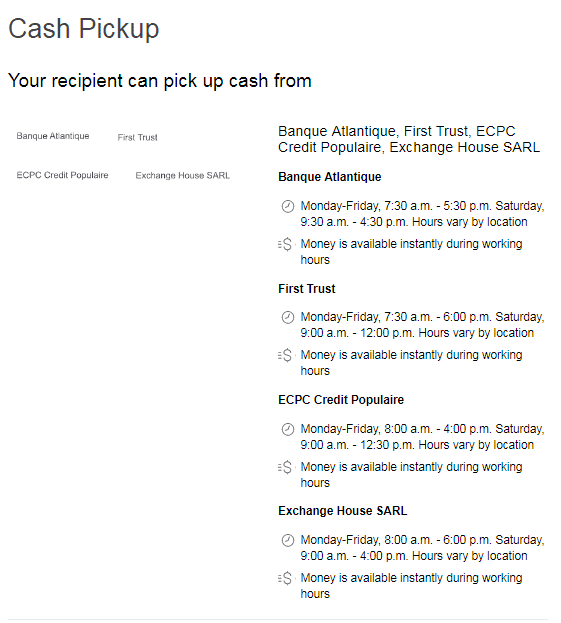

At the time of writing, Cash Pickup is available from Banque Atlantic, First Trust, ECPC Crédit Populaire and Exchange House SARL. I know this will increase rapidly over time.

Recharge your mobile phone in Cameroon, Nigeria and Africa with PayPal

Let me walk you through the process of buying airtime for any phone number in Cameroon (MTN and ORANGE). I don't have Nextell at the moment to try.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

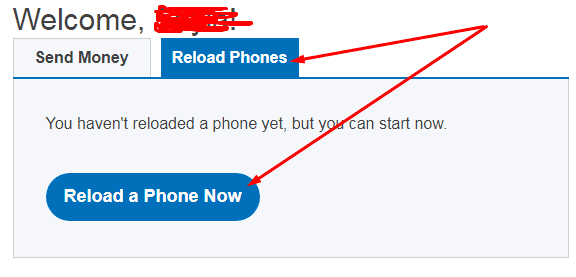

Go to Quick Start -> Recharge Phones

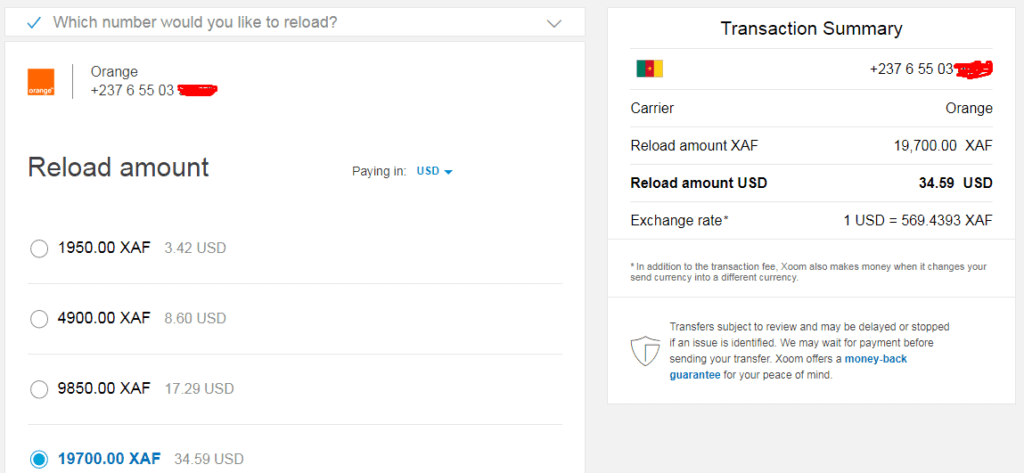

Then select the country of the phone, enter the number you want to recharge or select from the list:

Xoom will automatically detect the carrier and if the number is valid. Again, it's quick and cheap. They have a flat rate of $1,49 per transaction to Cameroon and the maximum top up amount at the time of writing was 19700. I don't know if this is unique to my Xoom account.

NB: If you are running the app for the very first time, PayPal may require certain authentication actions to ensure that your account is not hacked.

How much does the Xoom transfer cost?

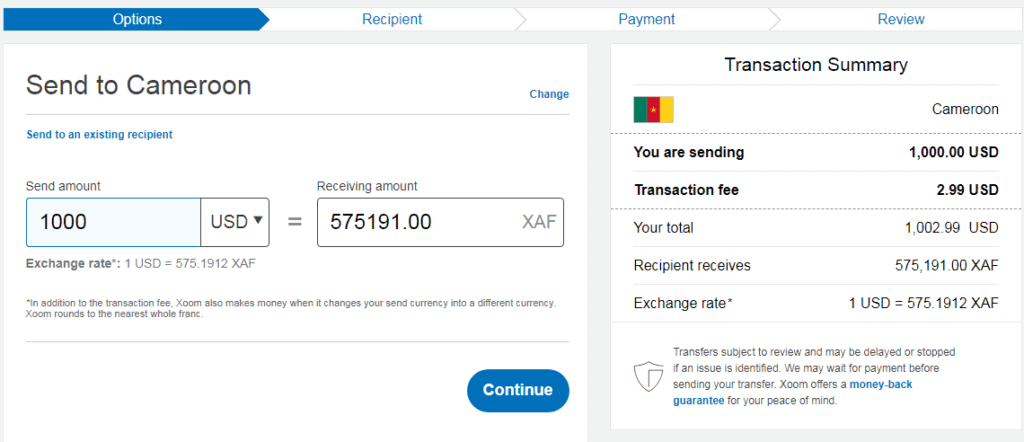

Xoom's service fees vary depending on your country, the country you're transferring money to, your funding source, the payout currency, and the overall transfer amount. You will pay the lowest fees if you transfer money through a US bank account.

However, the transaction may take up to four business days for Xoom to receive the funds from your bank. If you pay with a credit or debit card, the fees are slightly higher, but transactions are processed faster.

The majority of Xoom transactions are sent to Mexico and the Philippines, funded from a bank account and paid out in local currency. For these transactions, the customer pays flat fee of $4,99.

Xoom offers a fee and exchange rate calculator to help customers determine the total price of the transfer as well as how much their recipient will receive (depending on exchange rates.)

Suppose you want send $500 to a friend in Ireland. According to the Xoom calculator, it would cost you a total of $4,99 to send the money from your bank account. Alternatively, if you wanted to pay with a credit or debit card, you would pay a total of $15,49 in fees.

Fees are much lower for some countries. For example, If you wanted to send $500 to a family member in Chad, it would cost you a total of $2,99, whether you paid with a credit/debit card or directly from your Account.

Pros and cons

The main advantage of Xoom is the price. The service claims to offer lower prices on international money transfers than Western Union and MoneyGram. Xoom makes its money from transaction fees, as well as exchange fees charged when money is received in a currency other than US dollars.

According to the Xoom website, its transfer service is also extremely secure. Xoom says it uses 128-bit data security encryption to protect all information sent between the customer's web browser and its website. The company is certified and accredited by third-party privacy organizations and regulated by U.S. federal and state government agencies.

Xoom also offers a money back guarantee. If for any reason your money is not received by your recipient, they will refund your transaction in full.

So what about the downsides?

Some reviewers complain that Xoom often plays too safe, resulting in additional customer hassle and long processing times.

The service has received numerous complaints on the Consumer Affairs website in which customers report that their money was held too long, Xoom agents asked too many " unrelated questions ” and, in some cases, Xoom requested additional proof or information, such as bank statements.

Of course, taking these extra steps (and refusing to accept cash as a source of funding) are good ways to avoid money laundering schemes and terrorist financing.

Xoom vs. WorldRemit

For about a year now, I've been using WorldRemit to receive payments from the US and Europe. I also received funds from PayPal via WR. Here's how it goes:

- You link a valid bank account to PayPal

- Transfer Funds from PayPal to Bank Account

- Next, link the bank account to your WordRemit account

- Transfer funds from your foreign bank account to a local bank account, thanks to Worldremit

But I personally think Xoom is a serious thread for WR. The reason lies in the charges and the time. With WorldRemit, you lose a lot of money along the way. You'll also need a foreign bank account to work, which isn't necessary with Xoom.

Leave us a comment

Thank you Docta for your explanations. It's very interesting

It is a pleasure to serve you

Thank you very much doctor but I would like to have your coordinates I would like to develop several things with you!!!

it's very edifying as a tutorial I even tried a money withdrawal simulation but there are only proposals on mobile money not on orange money

Ok, if you have found satisfaction with the other networks it's a good thing

Hello Faustin,

Really interesting your info.

For my part, I would like to receive money from paid survey sites: one based in Europe and the other in the USA.

So if I understood correctly, all I have to do is 1) have a Paypal account created in France for example, 2) choose it as a means of payment and 3) after transferring the funds to this Paypal account, go via Xoom to make a bank transfer to my local bank here in Cameroon. Is it correct?

What you need to know is that Xoom only serves you when you don't have a card linked to your PayPal account.

Hello Mr. Faustin I hope you are well. I would like to know how to withdraw money from goods and services securely on PayPal

You can withdraw with your credit card

Hi, I recommend an African country like Senegal; Lesotho. For we will ask you for papers of the resident of the country. You also need to create a business account.

I have a solution with crypto currencies I buy my ustd with my paypal then I sell it to receive either orange money or wave

Where do you buy your cryptocurrency through PayPal?

Hello thank you for your article is edifying indeed I have a PayPal account which was created in France I have a sales and services site which targets countries like Canada and France I regularly receive payments from Canada but I currently reside in Cameroon the account is not linked to any bank account or card I would really like to know I was in Uba a manager told me that PayPal money withdrawals in Cameroon is impossible how to do s 'please

Hello to you, to answer you honestly I would say that what this gentleman says is not true. My primary PayPal account is using UBA VISA card and I have no issues. If linking your card still fails try creating a personal PayPal account. Contact UBA at this address after linking to get your verification code. [email protected]

I downloaded Xoom but they tell me that Cameroon is not part of the service

Hello for paypal, payoneer, ADvcash withdrawals you can consult the Paypalcamer Facebook page

For my part, I encountered a lot of problems with Xoom: money that does not arrive in bank accounts for example. In addition, Xoom does not always offer payment with its Paypal balance, which is a shame.

To allow people to withdraw their Paypal money, I have set up a money transfer system. now, you can receive your Paypal balance on your mobile wallet (Orange Money, Momo, MTN etc…) or at the counter near you.

Which system please?

Sorry for the late response. It's on DenelPay.

Hi, I'm in Burundi I created a personal PayPal account with a South African number but when I want to link it to xoom I'm asked for a US or Europe number. can do?

Just select your country of residence in Xoom

Hello Faustine I'm Rebecca I've been in Cameroon for a month since I received money in India in my PayPal I can't transfer it to my MTN money account I don't have a bank card how to do?

How much is the duration of the transfer to the account after transfer

Hello doctor,

Please since xoom only works for those who live in the west wanting to send money to Africa, how to open your PayPal account in Cameroon with a number from abroad in order to use Xoom please please!

Cordially !

This is not possible since it is necessary to verify the number

What to do when the Xoom application is not eligible in our country?!

find other ways

When I try to download xoom Google replies that I am in an uncovered geographical area, I am in Cameroon, what should I do in this case?

You are racists. You never loved us. For you, profit is everywhere. I don't like you either.