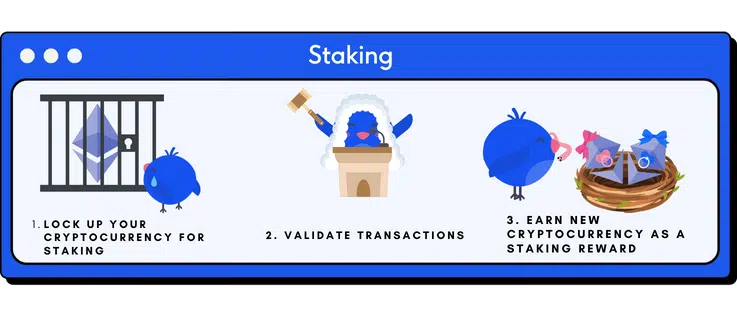

How to earn cryptocurrencies with staking?

Like many aspects of cryptomonnaies, staking can be a complicated or simple concept, depending on your level of understanding. For many traders and investors, staking is a way to earn rewards by holding certain cryptocurrencies. Even if your only goal is to get staking rewards, it is still useful to understand a little about the how and why it works.

While many speculators buy and sell cryptocurrencies for profit, another group of crypto owners profit from the revenue generated from staking.

Staking rewards are a kind of income paid to crypto owners who help regulate and validate transactions of a cryptocurrency. In this sense, staking rewards are like a dividend or interest in a savings account. However, it has a much greater risk.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Let's go

🥀 What is staking?

Staking is a key element of cryptocurrencies that operate using validation “ proof of participation ". In a proof-of-stake system, investors who own the cryptocurrency can help validate transactions against the blockchain database of a given cryptocurrency. Typically, they must own a minimum number of coins to verify transactions, and then they are allowed to become a validator.

Miners are those who validate transactions in a blockchain. To do this, they are rewarded with a cryptocurrency. But it is not a risk-free process for those who stake their coins and become validators. Stakers could lose part of their investment by approving transactions that do not comply with a cryptocurrency's rules.

Even those who don't have enough to become a validator themselves can stake their coins with a validator and win rewards. So, those who only have a few coins can earn staking rewards if they work with a crypto exchange. Rewards can be deposited into your account as they are earned.

🥀 How does cryptocurrency staking work?

There are many ways to get involved in staking. These include staking on a cryptocurrency exchange or joining a staking pool.

Betting on a cryptocurrency exchange

Staking through a cryptocurrency exchange means that you make your crypto available through an exchange for use in the proof-of-stake process. Essentially, it allows holders to monetize their crypto holdings that would otherwise sit dormant in their crypto wallet.

In this approach, the exchange does much of the administrative work for you, finding a node to join so you don't have to do it yourself. It is not entirely without risk, however, you have to take the risk of entrusting your coins to the exchange and the node in question.

Join a staking pool

A staking pool allows stakers to earn block rewards by sharing their resources. It works the same way as a mining pool. These pools tend to follow a system two-tier, with an administrator overseeing the work of the validators and ensuring that everything goes well.

When rewards are earned, they are split between the pool operator and pool delegates. But some pools also charge entry and membership fees.

🥀 How to stake cryptocurrencies exactly?

Cryptocurrency staking might seem a bit confusing the first time around, but it's a simple process. Here is how to stake cryptocurrencies step by step:

1. Buy a cryptocurrency that uses proof of stake.

Not all cryptocurrencies offer the possibility of staking. You need a cryptocurrency that validates transactions with proof of participation. Here are some of the main cryptocurrencies you can stake and a bit about each:

Ethereum It was the first cryptocurrency with a programmable blockchain that developers can use to build apps. Ethereum started using proof-of-work, but is moving to a proof-of-stake model.

Cardano. EIt is an ecological crypto-currency. It was founded on peer-reviewed research and developed using evidence-based methods.

Polkadot. It is a protocol that allows different blockchains to connect and work with each other.

Solana. It is a blockchain designed for scalability as it offers fast transactions with low fees.

Start by learning more about all the proof-of-stake cryptos that catch your eye, including how they work, their staking rewards, and the staking process with each. Then you can search for the crypto you want and buy it on apps and cryptocurrency exchanges.

2. Transfer your crypto to a blockchain wallet.

After purchasing your crypto, it will be available on the exchange where you purchased it. Some exchanges have their own staking programs with certain cryptocurrencies. If so, you can simply stake the crypto directly on the exchange.

Otherwise, you will need to move your funds to a wallet blockchain, also called crypto wallet. Wallets are considered the best way to securely store cryptocurrency. The quickest option here is to download a free software wallet, but there are also hardware wallets available for purchase.

When you have your wallet, choose the crypto deposit option, then select the type of cryptocurrency you are depositing. This will generate a wallet address. Go to your exchange account and choose the option to withdraw your crypto. Copy and paste this wallet address to transfer your crypto from your exchange account to your wallet.

3. Then join a stacking pool

Although staking may work differently depending on the cryptocurrency, most use staking pools. Crypto traders combine their funds in these staking pools to have a better chance of earning staking rewards.

Find available staking pools for the cryptocurrency you have. There are a few things to look for here:

Reliability : You do not earn rewards when servers in your staking pool are down. Choose one that has availability as close as possibly 100%.

Reasonable fees : Most staking pools take a small portion of staking rewards as a fee. Reasonable amounts depend on the cryptocurrency, but 2% to 5% is common.

Size allowed: smaller pools are less likely to be chosen to validate blocks, but offer bigger rewards when chosen, because they don't need to split the rewards as much. You don't want a pool that's too small and prone to breaking down.

On the other hand, some cryptos limit the amount of rewards a pool can earn, so larger pools can become oversaturated. For most investors, mid-sized pools are best.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Once you find a pool, put your crypto into it through your wallet. That's all you have to do and you'll start earning rewards.

🥀 Is cryptocurrency staking profitable?

Anyone can earn crypto by staking. But unless someone is sitting on a huge stash of proof-of-stake coins, they are unlikely to get rich from staking.

Staking rewards are similar to stock dividend payments. This is in the sense that both are a form of passive income. They do not require the user to do anything other than keep the right assets in the right place for a given amount of time. The longer a user stakes their coins, the more potential profit there will be in general, thanks to compound interest.

But unlike dividends, there are a few variables unique to proof of stake coins that influence the amount of stake reward users are likely to receive. Users would do well to look for these factors and more when looking for the most profitable stake coins:

- What is the block reward size

- The size of the staking pool

- The amount of supply blocked

Additionally, the fiat currency value of the staked coin must also be considered. Assuming this value remains stable or increases, stacking could potentially be profitable. But if the price of the coin goes down, profits could decline quickly.

🥀 What are the benefits of crypto staking?

Cryptocurrency staking has many attractive benefits for cryptocurrency holders. First of all, it offers very high yields, much higher than those of the traditional market. In "lending” your cryptocurrencies to secure a blockchain network, you can hope for between 5% to 15% in annual gains, where the average return on the stock market peaks at around 7%.

Second advantage: staking is a source of passive income, once the initial process is configured. Your cryptocurrencies will thus generate continuous profits effortlessly. A boon to supplement your income!

Third advantage: participating in staking allows you to contribute to the decentralized and democratic functioning of blockchains based on proof of stake or “Proof of Stake“. You participate in securing a promising ecosystem.

Finally, the last significant advantage: income from staking is currently not taxable in most countries. A welcome tax optimization for crypto holders. Enough to significantly transform the profitability of crypto-asset portfolios!

🥀 What are the risks of crypto staking?

Cryptocurrency staking, which consists of immobilizing one's digital assets to validate transactions and secure a blockchain network, can be very profitable. But this practice also involves certain risks that should not be overlooked.

First of all, by deciding to stake your cryptocurrencies, they find themselves technically blocked during the staking period. Impossible to exchange or sell them quickly in the event of a hard hit. This constrained immobilization makes you lose liquidity and flexibility.

Second risk: the significant fluctuation of the value of crypto-assets. If the price of the currency chosen for staking suddenly collapses, the value of your portfolio risks also falling significantly. A risk of capital loss does exist.

Third pitfall to anticipate: technical and cybersecurity risk. Some blockchain protocols are still new and may have flaws or bugs that can be exploited by malicious hackers. The loss or theft of funds participating in staking cannot therefore be excluded.

Although potentially very lucrative, this practice therefore deserves some basic precautions on the part of users. A thorough risk analysis is necessary before getting started.

🥀FAQ

🌟 What is cryptocurrency staking?

Staking consists of immobilizing your cryptocurrencies to secure a blockchain network operating with a proof of stake protocol. It allows blocks and transactions to be validated, in exchange for rewards.

🤔 Why rely on staking?

Staking allows you to generate very lucrative passive income on your cryptocurrencies, with annual returns of around 5% to 15%. It is also a way to participate in the decentralized security of a blockchain protocol.

💰 On which assets can you stake?

Many cryptocurrencies such as Cardano, Polkadot, Tezos, Cosmos, Ethereum 2 or Near use a consensus protocol compatible with staking and the payment of rewards.

⚙️ How to proceed technically to do staking?

You must transfer your cryptos to platforms specialized in staking such as Binance or Kraken for supported currencies. Then click on the option “Staking” to start generating rewards.

What form do staking rewards take?

The rewards are paid directly in the form of new tokens of the cryptocurrency concerned. It is also possible to transform them back into fiat currency if necessary or to reinvest them. I discovered a website called Money Online which explains all the strategies for making money on the internet.

Leave comments