Everything you need to know about the Ethereum network

The Ethereum project is part of an effort to democratize the internet by creating a world computer. Its goal is to replace the old model of servers or clouds hosting data with a new approach: nodes provided by volunteers. Its creators want to introduce an alternative structure for data and decentralized applications which do not depend on large technology companies.

The name of the creator of Ethereum is Vitalik Buterin and he is a Russian-Canadian under 30 years old. Later, other personalities joined the young man to refine the first White Paper: the British developer Gavin Wood, Jeffrey Wilcke, the main developer of the Go client, and Charles Hoskinson. The latter is an American mathematician who founded an educational project on blockchain. He is also the founder of the Cardano blockchain.

🥀 What is Ethereum?

Ethereum is a platform created in the last decade based on the blockchain or block chain system. It is an open source platform for operating and doing business online, which has a wide room for development. This happens because this type of tool is still taking its first steps among the most disruptive investors.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

In the same way that its development is not yet complete, because it still requires greater knowledge on the part of its target audience, we can assure you that its potential, in terms of earnings, is still very large.

Ether, the cryptocurrency that powers Ethereum, is used to pay for transactions that occur on the Ethereum network. Her primary objective is to reward miners who process data transactions on the homonymous network, although it is also possible to trade with this value.

Most people who are not actively involved in this network refer to Ether like Ethereum. This digital counterpart was issued as part of the crowdfunding campaign that started the initiative, but millions of new coins are created every year.

Purchasing this cryptocurrency requires the use of cryptocurrency platforms specialists, which can be a cumbersome and time-consuming practice that will compromise your ability to react to short-term price changes.

Trading Ethereum via CFDs allows you to react quickly to changes and profit from volatility on the spot. In fact, you don't need to own this cryptocurrency to be able to trade its price.

🥀 How does Ethereum work?

This blockchain works (for the moment) with the popular Proof of Work (PoW). Its mining algorithm is called “etash", instead of Bitcoin's SHA-256. Here, block validators (i.e. Ethereum miners) also compete to solve a mathematical problem, with the winner receiving a reward of around 3,5 ETH.

Regarding their mining, we can say that their miners and developers do not like ASIC machines because, according to them, they can cause a certain centralization. As a result, the algorithm etash has been specifically designed to repel these types of machines; or rather, make them somewhat useless in your mining. Indeed, unlike Bitcoin, most ETH was mined with video cards (GPUs).

Now, in the future, Ethereum is expected to abandon Proof of Work (PoW) and fully adopt Proof of Stake (PoS). With this system, there would no longer be miners, but delegates or validators of transactions who “would buy” their right with a certain amount of ETH in their wallet.

Thus, those with the most coins will have the best chance of being chosen by the system to validate transactions without any further expenditure of energy or material.

It should be mentioned that each ETH is divisible up to 18 decimal places (0,000000000000000001 ETH). Just like there is a cent in fiat currencies, he also named its smallest fractions.

Here we must mention that the Gwei is the most common unit to express small quantities, just like the satoshi in bitcoin. So instead of stating that your gas cost is 0,000000001 ether, you can say that it costs 1 gwei.

🥀 Can I pay with ether somewhere?

Do you have ETH and need to know what to do with it? Is it possible to buy something or pay for a service with this cryptocurrency?

Well, although it seems incredible to many, over 1 different companies accept ETH as a payment method worldwide, according to data provided by Cryptwerk. This includes supermarkets, tourism businesses, the video game sector, internet services and of course cryptocurrency-related services, among others.

When reviewing the site's statistics, a gradual but significant increase in cryptocurrency adoption by merchants is observed from 2018 to 2020. And we cannot fail to mention that the United States takes first place among the countries with the largest number of companies.

🥀 What is the Ethereum “virtual machine” (EVM)?

We can say that the EVM (Ethereum Virtual Machine) is something like the Ethereum CPU. And that's exactly what it sounds like: a digital machine that, in theory, is capable of solving almost any mathematical problem and, therefore, executing almost any instruction or program.

This is called a systemTuring complete“, and refers to the capacity of computers that we all know. And this is why Ethereum is also known as a “universal computer".

All kinds of computer programs are built on the EVM in the Solidity and Vyper languages. These are the programs we know as “smart contracts”, so as you can already imagine, the EVM is the heart of Ethereum, where the magic is born. Of course, to activate it, as we have already mentioned, it is necessary to supply it with gas.

Moreover, the EVM has its own language: the 'EVM bytecode'. Once the contracts are written in Solidity, Vyper or other, they are “translated” into byte code so that the EVM can read and execute them correctly.

🥀 What is “gas” and what is it used for?

If you have used Bitcoin at least once, you will know that each transaction has a small overhead. It is a commission intended for the minors who maintain the network. Well, the equivalent within Ethereum is the so-called “gas“. Here is the place of cryptocurrency mining in Blockchain technology.

Remember when they commented above that you pay a small fee in ETH to use the network? Well, that rate is gas. It's not that it's another currency, it's more of a measure of what you have to pay for what you do.

Although a Dapp or a custom token seems independent of Ethereum at first glance, the truth is that you must have “gas” in the form of ETH to be able to use them, because each transaction with them will include this small cost in ethers.

Before moving on to possible gas costs, it should be mentioned that there are two “types” of users: gas limit and gas price. The limit refers to the number of units of "gas" you are willing to spend on that particular transaction and generally does not vary. While price is the amount of ETH that is paid for each unit of “gas“. Thus, the total cost is calculated by multiplying the limit by the price.

🥀 Ether mining

Le minage is a fundamental aspect of how Ethereum works, just like it does on the Bitcoin network. Without mining, transactions would never take place and the network would be vulnerable to attacks.

Le Ethereum mining consists of the creation of transaction blocks, the securing of the network, and the circulation of new ether. Miners provide the computing power of their computers to validate blocks and be rewarded in newly created ether with each block.

Unlike Bitcoin, Ethereum mining is not based on hashing power but on memory. The mechanism used is called ProgPoW (Programmatic Proof-of-Work). It involves the intensive use of memory access from the GPUs that equip miners' computers.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Miners must solve complex math problems that require a lot of RAM power. The first miner to find the solution for each new block is rewarded with 2 newly created ether, plus the block transaction fee. A new block is found approximately every 13 seconds.

Note that mining activity consumes significant quantities of electricity. This consumption is estimated to be comparable to a small country. This is why Ethereum wants to move to proof of stake with Eth2, a much less energy-intensive mechanism.

Mining will remain necessary for a few more years during the transition to Eth2. Miners even created a consortium (Ethereum Mining Council) to support this major technological change for Ethereum.

🥀 Ethereum forks

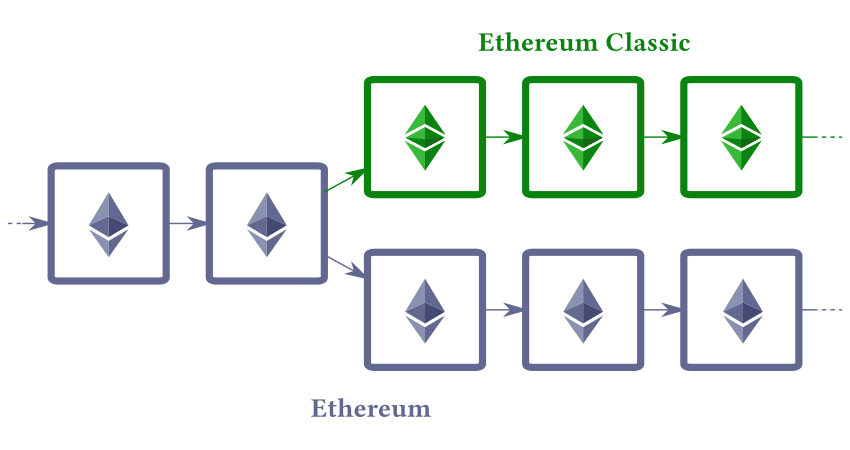

A fork is a technical divergence resulting in a separation between two evolutionary paths on a blockchain. On Ethereum, several forks have already taken place.

The most iconic fork is the DAO fork following a $50 million ether exploit in 2016. To recover the funds, Vitalik Buterin decided to perform a hard fork by reversing the transaction. This gave rise to two distinct channels: Ethereum (ETH) the main chain and Ethereum Classic (ETC) the dissident channel.

There was also the Byzantium fork in 2017 which introduced changes to prepare for Ethereum scaling. Then the Constantinople fork in 2019 which changed the economics of mining and fees on the network.

In 2020, the Istanbul fork made it possible to integrate interoperability between Ethereum and Zcash. And finally, in early 2022, the Arrow Glacier fork pushed back the date of The Merge and the move to proof of stake to stabilize the network.

Note that with Eth2, the move to proof-of-stake will also put an end to the regular forks that the Ethereum network has experienced since its creation, with the blockchain becoming much more robust.

Experts believe that the next forks should have a positive impact by improving the scalability, speed and cost of using the network for transactions and applications.

🥀 Ethereum and DeFi

One of the most revolutionary uses of Ethereum is the explosive development of decentralized finance (DeFi) since 2020. Cryptocurrencies and blockchain make it possible to build an open financial infrastructure, without intermediaries and accessible to all.

Decentralized finance applications are built on Ethereum using smart contracts. These automated computer programs manage trades, loans or interest transparently and securely.

A wide variety of DeFi services have thus emerged such as stablecoins, lending and borrowing platforms (Aave, Compound), decentralized insurers (Nexus Mutual, Etherisc) or even decentralized exchanges allowing the exchange of tokens and cryptocurrencies without an intermediary (Uniswap, Curve).

The total value locked in DeFi applications has exploded in 2 years to exceed $100 billion. This is just the beginning and it is estimated that 10% of traditional financial services could be decentralized by 2025 thanks to Ethereum.

Even if challenges remain in terms of privacy and security, there is no doubt that this growing sector will continue to develop and offer new innovative services focused on sharing value rather than extracting it.

🥀 Decentralized applications

One of the major innovations of Ethereum is the possibility of creating decentralized applications (DApps) using smart contract technology. These automated lines of code make it possible to build all kinds of applications directly on the blockchain.

There are already more than 3000 DApps active on Ethereum in a wide variety of areas. Among the flagship applications, we can cite decentralized finance platforms like Uniswap or Compound. But also blockchain games like CryptoKitties or Axie Infinity. Or even decentralized marketplaces like OpenSea.

These applications do not have a single point of check or failure. The data and code of DApps are distributed across the nodes of the Ethereum network. There is no centralized server and they are resilient to outages or censorship.

DApps are made up of smart contracts which define the rules of the program. They automatically execute according to the terms of the contract when certain conditions are met. They can manage cryptocurrencies, non-fungible tokens (NFTs) and much more to build innovative services.

Ultimately, we can imagine that decentralized applications will replace many current digital services, offering more transparency, efficiency and resilience while being based on value sharing. Thanks to Ethereum, DApps are only just beginning their revolution and are expected to profoundly transform the digital economy during the 2020 decade.

🥀 Ethereum and the regulatory environment

We already know that cryptocurrencies are not a favorite of governments and central banks around the world due to their core ideology: autonomy and decentralization. In some countries around the world, they have been banned altogether.

In others, they have been a relief in dealing with financial crises. And boy did they succeed! Still others, right in the middle of the balance, have decided to regulate certain activities.

In 2018, the platform was controlled by US regulators such as the Securities and Exchange Commission (SEC) and Commodity Futures Exchange Commission (CFEC); due to the pre-sale of its token in 2014.

Although the story was old at the time, they were concerned that the presale which raised 31 BTC (equivalent to around $000 million at the time) fell under the classification of securities sales. of the Securities Act of 18,3. If so, the developers must have registered the cryptocurrency as security before the sale.

However, Lubin said all the time they spent consulting with lawyers in the United States and other countries before the token sale was not in vain. Ethers were found not to be classified as a financial value according to the Howey test. So this statement from the authorities does not apply, and for the moment things remain like this on the eve of the introduction of PoS.

🥀 Ethereum: another system than cryptocurrencies

Although ether is the cryptocurrency of the platform that concerns us in this text, it is not the key to this operating system. The basis of its operation is what is technically called a smart contract, which involves a highly functional and simplified operating network support architecture.

This implies that procedures are automated, with great precision and the elimination of the role of intermediaries. Consequently, this network reveals itself as an alternative that gives power to small players against large companies that invest on a transnational scale.

You can record smart contracts successive with high security and optimal investment. This decentralization, moreover, avoids annoying interference from banks and other commission agents. Generally speaking, you work with derivative contracts linked to your amount of ether, but these will not be your property.

🥀 The relationship between Ethereum and Bitcoin

Finally, it should be noted that, since the birth of ethers in 2015, relationships and comparisons with bitcoins have marked its trajectory. Likewise, it has influenced the developments of other blockchain or cryptocurrency platforms.

You should keep in mind that bitcoins were the first cryptocurrencies that emerged. Its pioneering character paved the way for other less disruptive proposals. Buterin's platform followed suit and achieved great popularity.

But without focusing the base of the system on cryptocurrencies. It is normal, on the other hand, for investors to watch the pair that forms between bitcoins and the ether platform.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

In general, we emphasize the complementarity of the introduction of bitcoins in the network of operations of smart contracts. In this sense, the price increases of this system have been perceived to be directly driven by the influx of bitcoins.

It's gotten to the point where the network we're analyzing surpassed bitcoins in 2020 in records such as developer-related and transactions per second.

Generally speaking, tokenized bitcoins become the common trading cryptocurrencies on the ethers platform. It is a virtuous relationship for those who like to operate in blockchain, but in which, little by little, the system born in 2015 develops to the detriment of bitcoins.

Leave comments