Break-Even Analysis – Definition, Formula and Examples

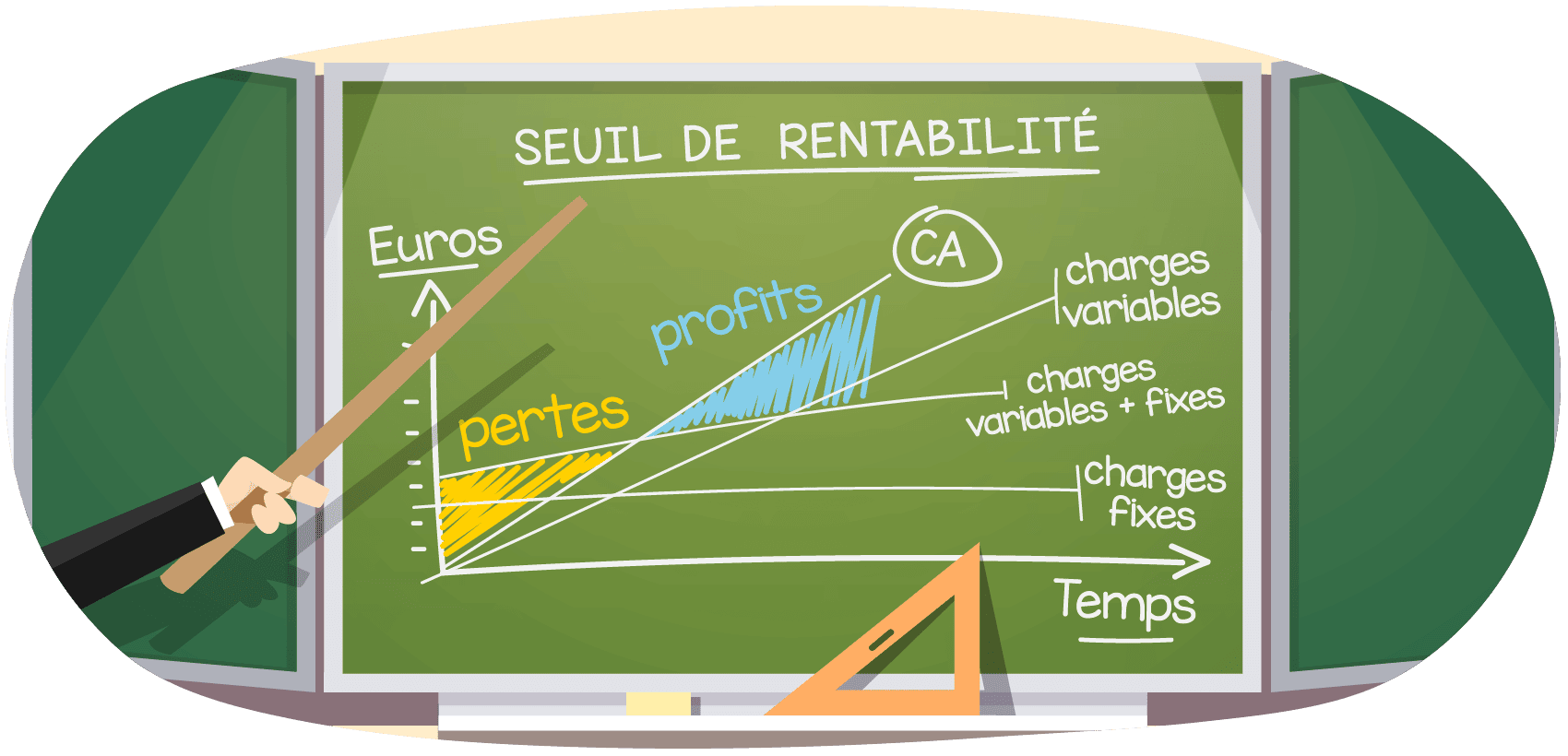

A break-even analysis is a financial tool that helps a company determine the point at which the business, or a new service or product, will be profitable. In other words, it is a financial calculation to determine the number of products or services that a company must sell or provide to cover its costs (including fixed costs).

In this article, I'll walk you through everything you need to know about break-even. But before you start, here's how to improve the conversion rate in your online store.

What is a business case

Break-even point is a situation where an organization neither makes nor loses money, but all costs have been covered.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Break-even analysis is useful for studying the relationship between variable cost, fixed cost, and revenue. Generally, a business with low fixed costs will have a low break-even point of sale. For example, say Happy Ltd has fixed costs of €10 vs Sad Ltd has fixed costs of €000 selling similar products, Happy Ltd will be able to break even with the sale of products of lower quality compared to Sad Ltd.

Break-Even Analysis Components

Fixed costs

Fixed costs are also called overhead. These overhead costs arise after the decision to start an economic activity is taken and these costs are directly related to the level of production, but not to the quantity of production.

Fixed costs include (but are not limited to) interest, taxes, salaries, rent, depreciation costs, labor costs, energy costs, etc. These costs are fixed regardless of production. If there is no production, the costs must also be incurred.

Variable costs

Variable costs are costs that will increase or decrease in direct relation to the volume of production. These costs include the cost of raw materials, the cost of packaging, fuel and other costs directly related to production.

Break-even analysis calculation

The basic formula for break-even analysis is derived by dividing the total fixed costs of production by the contribution per unit (price per unit minus variable costs).

Unit contribution = Unit selling price – Unit variable cost

Break-even point in quantity=(Total Fixed Costs)/(Unit Contribution) or

Break-even point in qty=(Total Fixed Costs)/(Average Unit Price-Variable Unit Cost)

For example: you are given the following information

- Variable costs per unit: € 400

- Selling price per unit: € 600

- Desired profits: €4

- Total fixed costs: € 10,00,000

First we need to calculate the break-even point per unit, so we will divide the €10,00,000 of the fixed costs by the €200 which is the contribution per unit (€600 – €400).

Breakeven point = €10,00,000/€200 = 5 units. Then this number of units can be stated in rupees by multiplying the 000 units by the selling price of €5 per unit. We get break-even sales at 000 units x €600 = €5000. (Break-even point in rupees).

Article to read: What to know about insurance

Marginal Contribution

The break-even analysis also deals with the contribution margin of a product. The excess between the selling price and the total variable costs is called the contribution margin.

For example, if the price of a product is €100, the total variable costs are €60 per product and the fixed cost is €25 per product, the contribution margin of the product is €40 (€100 – € 60). This €40 represents the revenue collected to cover the fixed costs.

In calculating the contribution margin, fixed costs are not taken into account.

When is break-even analysis used

Starting a new business: To start a new business, a break-even analysis is essential. Not only does this help decide if the idea of starting a new business is viable, but it will force the startup to be realistic about the costs, and provide a basis for the pricing strategy.

Creation of a new product: in the case of an existing business, the business should always perform a break-even analysis before launching a new product, especially if such a product is going to add a significant expense.

Changing the business model: If the company is about to change its business model, such as changing from wholesale to retail, a break-even analysis should be performed. Costs could change significantly and the break-even analysis will help set the selling price.

Break-even analysis is useful for the following reasons:

- It helps to determine the remaining/unused capacity of the business once the break-even point is reached. This will help show the maximum profit on a particular product/service that can be generated.

- The break-even point is used to determine the profit impact of moving to manual automation (a fixed cost replaces a variable cost).

- It helps to determine the change in profits if the price of a product is changed.

- It helps to determine the amount of losses that could be incurred in the event of a drop in sales.

Moreover, the profitability analysis is very useful to know the overall capacity of a company to generate a profit. In the case of a business whose break-even point is close to the maximum sales level, this means that it is almost impossible for the business to make a profit even under the best of circumstances.

Therefore, it is management's responsibility to constantly monitor the break-even point. This oversight certainly lowers the break-even point whenever possible.

Ways to monitor the break-even point

Price analysis: minimize or eliminate the use of coupons or other price reduction offers, as such promotional strategies increase the break-even point.

THETechnological analysis: implementation of any technology that can improve business efficiency, thereby increasing capacity at no additional cost.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Article to read: What to know about Forex trading as a beginner?

Cost analysis: Continually reviewing all fixed costs to see if any can be eliminated can certainly help. Also examine the total variable costs to see if they can be eliminated. This analysis will increase the margin and reduce the breakeven point.

Margin analysis: Push sales of the highest-margin items (high-contribution earnings) and pay close attention to product margins, thereby reducing the break-even point.

Outsourcing: If an activity consists of a fixed cost, try to outsource that activity (where possible), which reduces the breakeven point.

Benefits of the business case

Catch missing expenses : When you think about a new business, it is quite possible that you forget a few expenses. Therefore, a break-even analysis can help you review all financial commitments to determine your break-even point. This analysis certainly limits the number of surprises down the road or at least prepares a business for them.

Set revenue goals: Once the break-even analysis is complete, you will know how much you need to sell to be profitable. This will help you and your sales team set more concrete sales goals.

Use this promo code: argent2035

Make smarter decisions: entrepreneurs often make decisions about their business based on their emotions. Emotion is important, that is, what you feel, even if it is not enough. To be a successful entrepreneur, decisions must be based on facts.

Finance your business: This analysis is a key part of any business plan. This is usually a requirement if you want strangers to fund your business. In order to fund your business, you must prove that your plan is viable. Also, if the analysis looks good, you will be comfortable enough to take on the burden of various modes of funding.

Best price : Finding the break-even point will help to better evaluate the products. This tool is widely used to provide the best price of a product that can generate maximum profit without increasing the existing price.

Cover fixed costs: making a business case helps to cover all fixed costs.

Before you leave, here is a premium training that allows you to build your business online.

Leave us a comment

Leave comments