Working capital requirement in detail

Le working capital requirementt can be defined as the amount of money the company needs to cover the needs resulting from mismatches between cash inflows and outflows. It corresponds to the amount that a company must finance to manage the gap between disbursements and collections. It should not be confused with Working Capital.

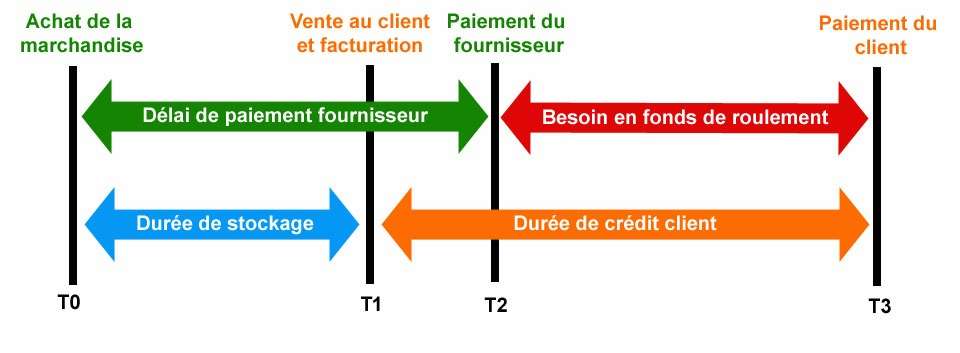

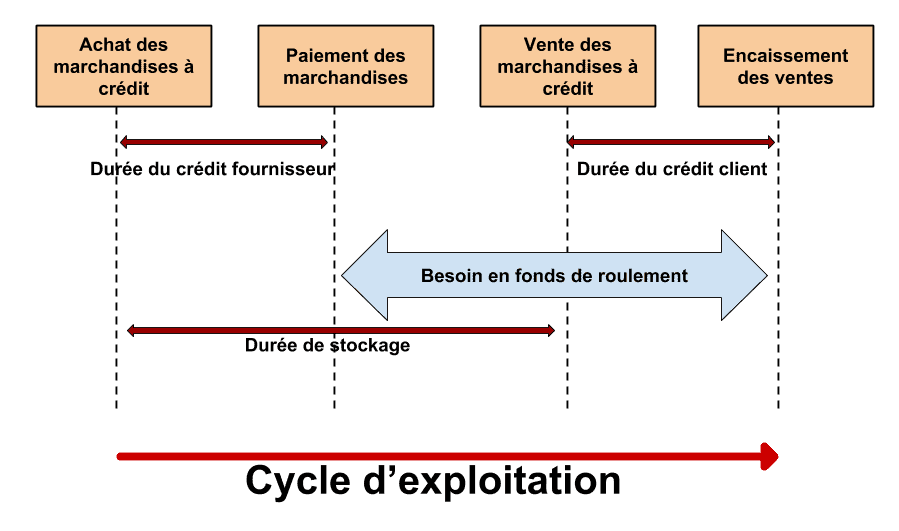

Concretely, the company which must pay its suppliers before obtaining the payment of its customers has a need for working capital to be financed. The greater the stocks and the lead times, the more the company risks having a significant working capital requirement.

The extent of the working capital requirement depends on several parameters: the sector of activity, the conditions of sale, the conditions of purchase, the stock rotation times and the volume of activity. In this article, we present the working capital requirement in detail. Let's go!!

Get 200% Bonus after your first deposit. Use this promo code: argent2035

🌿 What is the working capital requirement?

The working capital requirement is the amount required for the company to be able to pay all of its current expenses while waiting to receive the payment due from its various customers. It describes the financial autonomy of the company in the short term.

This indicator represents the amount needed to finance the company's expenses without it needing to collect the debts of its customers at the same time.

If you calculate a company's working capital requirement and realize that it is greater than 0, so the analysis that should be carried out is that it must pay its suppliers within 30 days.

Most businesses today have a working capital requirement close to zero, so that means they need to find funds to deal with cash flow mismatches.

✔️ Specific cases

Unlike companies that collect funds before disbursing them, they are companies that generally have a need for working capital less than 0.

In this case, we will speak of working capital resources. We have as an example, companies in the retail sector which are generally in this case, because their customers pay for the goods in cash.

The main advantage of the working capital requirement is to finance the company's operating cycle. It complements the meaning of working capital that emerges from the formula using permanent capital and fixed assets.

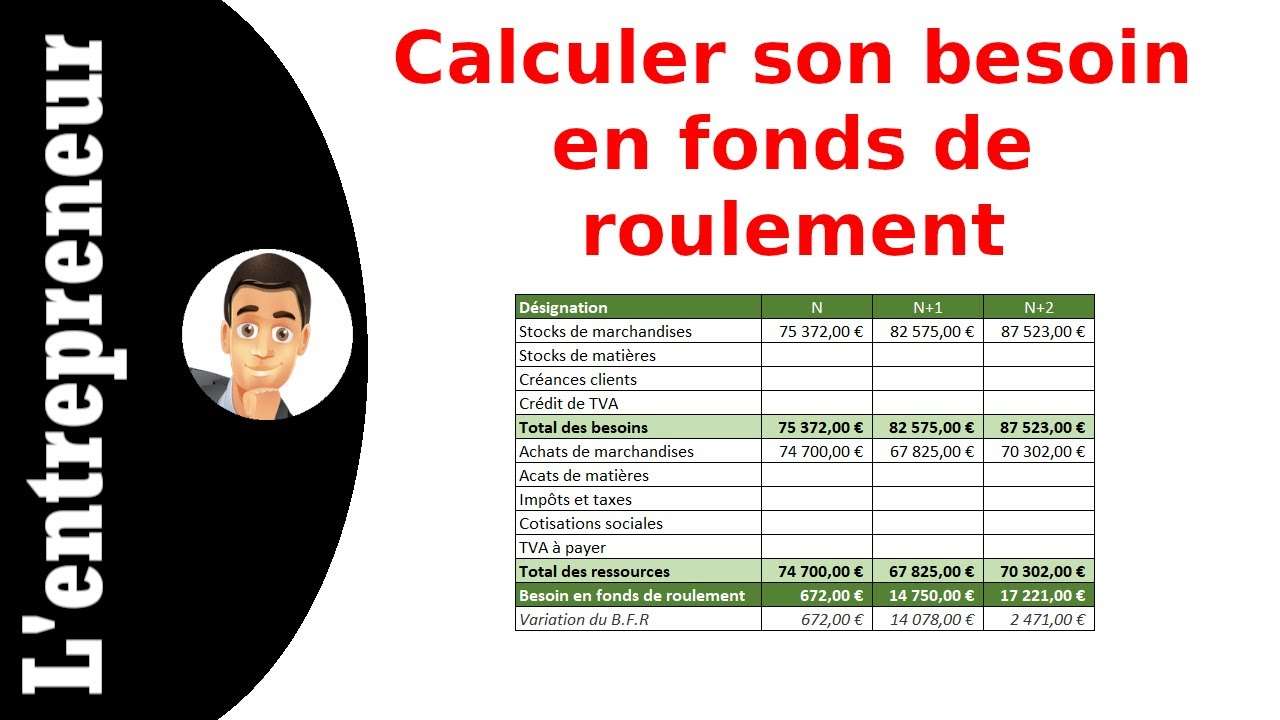

🌿 How to calculate working capital requirements?

The working capital requirement is generally calculated in number of days of turnover. When creating or buying a business, determining working capital requirements is a step that should not be neglected. If it is distorted or poorly performed, it could be the main reason for the disappearance of the company.

Thanks to the need for working capital, the manager of a company can assess the viability of your business just by analyzing the different results obtained.

The calculations can be weekly, monthly, quarterly or annual, they must be compared and studied. To do this, the manager should ask himself these questions:

- Are there any changes from the previous year, the previous half year, the previous quarter or the previous month?

- Is it possible to explain this change?

- If it is not favourable, how can financial stability be restored?

- If it is favourable, how can it be maintained, or even improved?

✔️ Service provider company

If a company specializes in the provision of services, then it does not have a stock of goods. Despite this, it must each time advance the current charges in order to be able to invoice the benefits and services it offers.

These current charges are generally recorded under the term “ work in progress ". At this time, the working capital requirement is calculated by taking into account the following data:

- The loads of a working day;

- All general expenses included (including remuneration);

- The time required to complete the service or service ordered by the customer.

The formula for determining the working capital requirement in this case is as follows:

- BFR = Work in progress + Ongoing average “ receivables » - Ongoing average “ customer deposits »

- BFR = Stocks + Receivables (trade receivables and miscellaneous receivables) - Debts (toutes les debts that are non-financial).

🌿 Variables that influence working capital requirements

Several variables influence the calculation of the working capital requirement

✔️ Payment deadline (which was negotiated with suppliers)

Calculation in days: (trade payables/purchases including tax) x 360. The result is that we obtain then corresponds to the payment terms that the suppliers offer to the company. Generally, we have a payment period of 30 to 60 days.

✔️ Payment time (which the company grants to customers when ordering)

Calculation in days of turnover : (trade receivables/turnover including tax) x 360. The result obtained is equivalent to the payment time for all the products that your company sells to its customers. This variable depends on many factors such as your sector of activity, your clientele, etc.

Just like the payment term granted to you by your suppliers, the payment term is between 30 and 60 days.

✔️ The duration of stock rotation.

Also calculate in days: (average inventory/manufacturing or production cost) x 360. The result you will obtain will determine when the products are purchased and when these products are resold, i.e. the number of days these products are in stock.

🌿 Analysis of working capital requirements

To be credible enough, the working capital requirement comes from the operating cycle of the company, it represents any need or a certain financing resource born from the principal activity of the company. The working capital requirement is therefore the difference between jobs and operating resources.

✔️ What to do if jobs exceed resources?

When jobs are greater than operating resources, the company must finance its short-term needs with its working capital or its financial debts.

Operating resources will therefore make it possible to cover operating jobs. The company will have no financial need. But it will not have any surplus funding either.

✔️ What to do if resources are greater than jobs?

If the resources are greater than the exploitation uses. The company will then not need financing and the surplus generated will feed its net cash and to avoid hoarding funds, it can be invested.

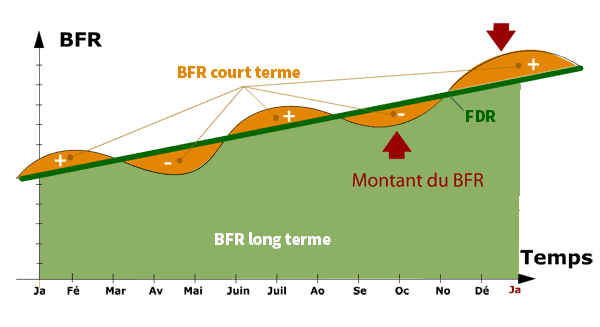

Working capital Allows the company to finance its working capital needs. It is the difference between permanent capitals (equity plus long-term debt) and investments of the company.

It therefore represents the capital which must remain continuously in the company to guarantee the operating cycle of the company. The greater the value of working capital, the greater the financial autonomy of the company.

🌿 What to do after determining the working capital requirement?

Once the working capital requirement has been determined, and you have analyzed it (whether positive, zero or negative), you must take this into account in the continuation of your activity and even more so if your working capital requirement is positive. In this case, you will have to finance it.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

At this point, a number of options are available to you. It is therefore up to you to choose the one that suits your objectives.

- Le overdraft ; you will have to opt for this solution if your financial needs are short term.

- The contributions in current accounts ; they are sums of money made available to the company by the various partners. You will have to take this option as a solution when your financial needs are short/medium term.

- Surplus long-term resources versus long-term financial needs if your needs are long-term.

🌿 What should we observe for good management of our WCR?

For good management of Working Capital Requirement (WCR), it is essential to carefully monitor inventory levels in order to avoid surpluses or shortages, which can affect cash flow. In addition, effective management of customer receivables is crucial to reduce late payments and maintain healthy cash flow.

When it comes to supplier debts, it is important to negotiate favorable payment terms while avoiding excessive delays. Finally, optimizing operational processes, such as inventory management and invoicing, can help reduce WCR and improve the overall financial health of the company.

For a good management of your working capital requirement, it is necessary to keep a precise look at the following points:

- Your accounts must be up to date (balance of customer accounts);

- You will need to ensure that you have good inventory management;

- Manage the customer position well: by limiting payment deadlines (process invoices quickly, follow up with customers quickly and collect);

- Carefully manage the supplier position (negotiate payment terms to make them longer);

- Choose a good financing method for your needs, such as bank overdrafts and factoring.

🌿 Closing

In conclusion, effective management of Working Capital Requirement (WCR) is essential to ensure financial health from a company. By closely monitoring inventory levels, payment and collection times, as well as supplier credit conditions, a company can optimize its WCR and improve its cash flow.

Close attention to operational processes and cash flow forecasts can also contribute to more accurate WCR management. Ultimately, management proactive BFR can help a business maintain adequate liquidity for daily operations and drive sustainable growth.

🌿 Frequently Asked Questions

What is Working Capital Requirement (WCR)?

Working Capital Requirement (WCR) represents the difference between a company's short-term resources (inventories, customer receivables) and its short-term obligations (supplier debts, accrued liabilities).

Why is WCR management important for a company?

Effective management of WCR is essential because it directly impacts cash flow and a company's ability to finance its daily operations. A poorly managed WCR can lead to liquidity problems and financial difficulties.

How can we optimize the WCR?

WCR optimization involves carefully monitoring inventory levels, improving accounts receivable management, negotiating favorable payment terms with suppliers, and optimizing operational processes to reduce payment and collection times .

What are the risks associated with poorly managed WCR?

A poorly managed WCR can lead to cash flow difficulties, payment delays, liquidity shortages and even long-term solvency problems. It can also affect a company's ability to seize growth opportunities.

We finished !! Please leave your opinions in the comments. But before you leave here how you should manage your family budget in peace.

Leave comments