What is tokenization technology

Tokenization is one of the consequences that constantly disturbs the technology of the Blockchain. This process set up promises to make changes on the society to give it an increasingly materialistic and commercialized vision where the population would have the opportunity to value and exchange any crypto according to its demand and his offer.

Undoubtedly, Tokenization technology opens doors to a whole universe of possibilities that previously were difficult or complex or even impossible to solve.

This innovation to begin initially in the economic aspect. It has expanded into several other areas. The potential of Blockchain technology and Tokenization is gigantic.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Would you like to get started in the world of Tokenization? You can know more from this article. Let's go!!

What is Tokenization?

La Tokenization is a strategy that allows the transformation or replacement of an asset, object or sensitive data with secure and non-sensitive data in a Blockchain.

To achieve this, Tokenization alludes to a transformation process that takes in terms of payment the card identification number, the card expiration date as well as the CVV2.

This transformation process consists of digitizing or even encrypting said information. Put them in combination of numbers and store all its information in a block of a Blockchain.

Once saved, they can be stored or exchanged. During this process, this information receives a token that allows them to manipulate such information as an integral part of the Blockchain in question.

Tokenization on a Blockchain can be applied to all types of data. This technology could profoundly transform processes, such as the supply chain or marketing.

If we apply a Tokenization technology in a supply chain, this can make the process very efficient in terms of security, transparency, better traceability.

How does Tokenization work?

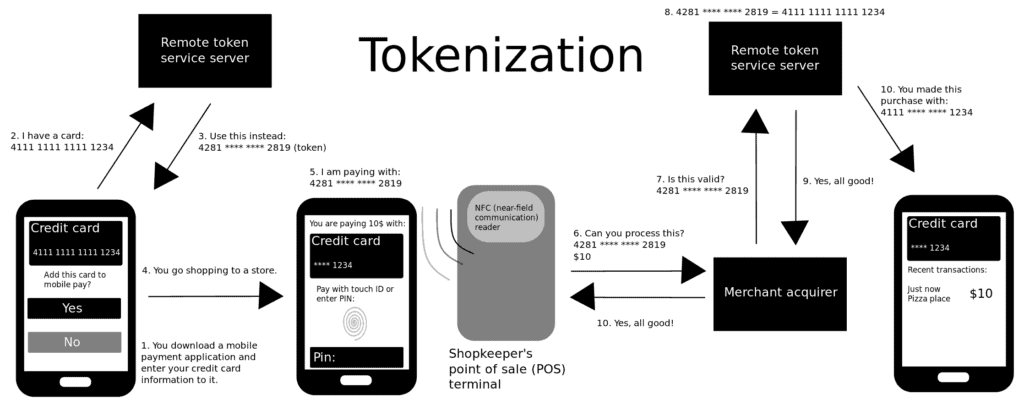

When you make a transaction, it creates a Token in real time, while connecting your customer's card to the bank issuing the transfer, to therefore issue a Token specific to the transaction.

This gives you a Pan, and this Pan is stored out of sight, which makes Tokenization the most reliable way to strengthen the security of your payment.

Being a payment service provider, Adyen can function as an issuer. The Tokenization service stores customer data securely and directly generates a Token that can be used, for example, to invoice the various purchases they will make in the future by companies.

Just as you can see in the diagram below.

How does card tokenization work?

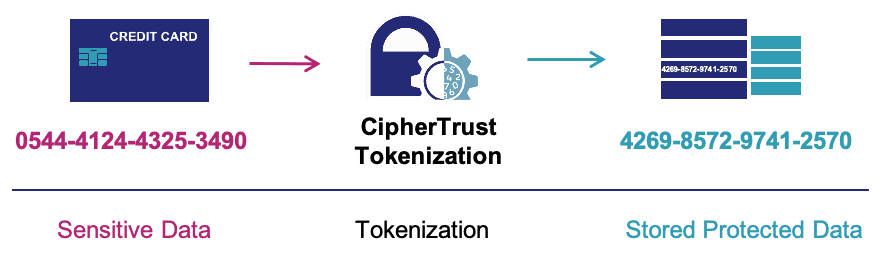

This technology replaces what is considered sensitive cardholder information on a debit or credit card and outputs a token, which stores customer card data while providing compliant security.

When we want to apply it to the security of multiple data, Tokenization replaces the element of data that is sensitive with an equally sensitive equivalent that has no meaning or even explainable extrinsic value.

In order to help you understand the process very easily, we present it to you:

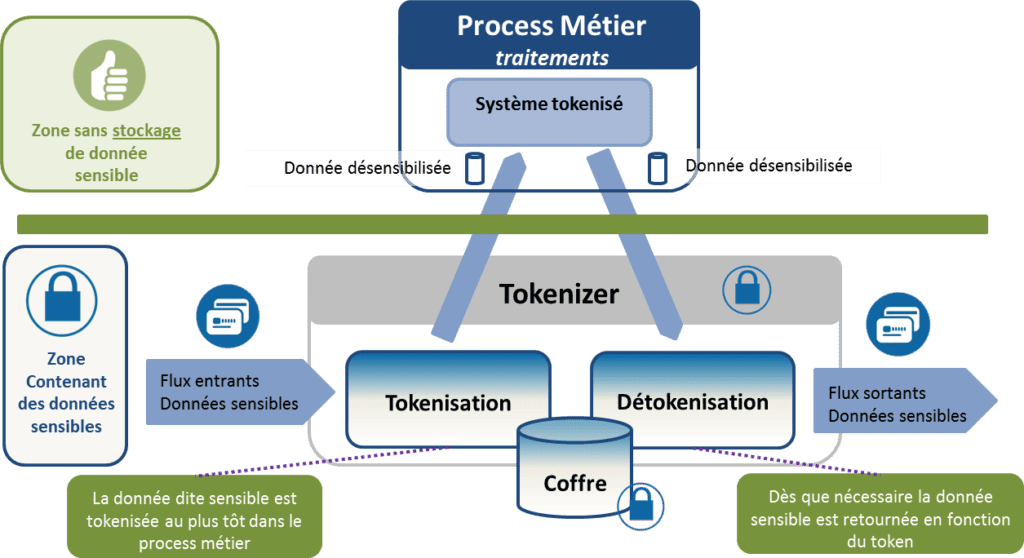

In fact, the system always receives confidential data. In this case, the personal information linked to the cardholder (surname, first name, account number, IBAN, etc.) is stored centrally. For example: in a database.

The Tokenization system therefore creates a Token and duplicates it with the data already stored. The added Token is not confidential, but it is a companion or an alias of the Token.

Then, the Token is placed in an operational flow and it replaces the confidential information which is represented in all operations. Increasingly, digital businesses are basing their models on daily, weekly, monthly and even annual subscriptions. However, there is a difference between Coin and Token.

Differences between Tokenization and Debit and Credit Card Encryption

The Tokenization technique as well as the encryption of credit card and debit have their important places in payments technology. But we have the possibility of finding some differences that exist between the two technologies.

While Tokenization replaces sensitive data of the cardholder, encryption or encryption of data fields in turn encrypts source card data and decrypts them when it arrives at its final destination. We can even take the example of Virtual Private Networks (VPN).

While both have their place and benefits in payment technologies, Tokenization emerges as the most secure primary solution to protecting a consumer's card information.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Tokens are not reversible if you want to use a decryption key, which is the case with encryption. In addition, it greatly reduces the scope of PCI DSS (Payment Card Industry Security Standard).

It is essential and mandatory for all companies that decide to accept or process data from their credit or debit cards.

The protection related to confidential data is becoming an increasingly important issue in E-Commerce. And even better, since the new Payment Services Directive, better known as PSD2, has been adopted.

Its main objective is the development of online payment markets within the European Union (EU). Its purpose is to strengthen security and provide insight into fraud.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

What changes have been made to E-Commerce since the establishment of PSD2?

Tokenization has become an indispensable technology. Companies increasingly need advanced payment systems that allow them to keep data available securely and also to make payments in the future.

In this context, there are several highly secure payment providers that give them the opportunity to take the plunge and level their business with this technology in a short time.

The Token is an identifier that has no value for hackers. Consider if there is a credit or debit card leak at some point. What are the consequences that this can entail.

On the one hand, regulation has brought a new reality to E-Commerce, for several reasons.

Until now, anytime a customer made an online purchase, the card issuer had to request certain information to enable them to confirm payment. By using an authentication code (OTP) or even by SMS.

With new technology, this method is no longer reliable, but double verification is required to comply with authentication. However, E-Commerce is not directly affected by this requirement, because the issuers present in payment systems are either banks or suppliers.

E-Commerce companies will need to ensure that all the payment methods they offer comply with the standards linked to the PSD2 SCA. If not, they risk losing user trust.

These changes are more than simple adjustments. They present the way forward for E-Commerce to provide online payment systems that are safer and more advantageous for everyone. In addition, they are an impetus to reduce the main pain angles of your business.

What is DeTokenization?

As its name suggests, DeTokenization is the opposite process of Tokenization. It consists of retrieving all the exact data linked to a card that was originally entered. Generally, this can only be done with the original system, the one used for Tokenization.

But it is also possible to do this using certain applications authorized to do DeTokenization for commercial purposes.

Conclusion

Here's what you need to know about Tokenization. We hope to have brought an improvement to your knowledge on the subject. If this article interested you, do not hesitate to give us a thumbs up and share to allow as many people as possible to benefit from it.

Leave comments