What is leasing?

Today, many people need financing. To finance their investment projects, businesses can use leasing. In the context of leasing, a bank makes a piece of equipment available to a company over a clearly defined period, in exchange for payment of a fee each period and a first rent which is often the highest.

At the end of the contract, the company which receives the good generally has several options: either acquire the good for an amount which was defined when signing the contract, return the good or renew the contract with conditions less expensive than the first.

Leasing is a contract by which a person, called lessor, makes movable property available to another person, the credit-praetor, over a clearly defined period and upon payment of royalties in return.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

In this article I give you the basics of what you need to know about leasing.

Let's go!!!

🌿 The practical consequences of this method of financing

Since the lending company is not the owner of the asset that was financed by leasing, this property cannot be included in its balance sheet.

The company that benefits from the leasing must mention the existence of a property or leasing operations in the notes appended to its balance sheet and attach to this the list of commitments made.

With regard to royalties, they are tax deductible over a different period of tax depreciation applied to the same type of property.

🌿 The challenges of leasing

Leasing is a means that allows businesses as well as individuals to make an investment in goods by paying a monthly lump sum which is generally called a royalty.

This does not formally affect the state of their financial health, mainly with regard to solvency ratios.

In fact, with this mode, the balance sheet of the company becomes more flattering, because it has less burden and debts on the liabilities side.

The credit lender records the payment of royalties rather as operating expenses. There tax consequence is that the profit before tax decreases and with it the tax payable too. And also, depreciation and interest are not deductible unless an option is exercised.

This therefore means that to assess the interest that leasing offers us vis-à-vis the acquisition of a property by self-financing or by borrowing, we must take into account the cash flows that each case generates. .

The best tool for comparing investments is the analysis of the net present value according to the mode of financing.

At the end of the contract, the royalties paid have the advantage of being tax deductible, but over a period different from the normal amortization of said property.

This system is generally used for vehicles as well as computer and industrial equipment, because this type of contract gives the possibility of including maintenance guarantees as well as VAT financing.

Compare to other means of financing, leasing poses an additional constraint for the user of the asset, such as the impossibility of terminating the contract before the arrival of the scheduled term, except following an explicit agreement of the lessor and to complete the payment of indemnities.

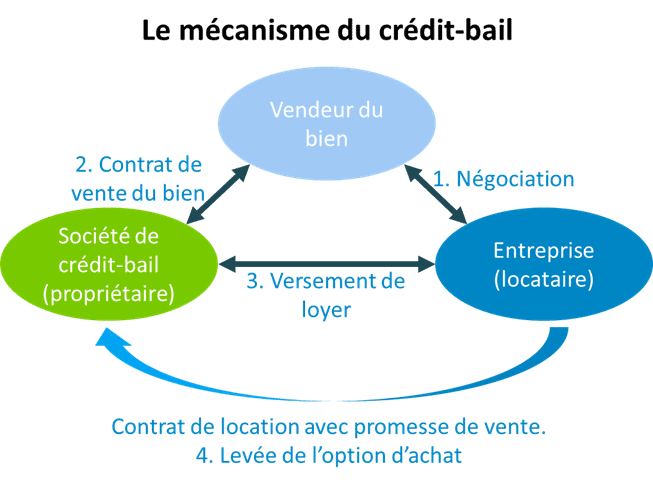

🌿 Participants in a leasing contract

In a leasing transaction, three parties are involved in the most cases:

equipment supplier, who is the one who owns the material and therefore its main purpose is to sell it.

The lessee, which is the party in need of financing. The lessor who supports the financing of the need felt by the lessee

So, here is the lessee who is the beneficiary company. She goes to the financial lessor, which is an establishment or a bank, to inform him of her needs and therefore go to the supplier if there is an agreement to take possession of the property.

🌿 Advantages and disadvantages of leasing

Leasing has a huge advantage for the business. Can afford equipment without an initial capital outlay with the possibility of taking possession as owner of the property at the end of the contract.

It has high-quality equipment: agricultural equipment, construction machinery, aircraft, medical equipment, etc.

The administrative formalities are not cumbersome. An exit is already possible at the 4rd année for equipment leasing and 7rd année for mortgage.

When you opt for equipment leasing, you have financing up to 100% of the amount of equipment. It is a financial lease which also bears the amount of VAT linked to the acquisition. For her, the company pays the VAT linked to the rent, before recovering them over time thanks to the VAT declarations.

The rental charges corresponding to the rents paid for the equipment reduce the taxable result, because they are recorded in the income statement as an operating expense.

???? Disadvantages of leasing

From an administrative point of view, leasing has a huge advantage, but the implementation of equipment leasing has disadvantages.

The cost of the leasing contract is very high compare to that of a traditional long-term loan. The application fees are extremely heavy and to this are added warranty costs.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Your financial lessor will generally ask you to pay a security deposit which will be almost 15% the value of the materials.

Leasing institutions are generally reluctant to finance specific investments, which will be difficult to resell if ever the lender defaults. In this case, a mutual guarantee company will have to intervene or the taking of real guarantees is sometimes necessary for the conclusion of the contract.

Insurance in complement have a cost like : assistance, warranty covering financial loss in the event of a breakdown, machine breakdown insurance, etc.

Rents are paid in advance before the arrival of each deadline. You should know that the final repurchase value of the property must be evaluated with correct precision so as not to pay additionally for the equipment if the purchase option is planned.

This value in practice is usually between 1% and 6% the initial price of the materials.

🌿 What is the difference between leasing and leasing?

Leasing is the rental operation of movable or immovable property with an option to purchase at the end of the rental period for the benefit of professional companies.

Leasing, on the other hand, is a financial rental of movable and immovable property that benefits individuals and professionals.

From this, we can draw 2 major differences between these financing methods:

Leasing benefits any natural person (individuals) or legal entity (companies) while leasing for its part only benefits professional companies.

At the end of the leasing contract, the beneficiary company has the possibility of taking possession of the property thanks to the purchase option; on the other hand, in leasing, the beneficiary company is not automatically granted this opportunity.

🌿 Closing

Arrived at the end of our analysis, it appears that leasing is a very important means for any company which would like to take possession of a good without however having the means of financing necessary for this one this mode of financing is advantageous.

Thanks to him, he will be able to benefit from a reduction in his taxable result consequently the reduction in the tax to be paid in addition to the advantages this method of financing also has disadvantages such as the high costs of the procedure for granting credit.

We can therefore tell you to think carefully before making a choice, ensuring that it is a very effective means of financing your activity and the dream possibility that you may have.

It is call option which gives you a way out of buying the property to be the owner once the contract ends.

🌿 Frequently Asked Questions

✔️ How to benefit from a leasing?

IF you are a company, from the smallest to the largest, that you have any activity, and you have the idea of setting up equipment to finance your activity, you will just have to put together a plan and go to an establishment or a bank.

Propose your plan and if it is correct, they will grant you financing for your activity and in return, you will have to pay a fee each month and at the end of your contract you will have the possibility of entering into possession of the said property.

✔️ On what type of equipment can I receive funding?

You have the possibility of receiving financing on any type of property! But it is also necessary that the material or the good respects certain conditions: it must be of durable use, it must be identifiable and depreciable.

Your investment has the possibility of including intangible elements such as, for example, software which is essential for the proper functioning of the equipment provided that they respect the conditions that we have mentioned above.

We finished !!! But before you leave, here's how Investing in real estate step by step.

Leave comments