What are mutual funds

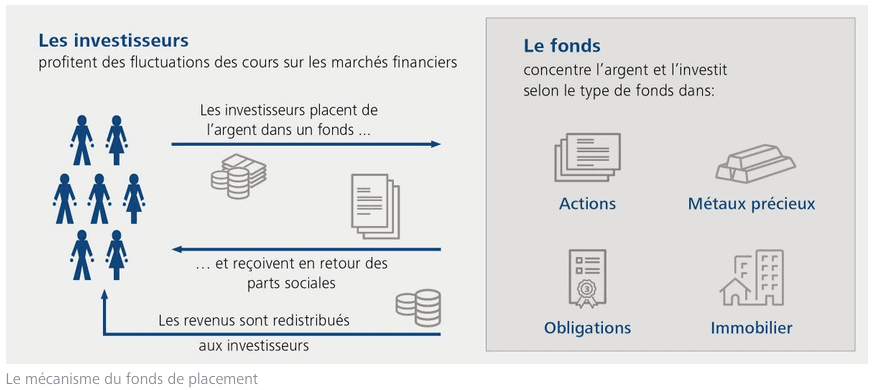

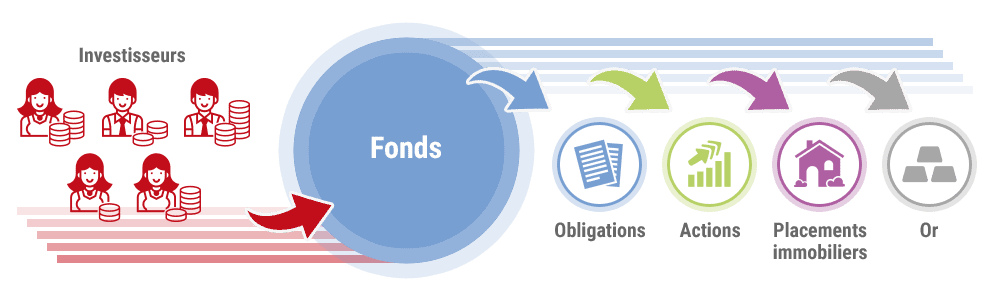

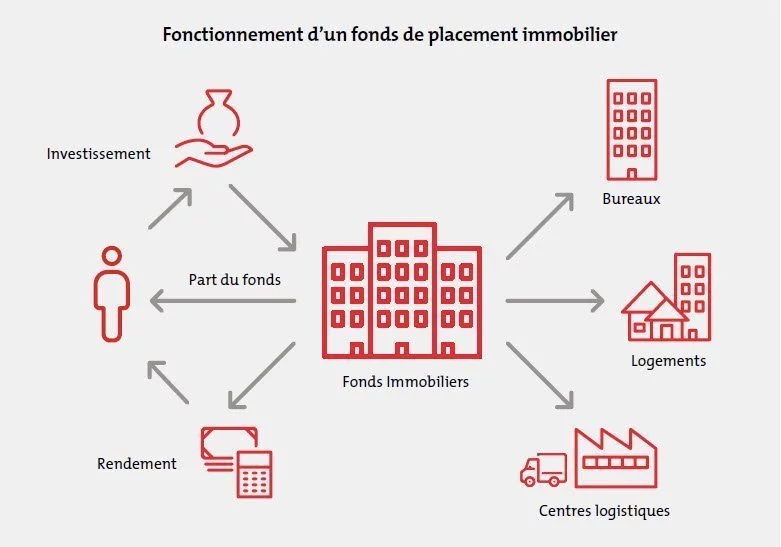

The mutual fund are an investment vehicle that pools the funds of several investors to invest in various securities such as stocks, bonds or money market securities.

Mutual funds are based on a single principle: connect money which belongs to several investors with ideas to invest in a wide and varied range of securities.

These securities can be shares, money market instruments, or even bonds. Each unit holder is given a portion proportional to the number of units they have from the investments, which come mainly from two sources:

Get 200% Bonus after your first deposit. Use this promo code: argent2035

- Revenues: interest paid on fund securities or dividends received.

- Capital gains or losses which generally arise from the sale of the securities held.

Each fund is therefore entrusted to a fund manager who in turn buys and sells the various investments. It does so in accordance with the objective of the fund which may be: long term growth, capital preservation, short term income or a huge combination of the three.

Depending on its objective, the fund can be invested in bonds, equities, money market instruments or a combination of the 3 securities. Let's go!!

🌿 What are the benefits of Mutual Funds?

Over the past two decades, mutual funds have grown in popularity due to the following advantages.

✔️ professional management

The money you put in a mutual fund is managed by experts who, on a daily basis, make investment decisions based on in-depth research, market information, sophisticated software and also their own experience.

✔️ Diversification

A single mutual fund alone can contain a very high number of securities compared to the number that most investors who are self-employed could afford.

This gives them the opportunity to spread the risks and reduce the effects of market volatility.

✔️ A variety of choices available

Given the variety of mutual funds, investors have the freedom to find those that meet their investment objectives.

✔️ Constant availability of resources

The units you hold in mutual funds can be bought and sold at any time so that each investor can easily access their funds.

✔️ Flexibility

As investors' investment goals change, they have the flexibility to move their money between funds seamlessly.

🌿 Types of Mutual Funds

Today, we have several mutual funds, the most important of which are:

✔️ The asset allocation fund

The primary purpose of allocation funds is to provide a variety of investors with a single vehicle that combines income and growth objectives.

To this end, asset allocation funds do not are not placed in a single asset class, but in many particularly bonds, cash and stocks, which makes them diversified investments.

With asset diversity, allocation funds suffer less loss in a stock market downturn because they have less exposure to just one industry sector.

These funds provide moderate capital preservation and offer very high moderate income potential in the short term. They are suitable for investors willing to accept certain risks in order to obtain the desired capital growth. Without, however, counting on a moderate income in the short term.

✔️ Securities funds with fixed income

Typically, fixed income funds invest in preferred stocks and bonds.

With these funds, you have a very high short-term income than money market funds, but gives you less capital preservation. Compare to the prices of equity funds, their price is generally very stable.

Returns and preservation of capital vary significantly from one security fund so the income is fixed to another.

With respect to high-yield funds, which aim to maximize returns through long-term, lower-quality bonds, and provide less capital preservation than fixed-income funds that are invested in securities with a much lower yield, but having better quality.

We should be aware that among fixed income funds, some seek to minimize risk through exclusive investments in securities that are fully guaranteed by Canada with respect to return of capital and payment of capital.

These funds are suitable for investors who would like to maximize their short-term income while accepting a very low level of risk.

The secondary objective of its funds is capital growth, as these funds are generally popular with retirees or other investors who are looking for a source of regular income with lower risk.

✔️ Canadian equity funds

These equity funds are invested in stocks with a wide range of Canadian companies. Each investor who acquires a unit of Canadian equity funds becomes a direct co-owner of each security in the fund's portfolio.

To invest in companies, some Canadian equity funds use their market capitalization, which relates to the market value of all shares outstanding.

Generally, Canadian equity funds therefore the capitalization is low are placed in companies therefore the size is very small or very specialized, whereas equity funds with a large capitalization are placed in large companies.

The objectives of each vary from one Canadian equity fund to another.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

- The dynamic growth fund. Here, funds are placed in companies that are characterized by specular growth potential. We have, for example, small companies that are in their initial public offering.

- Growth funds. These funds in turn are invested in companies that are known for their solid growth as well as their potential for capital gain and appreciation.

- Income and growth funds. These are funds that are placed in various companies that give a modest growth perspective with a very high dividend rate. We have, for example, public services.

When there's a rise and fall on the stock market, this carries over to equity funds.

Although stocks have traditionally outperformed other securities, we have no guarantee that this trend will continue in the short term. Reason why, today, Canadian stocks are listed as part of a long-term investment strategy.

✔️ Equity funds around the world

If diversification is part of objectives of mutual funds, isn't the easiest way for it to invest in assets that are spread around the world? Because it is logic that takes precedence over global action funds. These funds are only invested in foreign stocks, but may hold certain Canadian securities.

Considering the fact that these funds are volatile, and have risk advantages compared to Canadian funds, everything here depends on fluctuations in exchange rates, global conditions and other economic and political factors.

You can invest global equity funds in large, mid or small caps, and even in very specific sectors of activity. We have various variants that must be distinguished. In practice, a global fund must be placed in a combination of Canadian and foreign securities.

A fund that calls itself international must consist exclusively of foreign securities. A regional fund is focused on a very specific part of the market. Funds that claim to be emerging prioritize countries that are developing as well as securities that are listed on stock exchanges in these countries.

🌿 How to invest in a Mutual Fund?

When you invest in a mutual fund, you pool your money with that of other investors, called unitholders, to obtain a variety of securities such as stocks, bonds or money market instruments.

In return, you obtain a number of shares proportional to your investment. You can open an account with FlexiFunds online or by phone.

This savings solution offers an affordable service to investors, in addition to giving them access to investment products with a strong Quebec concentration, which support the local economy, and whose management fees are among the lowest on the market. walk. Before investing your money, the first step is to get to know you better when it comes to investing by defining your investor profile.

This helps to establish your risk tolerance, which will be reflected in the composition of the mutual funds in which you invest. To better understand yourself as an investor, you will need to determine your investment horizon and objective.

You will not invest in the same way if you save to buy a house within three years as if you do so for retirement, you count take in 20 years.

Your financial situation also weighs in the balance. Do you have a financial cushion in case of a hard blow? Are your incomes stable?

Finally, your risk tolerance will be determined by your ability to accept variations in return, and perhaps even a decline in the value of your investments.

🌿 Closing

Our article was about mutual funds and we can say that it is necessary for every investor to get started in this universe given its diversity and many other advantages.

We have presented to you the different mutual funds that exist, it is now up to you to make your investment choice to be among the leaders and benefit from the freedom it offers you.

🌿 Frequently Asked Questions

✔️ What level of risk?

When you have a mutual fund, you can lose and achieve gains. The level of risk varies depending on your risk tolerance.

If a fund's performance changes significantly from year to year, it is considered a risky fund, as its performance can fall and rise quickly.

✔️ What is the objective of the fund?

You should bear in mind that your objectives are the same as those of the fund. Because it generates a regular income, which gives you the choice over the investment period, and to integrate into your various investments.

We finished. Above all, please share with your friends and acquaintances so that they can benefit from it too.

Leave comments