How to invest in mutual funds

Mutual funds are usually defined as being a co-ownership of securities which sets up shares intended for various private investors. They are an integral part of undertakings for collective investment in transferable securities (UCITS) with also investment companies therefore the capital is variable (SICAV). Investing in mutual funds is a good idea.

Investment funds evolve according to the investment strategies that correspond to their profile. In terms of principle, they face an investment according to a very specific geographical and sectoral logic.

In this article, we will show you how to invest in mutual funds easily. But before we begin, here's how Investing in real estate step by step. Let's go!!!

Get 200% Bonus after your first deposit. Use this promo code: argent2035

⛳️ How do mutual funds work?

Mutual funds are mainly composed of a set of financial investments held by a large number of investors. They are managed by experts (portfolio managers).

The main purpose of mutual funds is to determine the types of securities that make up the common fund which can be centered on shares belonging to a company or government bonds.

That said, the purchase of a mutual fund by an investor pools the money he holds with that of another investor by buying shares or even fund units. They are issued as more investors join the list.

You should note that each portfolio has a share of the fund which allows it to receive income and also to suffer capital losses.

🌿 How to invest in mutual funds?

If the idea has come to you to acquire travel mutual funds, this is a good thing. We will now present to you the 5 steps that you will need to follow to ultimately gain possession of your personal fund.

✔️Step 1: Determine the purpose and duration of your investment

Before starting your investment, you must first make an assessment to know the precise financial objectives of your investment before determining the duration of your investment.

Let's take an example : A beginner investor who is young could invest his money for a good number of years, because he still has a lot of time in front of him.

But if he has a project in less than a year, he can make a short-term investment to be able to have what is necessary for his project, it's the same thing with a retiree if he wants to invest for himself, he can't do it for a long time.

But if it is to benefit his children or grandsons, he can make an investment of a considerably long duration.

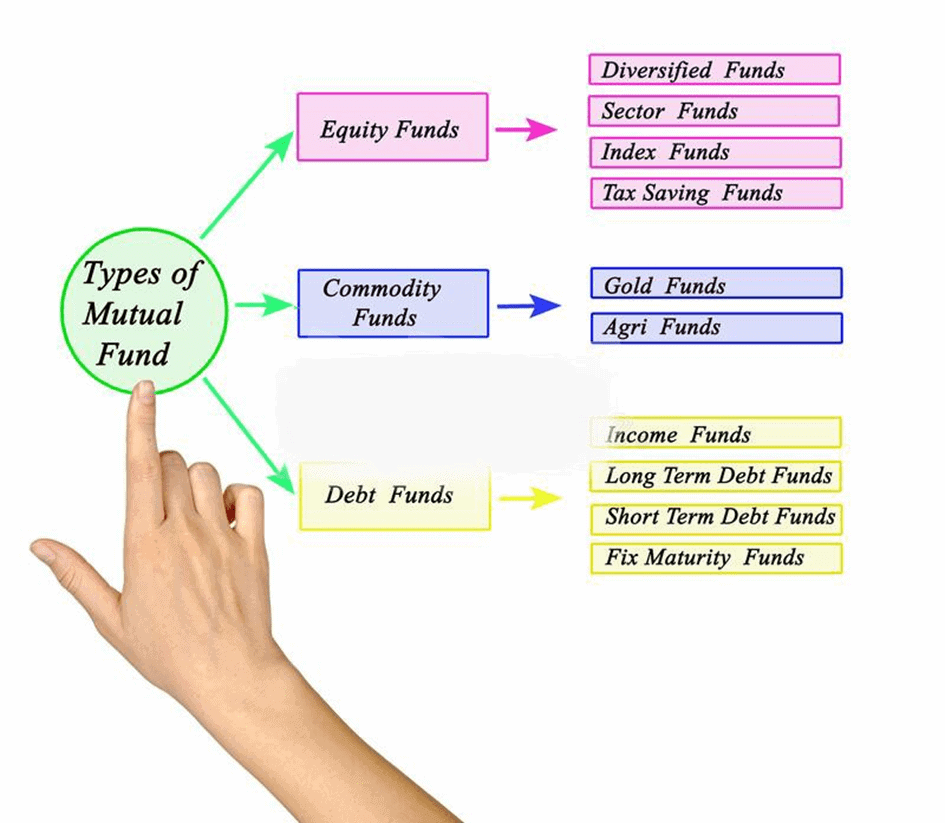

✔️ Step 2: Choose the type of fund

Your risk tolerance if helped you in this step, as it alludes to your ability to accept risk. The level of risk you can accept is very important when choosing the type of fund in which you will invest your money.

Let's take an example : if you don't want to lose too much money, you will definitely consider investing in a fixed income fund which will give you a fixed rate of return.

But if you want to increase your savings instead, you will opt for common stock investment funds (the Canadian funds). You will need to know that for this you will need to be comfortable with an additional risk that we fund presents.

But if you are looking for a better balance between return and risk, you will have to think about investing in balanced funds (global equity funds). You will need to ensure that the funds you choose fit into your various investments and that they correspond to the objectives of your investment plan.

✔️Step 3: Make a comparison between fees and returns

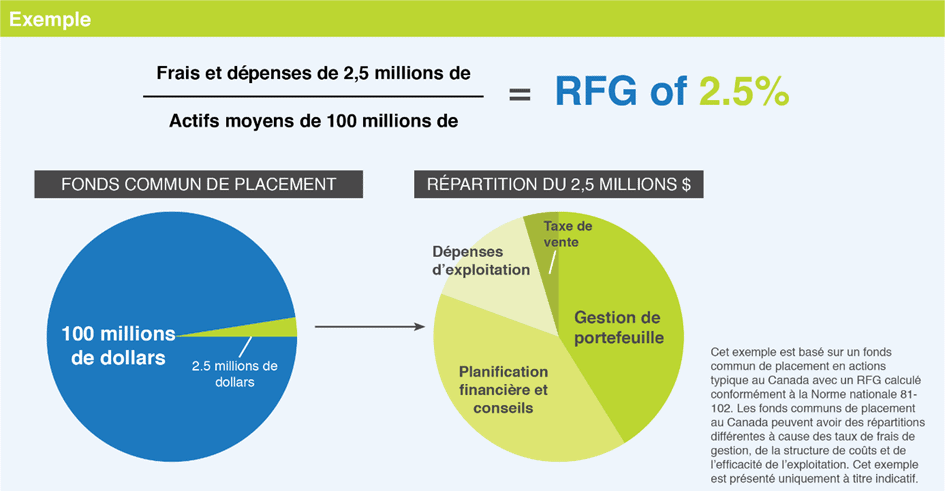

Be aware that every mutual fund has fees built in, but some have higher fees than others.

Fees will reduce your return. So please know what fees you will have to pay directly, such as acquisition costs. You will therefore need to compare the performance of a fund with the management ratio with those of similar funds.

You can use a fund's past performance to see how it performs in market situations. But there is no guarantee that the fund will behave the same way in the future.

NB: Before getting into ownership of a mutual fund, you will need to do a lot of research in disclosure documents, we can talk about financial statements that have been audited, recent management reports as well as performance reports of the fund.

This will give you the opportunity to see if the fund is suitable for your goals. To obtain these documents, you can go to your advisor or if you do not have one, you can find it on the website of the company that holds the mutual funds.

✔️Step 4: Find yourself an advisor or mutual fund company

To buy your funds, you should only do so from a company or person authorized to sell them.

Every person who sells or advises on mutual funds must be registered with their local securities regulator. In Ontario, the agency responsible for securities is the Ontario Securities Commission.

When an advisor sells you an investment fund, make sure you understand how it will be remunerated. Ask him if he sells a company's mutual funds or if he only focuses on a particular category of funds.

✔️Step 5: Complete the purchase request and make your purchase

Once the mutual fund company you choose to purchase gives you a copy of the fund facts, according to the law released on May 30, 2016, you will be required to provide certain personal information. This includes, for example, the level of risk you can accept and the level of investment knowledge you have.

By consulting the real estate values laws, each adviser will need to obtain this information before making recommendations to you on which funds you should put your money.

If you agree, you must sign the form and keep a copy in your various files.

In terms of investing, for each fund, you will need to deposit an amount minimum ($500 or $1000). Note that this amount is variable, depending on the investment fund you have chosen for your investment.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

⛳️ Closing

Having reached the end of our article, where it was a question for us of seeing how to invest in mutual funds, it appears that investing is a good thing.

But first of all, you will need to do research or seek professional advice on which fund you can invest in, having already assessed your objectives and determining the duration of your investment before making the purchase. Once the purchase is complete, observe the evolution of your investment and if you notice a problem, contact your advisor directly and he will know what to do.

🌿 Frequently Asked Questions

✔️Is it possible to invest in several funds?

Indeed, you can invest in several funds at the same time! It depends on your goals, because you can have different goals which conditions your investments and their duration as well.

✔️What to do if you made a bad purchase?

If you realize that the purchase you have made does not correspond to your objectives, you can cancel the purchase order within 48 hours of receipt and confirmation of your order. And these rules can vary from province to province.

If so, give us a thumbs up and give your feedback in the comments to let us know where you would like us to improve. But before you leave, here are the best tools for improve the management of your business

Don't forget to share the article with your friends. Leave us your opinions in the comments.

Leave comments