How to get a bank loan for your project

When embarking on an entrepreneurial project, the issue of funding is paramount. The sources of financing are diverse and varied, but obtaining a bank loan is often a must for most entrepreneurs. However, obtaining a bank loan for your project is not always easy, and preparation in advance is crucial. Another question we often ask ourselves is whether to take long term or short term loan.

In this article, we will give you all the keys to preparing effectively obtaining a bank loan for your project.

We will see how to properly prepare your loan application, what are the key elements to put forward to convince your banker and how to maximize your chances of obtaining financing.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Whether you are a beginner or an experienced entrepreneur, this article will allow you to better understand bank expectations and to prepare you optimally to obtain the financing you need to make your project a reality.

Let's go !!

🔰 What is a bank loan?

Un Bank loan is a contract by which a bank or financial institution put to use from a borrower a sum of money to finance a project, subject to the repayment of this sum, plus interest, over a fixed period.

It can be granted for different types of projects and take different forms: fixed or variable rate loan, repayable or in fine loan, short, medium or long term loan.

A bank loan is one of the most common ways to finance a project. It allows you to quickly have a large sum of money to carry out your project. It involves a significant financial burden to be sustained in the long term.

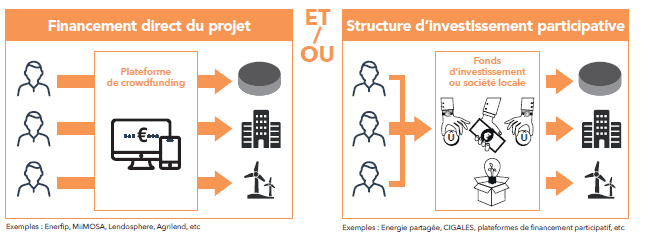

Think about it before taking out a bank loan and prepare yourself to get the best possible conditions. However, you can also finance your project by benefiting from crowdfunding.

🔰 The steps to benefit from a bank loan

To benefit from a bank loan, it is important to follow several steps. Here are the main steps to follow:

⛳️Step 1: Research potential lenders

Before you start looking for a bank loan, you need to research the different options available.

Lenders can include commercial banks, community banks, credit unions, online lending companies, and other financial institutions. You can also consider bringing in private investors or business partners.

It is important to find a lender that best suits your project and your financial needs. Compare offers from different lenders in terms of interest rates, fees and repayment terms. feel free to ask questions of lenders potential to clarify details.

⛳️Step 2: Assess your financial situation

Before submitting your loan application, you must assess your financial situation. Lenders will want to know that you are able to repay the loan.

This involves having a healthy financial situation, including a good credit score and a history of paying debts on time.

Be sure to get a copy of your credit report and verify that all information is correct. If you have errors or inaccuracies on your credit report, contact credit reporting agencies to correct them before applying for a loan.

⛳️Step 3: Develop a solid business plan

To obtain a bank loan, you must present a solid business plan. Your business plan must explain in detail your project, your growth strategy, your objectives and financial projections.

It should also include anticipated sources of income and expenses, as well as how you plan to repay the loan.

A well-written business plan demonstrates that you have a solid understanding of your business and that you are prepared to assume the financial responsibility that ensues. If you need help writing a business plan, you can call us.

⛳️Step 4: Provide strong guarantees

After you have produced your business plan, you will need to produce guarantees for your credit. Collateral is key for lenders as it represents a means of recovering loaned funds in the event of non-repayment.

It is therefore important to provide solid guarantees for maximize your chances to obtain a bank loan.

Collateral can be in the form of real estate, vehicles, stocks, bank accounts or other assets that can be seized in the event of non-payment. The stronger the collateral, the more lenders are willing to lend money.

⛳️Step 5: Apply for a loan

Once you're ready to apply for a loan, contact your bank or financial institution for application requirements and documentation.

Be prepared to answer any questions the lender may have and be prepared to negotiate loan terms if necessary.

🔰 Tips to easily benefit from a bank loan

Once you have chosen the bank from which you want to apply for a loan to finance your project, it is time to negotiate the terms of your loan. Here are some tips to help you negotiate with your banker:

⚡️ Prepare to negotiate

Before contacting your banker, make sure you have a good knowledge of your project and the figures associated with it.

Prepare a solid file that explains the details of your project and the reasons why you are able to repay the loan. You can also research current interest rates offered by other banks to help you negotiate competitive rates.

⚡️ Be honest

Be honest with your banker about your financial situation and your ability to repay the loan. If you have debts or financial problems, tell them clearly. They may be able to help you find a solution that works for your situation.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

⚡️ Show your commitment

Banks seek to lend money to reliable and committed borrowers. Show your banker that you are committed to your project by providing a solid and detailed business plan. The more prepared and committed you are, the more likely the bank will give you a loan.

⚡️Negotiate loan terms

The terms of your loan, such as interest rate, loan term, monthly repayment amount and necessary collateral, are all negotiable.

Don't hesitate to ask for terms that match your financial needs and situation. be ready to compromise where necessary to reach a mutually beneficial agreement.

⚡️ Compare offers

Do not hesitate to compare the offers of different banks before making a final decision. You can use the information you gather from your research to negotiate better terms with your preferred bank.

Don't forget to also think about yourself online banks and the worms neo-banks. Analyze all the possibilities. By following these tips, you can increase your chances of negotiating advantageous loan conditions and successfully financing your project.

🔰 FAQs

✔️ What are the criteria for selecting banks to grant a loan?

R: Banks look at several criteria when deciding whether to grant a loan, such as the level of risk of the project, the repayment capacity of the borrower, the quality of the project presentation file and the level of commitment of the borrower in the project.

✔️ How can I maximize my chances of getting a bank loan for my project?

R: You can maximize your chances of getting a bank loan by preparing carefully, presenting a solid credit history, having a good credit score and having a clear repayment strategy.

✔️ How long does it take to get a bank loan?

R: The time required to obtain a bank loan may vary depending on the bank, the complexity of the project and the quality of the presentation of the file. Typically this can take anywhere from a few days to several weeks.

✔️ Is it possible to get a loan without collateral?

R: It is rare to obtain a loan without collateral, but it depends on the loan amount and the confidence the bank has in the project and the borrower.

✔️ What happens if I can't repay my loan?

R: If you cannot repay your loan, the bank may pursue collection measures, such as seizure of property, reduction of your credit score, and additional interest.

✔️ What other financing options are available if I can't get a bank loan?

R: There are other financing options such as grants, private investors and crowdfunding platforms. It is important to explore all available options and choose the one that best suits your project.

✔️ How can I negotiate the terms of my loan?

R: You can negotiate the terms of your loan by presenting a solid file, having a good credit score, comparing offers from different banks and offering additional guarantees.

🔰 Closing

In conclusion, obtaining a bank loan to finance your project is a crucial step for any entrepreneur. To maximize your chances of obtaining a loan, it is important to be well prepared and to follow the key steps such as preparing your file, finding the most suitable bank for your project and negotiating the terms of your loan. .

It is also essential to fully understand the risks and obligations associated with a bank loan and to ensure that you can repay the loan according to the agreed terms.

LBank loans are not the only option funding for your project. There are many other sources of funding such as grants, private investors and crowdfunding platforms.

It is therefore important to carefully evaluate all the financing options available and choose the one that best suits your project.

But before you leave, here is how to get out of debt?

Leave comments