Value date and transaction date

What is the date on which I have to make a deposit or a withdrawal in my bank account? This question aims to address the concerns of many of you who are regularly victims of high bank charges without knowing why. In fact, many people often have difficulty understanding what happens to their bank account after being charged a high fee. This situation is essentially linked to an insufficiency financial education. In fact, by consulting the operations of our bank statement, we can see that there are two date data for each of them. This is the date on which each operation is carried out and its value date.

The two dates do not always coincide. And this is why not mastering these concepts often exposes you to high banking fees. In this article, we will explain in a simple way the difference between the value date and the transaction date. This is to help you know how to manage your bank account.

But before you start, here is my ebook that helps you take control of your finances.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

What are the dates concerned by our banking operations?

There are mainly two dates in our banking movements and operations: the value date and the accounting date. In addition to these two concepts, it is necessary to know the “ bank days » from your bank.

What is the value date?

This is the date from which an account credit begins to actually generate interest. It can also be understood as the date on which a debt ceases to generate interest. It is important to understand it in both senses.

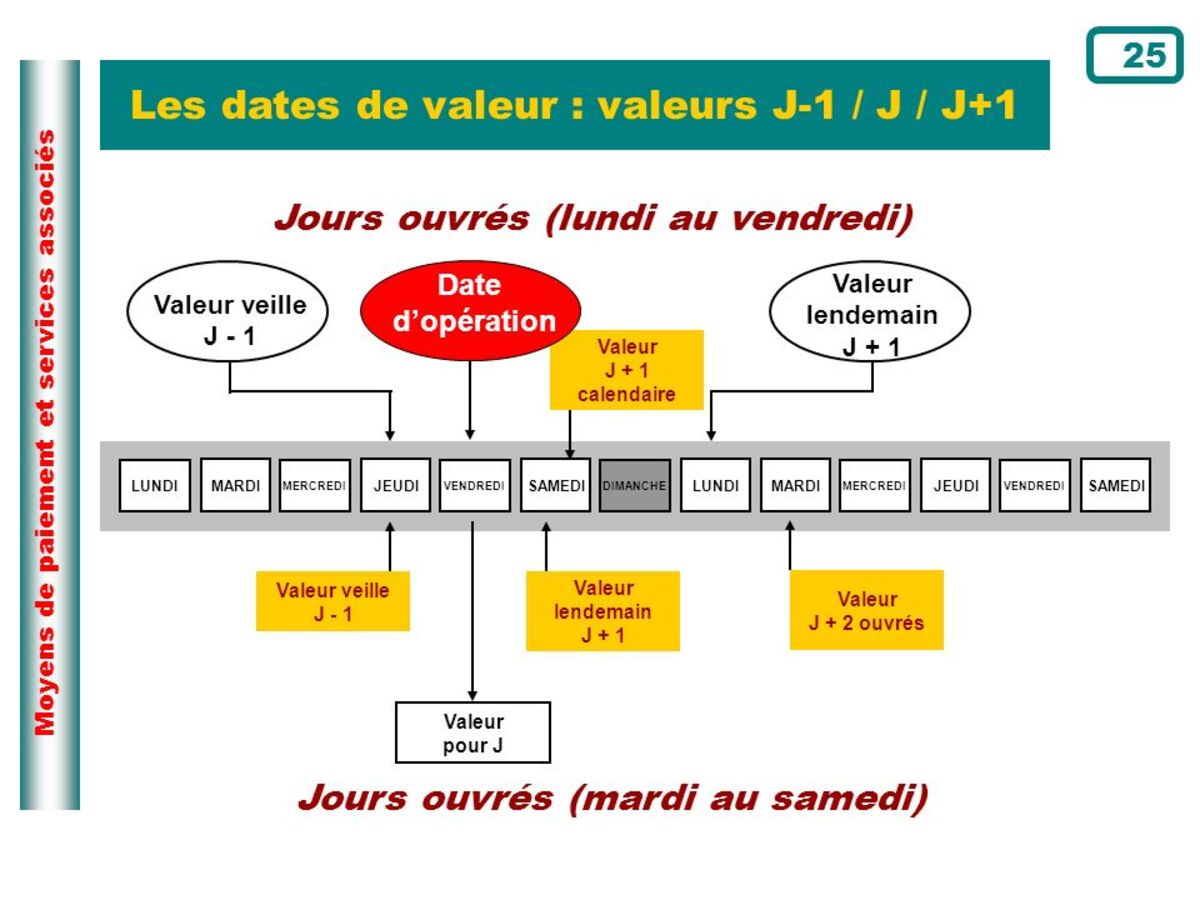

For operational reasons, the value date does not always coincide with that of the accounting entry. Cash inflows generally have a later value date than outflows. Moreover, if they come from another entity or from abroad, we must therefore take this into account when using our accounts.

For example the value date of a check cashed on March 12 may be March 13. The value date of a check issued and posted on January 10 may be January 9. All this depending on the number of banking days.

Practical cases

The value dates depend above all on the nature of the operations and the banking laws in force in your country. This delay can be explained by the processing of the data. It would therefore be logical that it would be different depending on the type of financial movement.

Cash deposit: When an individual pays cash into their personal account in their currency, then the amount paid is given a value date as soon as the funds are received. In other words, from the date of operation, D-day.

Payment by check : The value date for payment transactions by check cannot differ by more than one business day from the deposit date. D+1.

Bank transfers and direct debits. Whether it is a debit or credit transaction, the value date cannot be deferred by more than one day from the deposit date. Which means the value date and the transaction date must be equal.

Payment by deferred debit bank card. If you have a deferred debit bank card, the payments are accounted for individually with different processing dates corresponding to the day of the transactions. However, all these transactions are debited together with a single value date.

Tip: from the above, it can be noted that one should not receive his salary on the same day that he was fired. By doing so, you fall into bank overdraft which subsequently leads to agios.

What is the processing date?

It corresponds to the date of registration of your operation on your bank account. This date may be delayed from the transaction date in certain cases. During an online transfer order on Sunday, for example. This situation can also occur when depositing a check in your bank branch. In these cases the transaction is processed the day after the transaction date.

The posting or transaction date ?

This is the date on which the transaction is recorded. Either because it was actually carried out, or because the information concerning it reached the entity. For example, the date of operation in a transfer between two entities, for the payer it is the day he sends it, but for the beneficiary it is the day he receives it.

Normally, unless it is an electronic funds transfer with computers connected online, the value date and accounting date do not coincide.

As we have seen in the previous examples, the value date makes sense because there are operational limits that prevent certain operations from being executed at the same time as the customer orders them. It is normal, which happens as in other sectors than banking, but within limits.

In other words, financial institutions cannot impose whatever terms they want, but rather the central bank which sets the standard to be followed. This is the maximum number of working days that can elapse from the start of the operation by the customer, until it takes effect.

The applicable value date depends on the type of transaction we carry out. The value date does not necessarily have to coincide with the accounting date. It is generally later for credits and immediate (and even earlier) for debits. There may also be delays in processing transactions due to errors (all companies are exposed to them), or because these are special cases.

For example, in certain movements, the value date is before the accounting date. All financial entities have the power to improve the conditions set by the Central Bank, in favor of their clients, but they can never make them worse.

When we talk about working days, as a rule, these are weekdays from Monday to Friday. In certain types of operations in which there is an exchange between entities or other settlement systems, each year the non-working days of each system are published (settlement and clearing, etc.) and the terms of the operations are calculated taking this publication into account. calendar.

The importance of the value date for business invoicing

Usually the two dates coincide. For example, If you make a deposit into your account, the accounting date and value are the same. However, there are certain occasions where there is a period in between which we call the floating period. This is produced by the banking bureaucracy.

The difference between the value date and the accounting date is relevant in the case of companies. Knowing the times when these values are produced is essential to properly control invoicing, cash flows and avoid overdrafts or lack of liquidity.

Let's look at some cases in which the value date is later than the posting date:

- Transfers between banks. Depending on the banking entities concerned by a transfer, the value date will be recorded one business day after the accounting date. We tell you how long it takes to make a transfer.

- Deposit check. We will have the value date when the credit arrives in the destination account. For example, if the check was issued by an entity other than ours, the operation will take up to two days to become effective.

Example

Javier owes money to Miguel and decides to make a transfer to him. He will do this before going to sleep via your bank's application. Javier has a bank account at bank A and Miguel at bank B.

The money will not reach Miguel that the next day we will get the value date. The accounting date for this operation is that same night.

In short

It is important to take into account the date of transactions to always balance our accounts.

But before you leave, here is a premium training that will allow you to repay your debts in less than six weeks

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Leave us a comment

Leave comments