How can a financial planner help you?

Financial planning is done on a daily basis, while respecting your abilities and your priorities. Life events are often unpredictable. A good financial action plan is adaptable and must reflect your aspirations and your reality. A financial planner helps you develop the budget for your wedding for example.

In this post, Finance de Demain introduces you to the role of a financial planner. But before you start, here is a complete trading education for you.

🥀 What does a financial planner do?

A financial planner helps you understand what your financial goals are. It helps you develop a plan to achieve them. Whether it's saving for a new home,investing money for retirement, set aside funds for your children’s education, decide which insurance products you need, or all of the above.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

They analyze all aspects of your financial situation and use their expertise and insight to help you define and achieve your goals. This may include strategies for debt refund, ideal asset allocations for your retirement accounts, etc.

🥀 Financial Planner vs Financial Advisor

Terms financial planner et financial advisor are often used interchangeably. In fact, both types of professionals offer financial planning services that help clients achieve their financial goals.

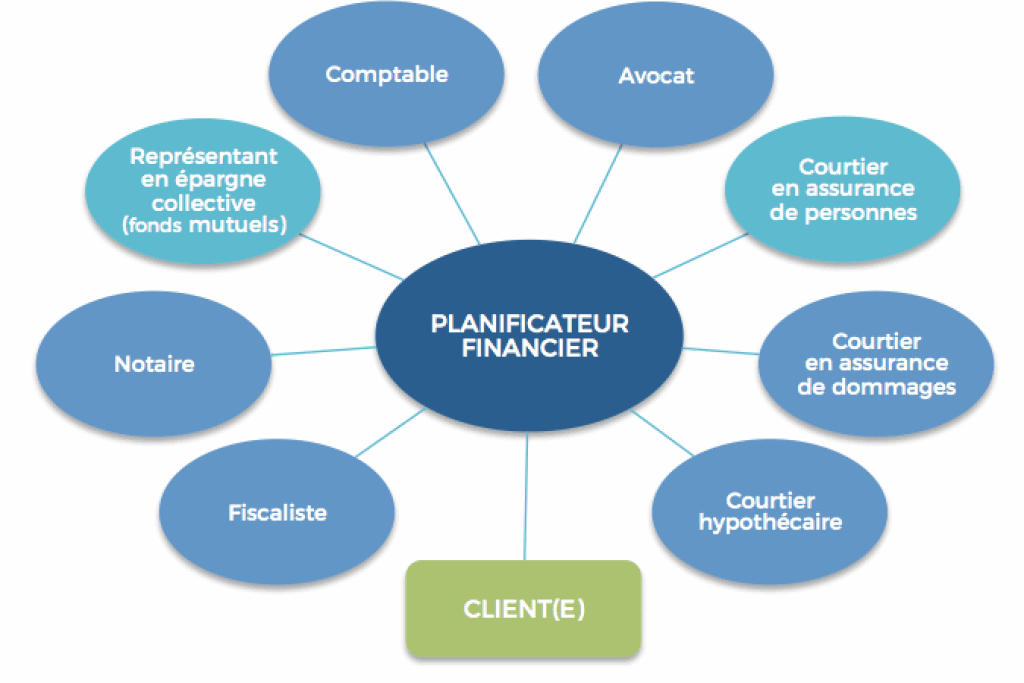

financial advisors, however, are generally considered a much broader category. They are professionals who manage your investments, arrange insurance coverage and act as a stockbroker, in addition to offering financial planning services. Financial planners limit themselves to more targeted services.

🥀 Types of Financial Planner

It is important to note that " financial planner itself is an unregulated generic term. Anyone can call themselves a financial planner and offer financial planning services.

Some may specialize in certain aspects of planning such as retirement or tax management. Others, however, take a more holistic approach. A few may not even have your best interests at heart and are best avoided.

✔️ Fiduciary Financial Planner

A fiduciary financial planner is required to act in the best interest of his client. The term fiduciary duty means that a planner is required to put the financial interests of his client before his own.

In practical terms, a fiduciary financial planner must offer their clients the best possible solutions at the lowest price. This is regardless of any fees or commissions the planner earns, from the client or other sources.

Some financial planners are only held to an adequacy standard. Under a suitability standard, a financial planner's recommendations must meet your needs. But they are allowed to recommend products or services that charge you higher fees or earn them higher commissions than similar products.

When choosing a financial planner, the best policy is always to choose a trustee so you know the products and services they recommend are best for you, not them.

✔️ Certified Financial Planner (CFP)

The Certified Financial Planner is an industry certification with rigorous educational and ethical requirements that fully prepares certificants to provide comprehensive financial planning services.

Notably, all CFPs must act as trustees, and most operate on a fee-only basis. Which means they will only be paid by you, not by the products they suggest.

Due to their extensive training and fiduciary standards, CFPs are the pillars of the financial planning community and where many clients choose to begin their financial planning journey.

✔️ Investment Advisor

Investment advisers are individuals or firms who help clients buy and sell securities and may provide financial advice. There are two main types, mainly differentiated according to whether they adhere to an adequacy standard or a fiduciary standard:

Registered Representatives: Registered Representatives buy and sell securities on behalf of their clients and are generally licensed by the brokerage firms that employ them. With many registered representatives, you make the decisions and the representative simply carries them out.

However, some present themselves as financial advisors or planners. If you choose to work with a Registered Representative who provides financial advice, keep in mind that they are only held to a standard of suitability, which may affect the products and services they provide to you. recommended.

Representatives of investment advisers: Investment Advising Representatives (IARs) are employed by companies called Registered Investment Advisers (RIAs), which are firms that provide financial advice and planning services.

Unlike Registered Representatives, RAIs are held to the fiduciary standard. Many may have additional credentials, like CFPs, to enhance their financial planning capabilities.

✔️ Robo-advisor

Robo-advisors provide automated investment management. Most put you in a predefined investment portfolio based on your goals and willingness to take risk which they will then manage and maintain for you over time.

These bots are technically RIAs, which means they are also held to a fiduciary standard, and more and more are supplementing their automated offerings with more comprehensive financial planning provided by human planners and CFPs.

If you're a newbie investor who only occasionally needs the services of a financial planner, this hybrid approach might be a good fit.

✔️ wealth manager

In practice, wealth managers are financial planners for high net worth individuals. Because of the clientele they work with, they typically specialize in the aspects of financial planning that most often affect the wealthy, such as estate planning, legal planning, and risk management to preserve assets.

As with the term financial planner, wealth manager is unregulated, which means anyone, regardless of their credentials, can call themselves a wealth manager. This means that only some, but not all, wealth managers are trustees.

🥀 Do you need a financial planner?

Although almost everyone can benefit from the services of a financial planner, the truth is that not everyone may need one. If your finances are fairly simple, meaning you work, have savings, and put money in a retirement account, you may not need a planner financial.

However, a financial planner can help you if your finances are more complex or your situation changes, such as if:

✔️ You receive a significant windfall

If you experience a sudden influx of money, such as a big job bonus or an inheritance after the death of a loved one, a financial planner will work with you to develop a plan for the money so you can achieve your goals.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

✔️ Your income changes

If you find a new job that significantly changes your income, a financial planner can help you create a new budget and adjust your retirement contributions.

✔️ You are getting married

If you are getting married, you and your future spouse might meet with a financial planner to discuss how to manage existing debts, save for a new home, or plan for children in the future.

✔️ you divorce

Financial planners can also help you deal with difficult situations, such as a divorce. By working with a financial planner who specializes in divorces, you can get help determining child support and alimony, dividing personal assets, and understanding tax laws.

✔️ A new child arrives in the family

If you're planning to adopt or give birth, a financial planner can help you decide what kind of life insurance policies you need and how to save for your child's college education.

🥀 How to choose a financial planner

If you decide that working with a financial planner is the right decision for you, there are a few things you'll want to look for:

✔️ Credibility and trust

Because anyone can call themselves a financial planner, it's wise to seek out highly respected credentials, such as:

CFP: A CFP is well equipped to help you plan all aspects of your financial life. If you are looking for general help in getting your finances under control, a CFP is a great place to start as they all have to meet strict requirements and act as trustees for their clients.

CPA: A Certified Public Accountant (CPA) specializes in tax planning and is licensed in his state. If you're looking for help managing your taxable income or reducing what you owe at tax time, you might want to turn to a CPA.

CFA: A Chartered Financial Analyst (CFA) can act as a financial planner, although most choose to help businesses manage their finances, rather than individual consumers.

That said, if you come across a CFA offering financial planning services, know that they have passed many rigorous industry exams and have years of professional experience qualifying them for this title.

✔️ The fiduciary duty

If you're not a finance professional yourself, you're probably unfamiliar with the ins and outs of most financial products and their associated tax codes. That's why it's invaluable to have an expert guide you through the process who only has your best financial interests at heart.

Unfortunately, not all financial planners are fiduciaries. Some only offer advice on the products they sell, such as certain investments or insurance accounts. They can also direct you to products that will earn them higher commissions.

✔️ The payment structure

Financial planners can get paid in countless different ways. Some rely on commissions from the products they recommend; others charge a percentage of the assets they manage for you. Still others charge by the hour or a monthly or annual retainer.

Make sure you know how your financial planner will be paid for their services before you contact them. Even general CFPs may specialize in specific types of clients, such as doctors, lawyers, or those with high student loan debt.

Ask potential financial planners about the types of people they typically work with. Also ask about the types of services they tend to provide. This way, you can ensure that you choose a professional with extensive experience in the types of financial problems you face yourself.

🥀 Conclusion

Perfect harmonization of income and expenditure is difficult to achieve in practice. This is why the planning of a liquidity reserve often aims at a target cash fund or a margin for the reserves of means of payment.

The specific liquidity needs of the individual sectors are decisive for the amount of these liquidity reserves. The financial planner helps you reconcile your investments. Now you know the role of a financial planner.

If you are one of the experts in the field, then leave us your experience in the comments. But before you leave, here is training that allows you to master your personal finances.

Thank you for this article on managing finances with the help of a financial planner. My family and I want to better manage the finances within the family and in particular the heritage. I suspect that the commitment of a fiduciary can be very useful. Please direct my attention to the different types of financial planner to better understand exactly what I need.

Thank you very much for your message. You can request our services at any time