Bank checks, personal checks and certified checks

There are many people who, on a daily basis, issue or receive checks without having sufficient knowledge of these instruments. In reality, he there are several types of checks : electronic checks, certified checks, postal money orders, bank checks, personal checks, etc.

A personal check allows you to send money to someone from your personal bank account. The bank check, on the other hand, is drawn on the bank's funds rather than on yours. A certified check is another special type of check drawn on your funds with a guarantee from the bank that the money is there.

Many major purchases of items such as cars and property require certified checks or cashier's checks. In this article, I present the differences between these three types of checks.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

🥀 How do personal checks work?

A personal check is a legal document that instructs a bank to give a certain person a specified amount of money from a particular bank account. You can fill one out and give it to almost anyone. The money will be taken from your account.

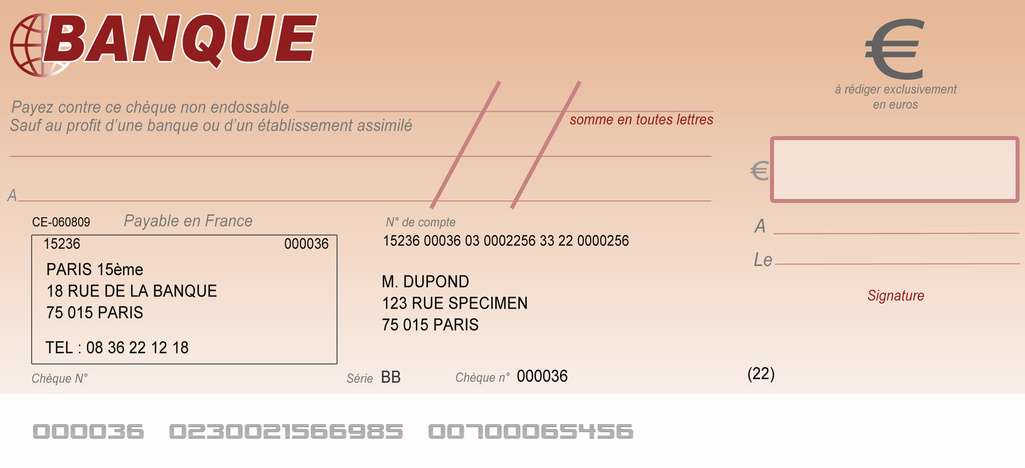

Personal checks already have your name and address printed on them along with your bank account number and bank routing code. You just need to indicate the name of the person to whom the check is payable and the exact amount.

Personal checks are used to pay a person or store that accepts personal checks and the funds are deducted directly from your bank account. The problem with personal checks is that most stores don't accept them as payment.

Normally, if you have a checking account or another account with check writing capabilities, such as some money market accounts, you can order checks from the bank preprinted with your bank account number and bank routing number.

When you need to pay someone, you can put their name or company name on a check, date it, write the amount you want to pay, and sign the check.

(I.e. Types of personal checks

There are two types of personal checks: personalized personal checks and personal blank checks.

Le personalized personal check is printed with your name, address, telephone number, bank account number and bank routing number. All you have to do is enter the name of the person to whom the check is payable and the amount to be paid.

Un blank check is an unfilled check given by the "drawer" (the one who signs the check) to a payee. It therefore gives the possibility to the wearer to fill it himself. It does not contain your name or address.

However, this information is not necessary because the check contains your bank routing number and bank account. Even if its use is marginal, the blank check is sometimes useful when a third party has to pay an expense for which he does not know the amount in advance.

However, the blank check is potentially dangerous since, in the event of loss, the person who finds it can fill it out as they wish and designate themselves as the beneficiary. Furthermore, the shooter's recourse in this case is limited.

(I.e. Personal checks issued with insufficient funds : What's going on?

Personal checks are among the various check models that banks make available to their customers who request them. If you give someone a personal check and the money isn't in your account when they try to cash or deposit it, the check will be returned to you as insufficient. You will therefore pay a bounce fee for this check.

If you write a check with insufficient funds and have an overdraft protection plan, the bank may lend you money to cover the check, but the fees and interest may be high.

Some banks may automatically transfer funds from another account, such as a savings account, to cover the check amount if money is available.

It is sometimes possible for banks to determine if there is enough money in an account to deposit or cash a check when you present it to a teller. Some businesses can also cash checks immediately by treating them as digital funds transfers.

(I.e. The risks associated with personal checks

As it is not always possible to verify that there is money in the account, there is some risk in accepting a personal check for payment, especially from someone you do not know well. If you can, you'll want to make sure a check is cleared before giving anything of value in exchange.

Make sure you can contact the person who issued you a check if there is a problem. While intentionally writing checks that aren't backed by real money in the bank is a crime, that doesn't mean it doesn't happen by accident.

Unrelated banking errors and fraudulent withdrawals can also cause checks to bounce or reject without the issuer being responsible. Personal checks also take some time to clear or settle. Until they are, funds may not be fully available in your account.

Depending on the bank where the check is issued and where it is deposited, checks may take a few days or longer to clear. Your bank may make funds available for you to spend before the check you deposit clears.

(I.e. What happens if you bounce a personal check?

Well, you pay a fee if you don't have the funds you promised in your account. Depending on the financial institution and current account, here are the fees you are liable to pay:

- Overdraft fees

To clear this check, your bank may authorize a bank overdraft, which will put your account in the red. You will therefore pay bank overdraft fees which vary depending on the bank and the amount of the overdraft.

- Non-Sufficient Funds (NSF) fees

Your bank may not allow the overdraft and reject clearing the check. At this time, they charge you an FNS fee, which, like overdraft fees, generally varies depending on the bank and the amount requested.

- Overdraft protection transfer fees

Some banks offer overdraft protection, which allows you to link your checking account to a savings account, a credit card or, in some cases, a line of credit reserved in advance for this purpose. The bank then exploits this link if you overdraw your current account. Your bank will transfer funds from the linked account to cover the check and charge a small fee.

If you do not pay the FNS fees or if you get into the habit of writing bounced checks, the bank can close your account and you could face criminal charges. You may also find it difficult to open another account elsewhere if you are blacklisted by ChexSystems.

🥀 Understanding bank check

A check is often requested as payment for large purchases, such as a down payment on a house. Indeed, a cashier's check is drawn from a bank account and is therefore as reputable as cash. For small transactions, sellers often accept a money order, which is another form of guaranteed payment.

To get a cashier's check, you will need identification and other relevant information. You will also need the amount of the check, the correct spelling of the payee's name and any memorandum. This information is printed on the check – you cannot add anything in handwriting.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

You can't scratch anything either. If you have an account with the institution, the requested amount is withdrawn from your personal account and transferred to the bank's own account. If you do not have an account with the bank, you may be able to pay in cash. Once the cashier prints and signs the check, it is ready to use.

(I.e. Where can I get a cashier's check?

Like most other checks, there are three main ways to get a cashier's check: from a bank, credit union, or online.

You can buy a check from a bank teller. Keep in mind that some banks only sell cashier's checks to their customers. So if you don't have a bank account, you should call before going to a bank to make sure they will issue you a cashier's check.

The process of getting a cashier's check from a credit union is similar. One difference, however, is that you can usually get a cashier's check from almost any credit union, whether or not you're a member.

The final option is to order a check for online bank. This varies from place to place, but most banks only offer this option to their customers. When you request a cashier's check online, the bank will send a physical check to your mailing address. This makes it your responsibility to get it to the recipient.

This saves you a trip to the bank, but it will take even longer since you have to rely on the mail. If you don't have an online bank account yet, I suggest my complete guide on how to create an online bank account.

(I.e. The risks associated with the use of bank checks

Cashier's checks offer a secure method of payment. Their security features printed on the check prevent any possible falsification. But counterfeit scams still happen.

A fraudulent cashier's check will likely clear immediately on the first deposit. Indeed, the bank has guaranteed that the funds will be available. But when the bank discovers the check is fake, often weeks after deposit, they get the money back. Unfortunately, the beneficiary is out of pocket for any money that has been spent.

For this reason, you should take extra care with a cashier's check that a stranger sends you as a gift. Show it to a cashier to certify that the check is legitimate. If you're really worried, you can also wait several weeks to make sure the check has cleared before spending the funds.

To learn more about bank checks, check name complete guide on everything you need to know about bank cheques.

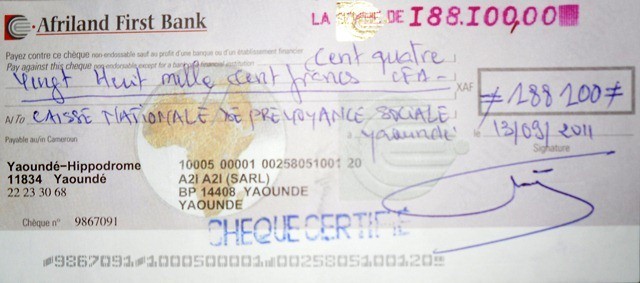

🥀 How certified checks work ?

Certified checks are another type of special check. They are somewhat of a hybrid between bank checks and personal checks. A certified check is a personal check guaranteed by the check issuer's bank. The bank verifies the account holder's signature and that they have enough money to pay, then sets aside the amount of the check for when it is cashed or deposited.

Obtaining and using a certified check is easy. Banks issue both certified checks and bank checks. Usually, you have to go to a branch, your bank's website, or order it over the phone.

Certified checks are super secure. The security features of these checks largely benefit the payee rather than the payer, as the funds are guaranteed. However, a certified check can be a safer alternative to carrying a large amount of cash to pay for a transaction.

Of course, a certified check can also be mailed or couriered, which you wouldn't want to do with cash.

(I.e. How to Avoid Certified Check Fraud ?

There are three main reasons why people like to use certified checks. They seek security to avoid fraud and bounced checks for large transactions. Using a certified check can give the seller more certainty that they will be paid.

However, here are some tips to avoid possible fraud:

- When you receive a certified check, call the bank immediately after receiving the check. Do not use any bank phone number that is printed on the check. If the check is fraudulent, this number may also be false. You can search online banking.

- Ask the bank to verify the name and check number of the account holder.

Counterfeiters are becoming increasingly sophisticated at printing official-looking bank logos and creating physically convincing fake checks. Although a certified check is generally safer than a personal check, make extra arrangements.

(I.e. When to use a certified cheque?

Certain types of transactions such as the purchase of an apartment often require guaranteed funds. You may also need a certified check to buy a used car or for the down payment on a mortgage. In these cases, a standard personal check might not be accepted, which is often understandable.

After all, there is no guarantee for the payee that a personal bank account contains enough money to cover the check. Using a certified check does not necessarily benefit the payer, although it may offer some advantages.

Instead, it provides a greater level of security for the recipient. In some cases, the transaction cannot proceed without payment by certified check. As an alternative, you have cashier's checks, a money order or a wire transfer.

🥀 Summary …

Certified checks and cashier's checks may be considered " official checks ". Both are used in place of cash, credit, or personal checks. They are used to guarantee payment. It is difficult to replace these types of checks.

For a lost cashier's check, you will need to obtain an indemnity guarantee, which you can obtain through an insurance company, but this is often difficult. Your bank may require you to wait up to 90 days for a replacement check.

A cashier's check is different from a personal check because the money is drawn from the bank's account. With a personal check, money is drawn from your account. Additionally, once the cashier's check is made, it is difficult to cancel it. With a personal check, you simply tear it up or call the bank to stop payment.

If you have any concerns, please leave us a comment. Your advisor is always at your disposal.

However, here is a training that allows you to have an explosive conversion rate on your online store. It's an affiliate link.

Thanks for the loyalty

Leave comments