Cash management best practices

Better cash management practices are essential for a company's financial management. Cash is the amount of cash available for a business at any given time. It can be used to pay debts, current expenses, investments and day-to-day business operations. However, poor cash management can lead to liquidity problems and ultimately the bankruptcy of the company.

It is therefore important for entrepreneurs and managers to know the best practices for corporate cash management. This will allow them to make informed decisions and maintain the financial health of their business.

In this article, we'll take an in-depth look at best practices for corporate cash management, including understanding zero cash, cash forecasting techniques, and cash risk management strategies.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

But before we start, here's How can you better finance your future retirement? Let's go !!

🚀 What is cash management?

Cash management is a crucial activity for any business, regardless of size or industry. It involves effectively managing the cash flow in and out of the business to ensure its survival and long-term growth.

Article to read: What to know about ChatGpt?

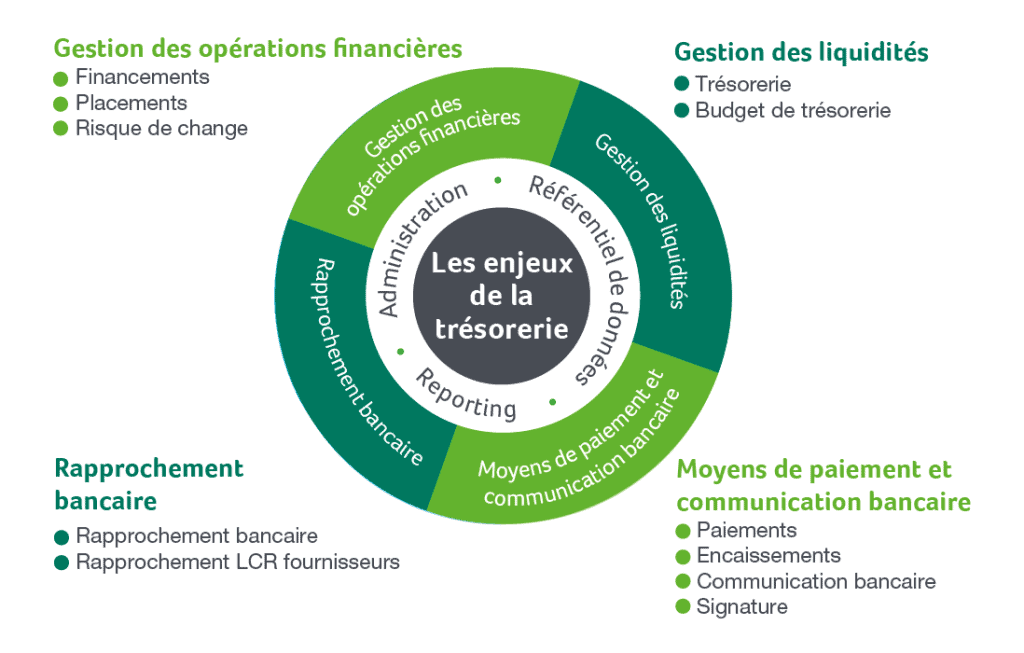

Cash management involves several activities, such as cash forecasting, management of receipts and disbursements, financial risk management, negotiation with financial partners, and financial planning.

Businesses must be able to accurately forecast their short and long-term cash flows to avoid cash shortages and unnecessary financial costs. In addition, they must be able to effectively manage their receipts and disbursements to optimize their cash flow and avoid bank charges.

Finally, cash management must take into account financial risks such as fluctuations in exchange rates, interest rates, credit risk and market risk. Companies must be able to manage these risks to minimize their impact on the company's cash flow.

Cash management is therefore a complex activity that requires a thorough understanding of the company's finances, careful planning and effective execution. It is essential to ensure the financial stability and long-term growth of the company.

🚀 Why is cash management important?

Cash management is important for several reasons. First of all, it keeps the company's liquidity, i.e. the ability of the company to honor its short-term debts.

Poor cash management can lead to payment difficulties and delays in the payment of invoices, which can have negative consequences on the company's reputation and the confidence of business partners.

Article to read: The Future of Blogging in the Age of Artificial Intelligence

In addition, cash management allows optimize the use of financial resources business by maximizing returns on investments and minimizing financing costs. This can translate into a improvement of the company's profitability.

Finally, good cash management makes it possible to anticipate and manage financial risks to which the company is exposed. It allows you to anticipate cash needs and take the necessary measures to meet them.

🚀 Cash management practices

Cash management is a crucial task for any business, regardless of industry or size. Good cash management makes it possible to optimize the company's profitability, ensure its sustainability and anticipate financial risks.

✔️Establish a provisional budget

The first step for effective cash management is to define a provisional budget. This involves determining the company's income and expenses for a given period, usually a year.

Article to read: Artificial Intelligence and digital marketing

The provisional budget makes it possible to forecast future cash flows, to better plan investments and to anticipate periods of stress on cash.

✔️ Track cash flow daily

Once the provisional budget has been established, it is important to regularly monitor the company's cash flow.

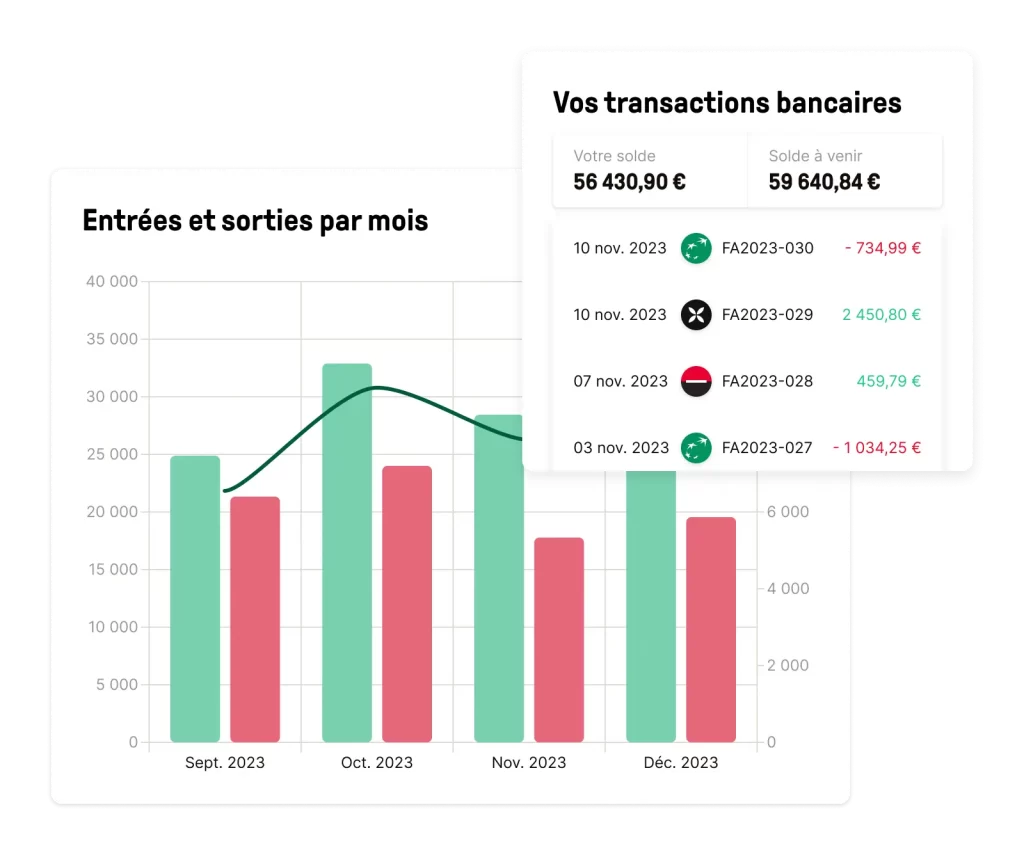

This makes it possible to quickly detect discrepancies between forecasts and reality, and to take corrective measures if necessary. Cash flow tracking tools, such as financial dashboards, can help visualize cash flow in real time.

✔️ Anticipate payment deadlines

Payment deadlines, such as supplier invoices or loan repayment deadlines, can have a significant impact on a company's cash flow. It is therefore crucial to anticipate them and plan them in the provisional budget.

It is also important to negotiate payment terms with suppliers to avoid cash flow tensions.

✔️Optimize inventory management

Inventory management can have a significant impact on a company's cash flow. Inventory represents a significant cost in terms of investment and storage, and can generate losses if the products do not sell.

Article to read: AI in health: what a transformation

It is therefore important to optimize inventory management by regularly assessing inventory levels, adjusting orders based on sales and negotiating payment terms with suppliers.

✔️Establish debt collection policies

Debt collection can be a major source of cash flow stress for businesses.

It is therefore crucial to establish effective debt collection policies to minimize late payments and bad debts. This may include setting up regular payment reminders, negotiating payment terms with customers, and setting up collection measures in the event of non-payment.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

✔️ Establish strict credit policies

Strict credit policies can help minimize trade receivables risk. Businesses can set credit limits for customers based on their credit history. payment and their solvency.

They may also request guarantees or deposits for large contracts or for high-risk customers. It is important to regularly monitor trade receivables and take steps to collect late payments.

✔️Use cash management tools

There are many cash management tools available in the market that can help businesses monitor their cash flow, forecast future cash flow, and automate certain administrative tasks.

Article to read: How to sell your music online?

Accounting software, online cash management solutions, and mobile apps can help simplify cash management and improve forecasting accuracy.

✔️Avoid unnecessary expenses

Cutting costs can help companies improve their cash position. Businesses should regularly review their spending and identify areas where savings can be made without affecting their activities negatively.

This may include negotiating contracts with vendors, optimizing purchasing, reducing overhead, and improving operational efficiency.

✔️ Plan long-term investments

Long-term investments can have a significant impact on a company's cash position. It is therefore important to plan these investments in advance and ensure that they are financially viable.

Businesses also need to weigh the pros and cons of different ways of financing investments, such as debt, equity, and grants.

✔️ Ensure transparent communication

Transparent communication is essential for good cash management. Companies must ensure that all departments are informed of the current cash position and future cash forecasts.

This can help avoid surprises and facilitate informed decision-making.

✔️ Hire a cash management professional

Finally, businesses can consider hiring a cash management professional to help them improve their cash position. Cash management experts can offer.

🚀 FAQs

✔️What are the main practices to follow for good cash management?

A: The main practices to follow for good cash management are:

- Regularly monitor cash flow and forecasts,

- Establish a realistic budget,

- Closely monitor payment deadlines and unpaid invoices,

- Negotiate favorable payment terms with suppliers,

- Use cash management tools and accounting software.

✔️How to avoid cash flow problems in a business?

A: To avoid cash flow problems in a business, it is important to closely monitor cash flow and forecast upcoming expenses.

Article to read: The 5 conditions for successfully creating your business

It's also important to set a realistic budget and track payment deadlines and unpaid invoices. It is advisable to negotiate favorable payment terms with suppliers and use cash management tools to monitor expenses and income.

✔️What are the most used cash management tools by companies?

A: The cash management tools most used by businesses are accounting software and cash management systems.

These tools allow you to track cash flow in real time, automate accounting tasks, generate financial reports and analyze cash trends.

✔️How to improve a company's cash flow?

A: To improve cash flow, it is important to reduce unnecessary expenses, optimize inventory, negotiate favorable payment terms with suppliers, and promptly invoice customers.

✔️How to set a realistic budget for a business?

A: To establish a realistic budget, consider the expected expenses and income for the coming year.

Article to read: The particularities of Islamic banks

It is also important to consider unforeseen expenses and financial emergencies. It may be helpful to seek the help of an accounting or cash management expert to establish a realistic and accurate budget.

✔️How to manage unpaid invoices in a company?

A: To manage unpaid invoices in a business, it is important to closely monitor payment deadlines and contact customers promptly in the event of late payment.

It can be useful to send payment reminders by e-mail or by post and to negotiate payment terms for customers in financial difficulty. It is also advisable to use.

Leave comments