Open a 100% online bank account

Nowadays, opening a bank account 100% online has become very easy. With some online banks, everything has become possible these days. No more need to go to an agency and wait for hours! In just a few clicks from your computer or smartphone, you can access a modern, economical bank that is accessible at any time. 💻

This dematerialized procedure has many advantages in terms of simplicity and speed. But beware, a few key steps must be followed to carry out this process.

In this comprehensive guide, Finance de Demain give you step-by-step instructions on how to open and activate your online banking account. Thanks to these valuable tips, you will avoid pitfalls and take full advantage of your 100% online account. But before you start, here's how Investing in real estate step by step

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Let's go ! 🚀

🌿 Open an account online

✨ Choice of online banking

When considering opening a 100% online bank account, choosing online banking is a crucial step. Here are some things to consider to help you make your decision:

✔️ Reputation and reliability

Find out about the reputation of the online bank you are considering. Check their financial strength, experience in the banking sector and reviews from existing customers. A well-established and reliable online bank will give you peace of mind that your funds are safe.

✔️ Fees and rates

Compare the fees and rates offered by different online banks. Make sure you understand the fees for checking accounts, credit cards, money transfers and other banking services. Look for online banks that offer competitive and transparent fees while meeting your specific needs.

✔️ Services and features

Review the services and features offered by each online bank. Check to see if they offer savings accounts with attractive interest rates, loan options, rewards programs, financial management tools, and user-friendly mobile apps.

Choose an online bank that offers the services you need to effectively manage your finances.

✔️ Accessibility and customer support

Make sure online banking provides easy access to your accounts via a user-friendly online platform and an intuitive mobile application.

Also check available customer support options, such as call centers, live chats, and online FAQs. Good customer support is essential in case of any problems or questions.

✔️ Security and data protection

Security is paramount when it comes to choosing an online bank. Check the security measures the bank has in place to protect your personal and financial data.

Look for features like two-factor authentication, data encryption and proactive monitoring against fraudulent activity.

✨ Prepare the necessary supporting documents

When you are about to open a 100% online bank account, It is important to prepare the necessary supporting documents to facilitate the account opening process. Here are the documents commonly requested by online banks:

✔️ Pièce d'identité

Prepare a copy of your valid identification, such as a national ID card, passport or driver's license. Make sure the copy is clear and readable.

✔️ Proof of address

Most online banks require recent proof of address, generally less than three months old. This could be a utility bill (electricity, water, gas), a landline or mobile phone bill, a bank statement or an accommodation certificate.

✔️ Account statements

Some online banks may ask you to provide recent months of bank account statements from another financial institution. This can help them assess your financial history and creditworthiness.

✔️ Personal informations

Also have your personal information ready such as your full name, postal address, telephone number and email address. You will need to provide this information when applying for an account.

✔️ Proof of income

Depending on online banking requirements, you may be required to provide proof of income, such as pay slips, tax notices or bank statements showing regular deposits.

It is important to check the specific requirements of each online bank, as they may vary slightly. Make sure you have all required documents on hand before beginning the online account opening process. This will allow you to complete your request quickly and efficiently.

Depending on your situation, other documents may be required (visa, residence permit, Kbis extract, etc.). Check the bank's website first.

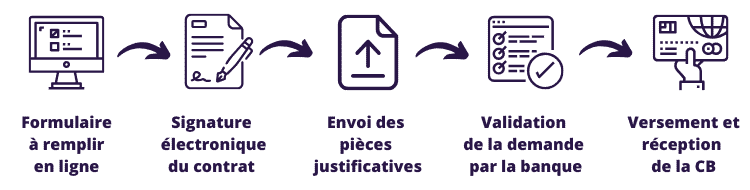

✨ Complete the online form

Once you have chosen your bank, you can fill out the account opening application form directly online. 🖥️

The establishment will ask you many questions: contact details, professional and family situation, income, etc. Respond conscientiously to all requests, attaching the required supporting documents in electronic format. Then validate your request, and your file is sent to the bank!

✨ Verification by bank

When you open a 100% online bank account, the bank will verify your identity and information. The online bank will use identity verification methods to confirm that you are the person you claim to be.

This can be done by providing personal information such as your full name, date of birth, address, as well as identification documents such as your ID or passport.

The online bank will examine the supporting documents you have provided, such as your identity document and your proof of address, to ensure their validity. validity and their conformity regulatory requirements.

In some cases, the online bank may perform additional checks, such as credit checks or background checks, to evaluate your creditworthiness and financial history.

Some online banks may use a video identification process to verify your identity. This involves a live conversation with a bank officer via video conference, during which you will need to show your ID and answer security questions.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Once the verification is completed, the online bank will usually send you an email or SMS confirmation to let you know that your account has been opened successfully.

✨ Acceptance (or refusal) of the request

You will then receive by email the decision of the bank concerning your application for an online account: agreement or refusal. 📧 If accepted, congratulations! 🎉 Your online bank account is open. You will receive your login credentials and can start using it.

If your request is refused, do not be discouraged! Each bank has its own criteria. Try again with another institution.

✨ Online account activation

Once your account has been validated, you still need to activate it. 🎛️ To do this, log in to your bank's customer area with the credentials received.

You will generally be asked to choose your confidential codes, download your RIB/IBAN, activate your bank card, etc. Take the time to properly configure all the settings of your account during this activation, it is important.

There you go, your 100% online bank account is operational! 🏦 You can now use it to manage your daily finances independently.

🌿 Fund your online account

Once you have opened a bank account 100% online, it's time to feed it with funds so you can start using it. Here are some common ways to fund your online account:

✔️ Bank Transfer

You can transfer funds from an existing bank account by making a wire transfer. To do this, you must use your new online banking account information to set up the transfer from your existing bank account.

Processing times may vary between banks, but electronic transfers are generally fast and secure.

✔️ Check deposit

Some online banks allow you to deposit checks using their mobile app. Simply take a photo of the check and send it through the app. The funds will be credited to your account once the check is processed, which may take a few days.

✔️ Credit or debit card

You can use a credit or debit card to make a direct deposit into your online banking account. Processing is usually quick, but there may be fees associated with using this method.

✔️ Online money transfer

Online money transfer services such as PayPal or TransferWise can also be used to fund your online banking account. You can transfer funds directly from your PayPal account or TransferWise to your online banking account. Be sure to check the fees associated with this method before using it.

It is important to check policies and associated fees with each method before funding your online banking account. Also make sure you are using a safe and secure method to protect your funds and personal information.

🌿 Order your means of payment

Your account being supplied, you can order your means of payment: bank card, checkbook…🔑 Depending on the banks, the card can be offered automatically or on demand. The checkbook is generally optional for online accounts.

Once ordered, the card and checkbook will be sent to your home within a few working days by secure mail. You can then perform your first payments and withdrawals!

🌿 Link your beneficiaries

When you have an online banking account, you can associate beneficiaries to facilitate money transfers. Here's how you can do it:

Access your online banking account using your login credentials. Look for the option or tab that allows you to manage your beneficiaries or money transfers. Select the option to add a new beneficiary.

You will need to provide the necessary information, such as the beneficiary's full name, bank account number, the BIC/IBAN code (for international transfers) and possibly other specific details required by your bank.

Before confirming the beneficiary addition, be sure to carefully review the information you provided. This ensures that money transfers will be carried out accurately. Once you have verified the details, confirm the addition of the beneficiary by following your online banking instructions.

There may be a stage of additional validation, such as a confirmation code sent by SMS or email. Once you have associated a beneficiary with your online banking account, you will be able to easily select this person for your next money transfers.

This simplifies the process and saves you from having to re-enter all the information every time you want to make a transfer to that specific beneficiary.

🌿 Migrate your direct debits and transfers

If you're changing banks, you'll probably want to migrate your regular transactions to your new online account. 📤 For this, make a list of all your transfers and direct debits recurring.

Inform each organization and change your bank direct debits to your IBAN online, either via their website or by post. It is tedious but necessary. You can then manage all of your finances from your 100% online account!

🌿 Close your old bank account

Once all your operations have been migrated, you can proceed to close your previous bank account. ✖️ Complete the banking mobility form that your new online bank provides you.

The closing will be automatically requested from your old bank and the transfer of the balance carried out. No need to worry about it anymore. Your banking migration to the 100% online is over !! 🏁

🌿 Closing

Opening an online bank account is now child's play, fast and paperless. 👍 Just a few clicks and you have access to a modern and economical bank, accessible 24 hours a day on all your devices.

By following this step-by-step procedure, you will avoid the pitfalls and be able to enjoy your account 100% online in an optimal way. No need to go to an agency!

Feel free to ask me questions if you have any doubts about any of the steps presented in this guide. I will be happy to help you complete this process.

But before you leave, here's how Live from your website in 3 months

Leave comments