What to know about the currency swap?

Currency swaps are an increasingly common derivative in corporate debt capital structures. When organizations assess whether this product is right for them, they consider a variety of issues, from trade structuring to accounting treatment. Moreover, the future of banking lies in securitization and portfolio diversification of credits. The global currency swap market will play a key role in this transformation.

In this article, I present to you the essentials of what you need to know about currency swaps. But first, here is a paid training course that allows you to get started with online training.

What is a currency swap

A currency swap is an agreement between two parties to exchange the cash flows of a loan from one party for the other in a different currency. They allow companies to tap into global capital markets more efficiently because they provide an integral arbitrage link between interest rates in different developed countries.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

A currency swap is simply an agreement to exchange cash flows in one currency for cash flows in another currency at set rates.

For example, a company can enter into an agreement with a hedge bank to receive a certain notional amount of USD at a fixed interest rate in return for payment of a specified notional amount of EUR at a different interest rate. It is important to note that each stage of the transaction could be a fixed or floating rate.

Like any OTC derivative, these transactions are customizable. In some cases, there is an initial notional exchange. For other cases, there is a final notional exchange. In almost all cases there are interim interest payments, which may or may not also include notional swaps. The chart below provides a common example.

Historical origin of swaps

The swap dates back to the 1960s when the FED (US central bank) intervened in the foreign exchange market to support the dollar by exchanging greenbacks for marks with the Bundesbank (the German central bank). The FED had then made the commitment that the reverse exchange (return of the marks and recovery of the dollars) would take place on a date fixed in advance.

Why use currency swap?

Swaps are used by some investors as speculative instruments to bet on the evolution of the prices of different markets. Thus you will find swaps on currencies, on rates, on shares, on raw materials, etc.

Article to read: All about the stock market

A swap must include elements such as a schedule, the duration, the start date, the value of the fixed rate, the nature of the underlying, the nominal amount, the basis of calculation and the reference of the variable rate.

Swap Example

Let's take as an example from a US-based company we'll call Acme Tool & Die. Acme raised funds by issuing a Swiss franc-denominated Eurobond with fixed semi-annual coupon payments of 6% on 100 million Swiss francs.

Initially, the company receives 100 million Swiss francs from the proceeds of the Eurobond issue (ignoring any transaction or other fees) and is able to use the Swiss francs to fund its operations in the United States.

Article to read : How to develop brand imagethan a business ?

Since this issue is funding US-based operations, two things are going to have to happen: Acme is going to have to convert the 100 million Swiss francs to US dollars, and it would prefer to pay its liability for the coupon payments in US dollars every the six months.

The company can convert this Swiss franc denominated debt into US dollar-like debt by entering into a currency swap with First London Bank.

He agrees to trade the 100 million Swiss francs initially in U.S. dollars, as well as to receive coupon payments in Swiss francs on the same dates that coupon payments are due to Acme Eurobond investors and to pay coupon payments in U.S. dollars linked to an indexer and re-exchange the notional US dollar into Swiss francs at maturity.

Acme's U.S. operations generate U.S. cash flow who pay index payments in US dollars. In this way, the currency swap is used to hedge or lock in the added value of the Eurobond issue, which is why these types of swaps are often traded as part of the entire issuance program with the main issuing financial institution.

Flexibility

Unlike interest rate swaps, which allow companies to focus on their comparative advantage by borrowing in a single currency in the short term, currency swaps provide companies with additional flexibility to exploit their comparative advantage in their markets. respective loan.

They also provide the ability to leverage advantages across a network of currencies and maturities. The success of the currency swap market and the success of the Eurobond market are explicitly linked.

The exhibition

Currency swaps generate greater credit risk than interest rate swaps. This is due to the swapping and re-trading of notional amounts. Companies must find the funds to deliver the notional at the end of the contract and are obliged to exchange the notional of one currency for the other at a fixed rate.

The more actual market rates deviate from this contractual rate, the greater the potential loss or gain.

This potential exposure is magnified as volatility increases over time. The longer the contract, the more chance the currency has to move either side of the agreed primary exchange rate. This explains why currency swaps mobilize more credit lines than traditional interest rate swaps.

The Price

Currency swaps are valued or valued in the same way as interest rate swaps. This is done using a discounted cash flow analysis having obtained the zero coupon version of the swap curves.

Typically, a currency swap initially trades with no net worth. Over the life of the instrument, the currency swap can go “in-the-money”, “out-of-the-money” or it can stay “in-the-money”.

Types of Swaps

The instruments that are exchanged in a swap need not be interest payments. In fact, there are countless variations of exotic swap deals. Relatively common agreements include currency swaps, debt swaps, commodity swaps, and total return swaps.

Interest Rate Swaps

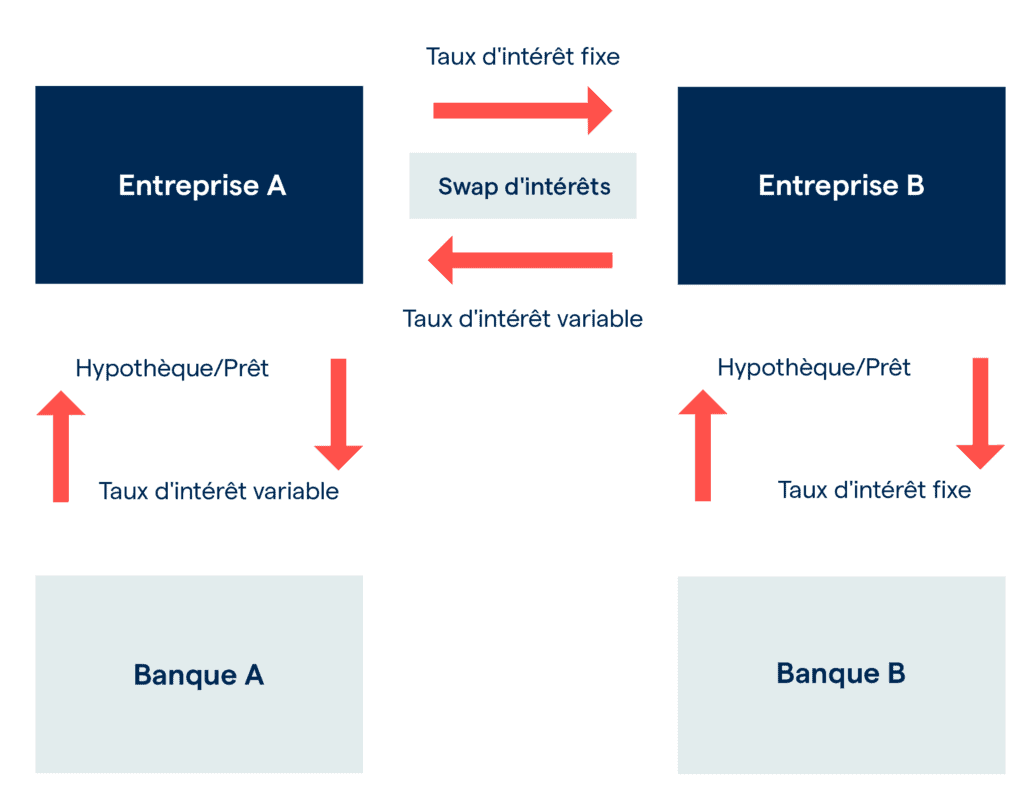

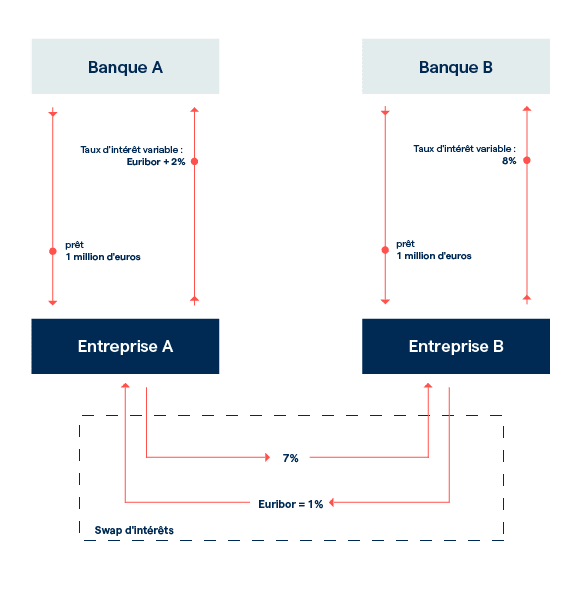

The simplest and most common type of swap is known as a vanilla simple interest swap. In such a swap, Party A agrees to pay Party B a fixed, pre-determined rate of interest on notional principal for a specified period of time on specific dates.

Article to read: How to monetize your blog with sponsored articles?

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Therefore, Party B agrees to make any payment to Party A on a variable interest rate with the same notional principal for the same term on the same specified dates.

In a classic interest rate swap, also known as a vanilla simple interest rate swap, the same currency is used to pay both cash flows. Payment dates that have been predetermined are called settlement dates, and the time between them is the settlement period.

Since swaps are personalized contracts, payments can be made monthly, quarterly, annually or at any interval determined by the parties.

Example of interest rate swap

Suppose two entities seek to "artificially" convert their interest payment obligations. Company A could seek to exchange its variable interest payment obligation for a fixed rate allowing it, for example, to obtain another loan.

Its counterparty, Company B, may prefer to convert its payments to a floating rate, depending on expectations of lower interest rates.

The currency swap

In a currency swap, the two parties exchange principal and interest payments on debt denominated in different currencies. Unlike an interest rate swap, the principal is often not a notional amount but is instead exchanged with interest obligations. Currency swaps can take place in different countries.

For example, Argentina and China used this swap, in particular so that China could stabilize its foreign exchange reserves.

As a second example, even the US Federal Reserve has engaged in an aggressive currency swap strategy with European central banks. This was done during the 2010 financial crisis in Europe, which was aimed at stabilizing the euro which was falling following the Greek debt crisis.

Currency Swap Example

The most emblematic example of this type of swap was entered into in 1981, when the World Bank accepted a USD bond, then swapped its dollar payment obligations with the American company IBM in exchange for the debt cover. of the company issued in German marks (DM) and Swiss francs (CHF).

This swap allowed the World Bank to increase its exposure to the currencies of Switzerland and Germany, which had interest rates between 8% and 12%, compared to 17% in the United States - while IBM hedged its obligations in these currencies.

The Total Return Swap

In total return swap trading, the total return of a particular asset is swapped for a fixed interest rate. The party that will pay the fixed rate exposure to the underlying asset, whether it is a stock or an index.

For example, an investor can pay a fixed rate to a party in exchange for capital appreciation in addition to dividend payments from a stock pool.

Commodity swaps

Trading a floating commodity price is what is seen in a commodity swap. Take for example the spot price of Brent crude oil, for a price which is fixed over an agreed period. As the example suggests, a commodity swap will most often involve crude oil.

Debt-for-equity swaps

As the name suggests, a debt-for-equity swap involves the exchange of equity for debt and vice versa. When dealing with a publicly traded company, this would mean exchanging bonds for stocks. Debt-to-equity swaps are a way for a company to refinance its debt as well as relocate its capital structure.

The credit risk swap

Credit default swap swaps consist of an agreement by a single party to pay the principal amount forfeited plus interest on a loan to the credit risk buyer, provided that the borrower defaults on its ready. Poor risk management and excessive leverage in the credit market were the main causes of the 2008 financial crisis.

Example of a credit risk swap

Suppose that in exchange for an attractive interest rate (underlying value), the pension fund “FP” decided to invest by lending a large sum to company ABC. To mitigate its risk, FP (buyer) decides to open a credit default contract with an insurance company (issuer) in exchange for a fraction of the interest received on its investment.

With this swap, FP manages to protect itself against the default (non-payment) of company ABC, by transferring the obligation to cover the losses to the insurance company.

Other types of swaps

- The basis swap: allows you to exchange two variable rates indexed to short-term rates, in the same currency or in two different currencies

- The constant maturity interest rate swap: makes it possible to exchange a variable rate indexed on short-term interest rates against another variable rate indexed on a medium or long-term interest rate.

- The asset swap: it is the merger between an interest rate swap and a fixed rate bond creating a synthetic floating rate bond.

- The total return swap: allows you to exchange the income and the risk of changes in the value of two different assets during a given period of time.

- The inflation swap : the exchange of a fixed or variable rate against an inflation rate

- Equity swaps: works the same way as the interest rate swap

- Curve Swap: interest rate swap (variable against variable) single currency betting on the shape of the yield curve.

Difference between currency swap and interest rate swap

An interest rate swap involves the exchange of cash flows related to interest payments on the designated notional amount. There is no notional swap at the start of the contract, so the notional amount is the same for both sides of the currency and it is delimited in the same currency. The main exchange is redundant.

Article to read : How to develop the brand image of a company?

In the case of a currency swap, however, the principal exchange is not redundant due to currency differences. The exchange of principal on notional amounts is done at market rates, often using the same rate for the transfer at the beginning as that used at maturity.

The pros and cons of swaps

Swaps are used not only for hedging operations tending to cancel or reduce the risk exposure of a company or an individual, but also for speculative operations. The major drawback of swaps remains related to the counterparty risk.

It is indeed always possible that the counterparty does not meet its payment obligations. By opting for the swap for speculative purposes, you also risk experiencing losses when your predictions are not correct.

Conclusion

The swap is a complex financial instrument that is mainly used by professional investors. This mechanism present on the currency market is also a derivative financial product that allows cash transactions and credit optimization.

It is used by some traders to generate long-term forex profits by taking advantage of the interest rate differential between currencies through the “ carry trade ". However, retail investors are advised to seek to understand the basic mechanism by incorporating it into your portfolio.

But before you leave, here is premium training that will help you take control of your personal finances.

Leave comments