What to know about mortgages

For many, owning a house is part of the dream, it is the fulfillment of a better life, the purpose. For most homeowners, getting mortgages is just one of the necessary steps to get there. Taking out a mortgage loan is one of the financial decisions the biggest ones most of us will ever take. So it's essential to understand what you're signing up for when you borrow money to buy a home.

If you're considering home ownership and wondering how to get started, you've come to the right place. Here we will cover all the basics of mortgage lending. In truth I TELL you EVERYTHING on this subject. But before you start, here is a premium training that will allows you to know all the secrets to succeed in the Podcast.

✔️ What is a mortgage loan?

The mortgage loan, also called real estate loan, is a long-term loan used to finance the acquisition of real estate. Its main characteristic is to be guaranteed by a mortgage on the property in question.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Concretely, the borrower will take out the mortgage loan with a credit institution, generally a bank. The amount granted is capitalized over a long period of up to up to 25-30 years old. During this period, the borrower repays constant monthly payments made up of part interest and part capital.

The collateral for the bank is the real estate itself on which a mortgage is placed. This means that in the event of prolonged default, the bank may require the sale of the property in order to recover the amounts still owed.

Thanks to this solid guarantee, and over such a long term, the interest rate of the mortgage loan remains Quite low and gives this financing a definite advantage for becoming an owner. These advantages make it a financial product adapted to the real estate market.

✔️ Who can get a mortgage?

Anyone can get a mortgage loan. Most people who buy a home do so with a mortgage. A mortgage is a necessity if you cannot afford the full cost of a home out of pocket.

There are times when it makes sense to have a mortgage on your home even though you have the money to pay it off. For example, investors sometimes mortgage properties to free up funds for other investments.

To qualify for the loan, you must meet certain eligibility conditions set by the bank. Therefore, a person who gets a mortgage will most likely be someone with a stable and reliable income, a debt-to-income ratio below 50%, and a decent credit score. Besides this type of loan, we can have car loans, etc.

✔️ How do mortgages work?

The mortgage is a right granted to a creditor over real estate, so that he can repay himself in the event of default by the borrower. Concretely, this means that in the event of non-repayment of a loan, the mortgagee can demand the sale of the mortgaged property to recover its debt.

To set up a mortgage, you must contact a notary. The latter will then register the mortgage with the land registration service after signing the mortgage deed. Mortgage guarantee fees generally apply.

Once the mortgage registration has been carried out, the creditor is assured of being able to repay himself thanks to the value of the real estate if the borrower stops all repayments. The bank can demand the seizure and auction of the mortgaged property if necessary.

The mortgage however, retains the debtor's right to remain in the premises. It concerns only the right to property. It is prohibited for the creditor to despoil the property as long as the owner continues to honor the repayment of his debt.

✔️ How does interest work on a mortgage?

The amount of interest you will pay on your mortgage depends on the mortgage deal you have chosen. If, for example, you opt for a fixed rate mortgage for a fixed period of time, then during this period the amount of interest you will pay will remain the same each month.

At the end of the fixed rate period, you will usually be automatically transferred to your lender's standard variable rate, which will usually be higher than any special offers you have entered into.

At this point, you will see your interest payments increase. However, you will be free to remortgage a new mortgage transaction, which can help lower your payments.

If you choose a variable rate mortgage, then the amount of interest you pay may fluctuate over time. If interest rates drop, this drop could be passed on to you and you will see your monthly payments decrease.

However, if mortgage rates rise, borrowing costs become higher for lenders, and these higher costs are generally passed on to homeowners. In this case, your monthly payments would increase. That's why many buyers opt for fixed rates to ensure that their interest rate and monthly payments won't change.

In the early years of your mortgage, more of your monthly payment goes to paying off your interest and a smaller amount to your principal. Gradually, you will begin to repay more of your principal over time as your debt decreases.

✔️ The components of a mortgage payment

Your monthly mortgage payments can cover several things, including:

🎯 The principal of the loan

The " mortgage capital » means two things. It may refer to the amount you borrowed. It can also refer to the amount you owe after making payments.

For example, if you borrowed $200 and repaid $000, the remaining principal balance is $24. A portion of each mortgage payment is applied to your principal, reducing the total amount owed over time.

🎯 interest on mortgages

The interest rate on your mortgage determines the amount you will pay the lender for the loan. A portion of each monthly payment reduces the principal due and a portion is used for interest. In the first few years of the loan, most of each monthly payment pays interest and little is spent on principal.

In later years, most of the payment reduces the principal. This process is called depreciation.

🎯 Property taxes

Your lender can collect property taxes along with your mortgage payment and hold the money in an escrow account until your property tax bill is due, paying it on your behalf at that time.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

🎯 Home insurance

Homeowner's insurance, which can cover damage caused by fires, storms, accidents and other disasters, is typically required by mortgage lenders. They can collect the premiums with your mortgage payment and then pay the insurance bill out of your escrow account when it is due.

🎯 mortgage insurance

When you put down less than 20%, lenders usually ask you to pay for mortgage loan insurance. This insurance protects the lender against the risk of loan default.

There are two types: private mortgage insurance and the forms of mortgage insurance required for government-backed loans. Premiums may be billed to your monthly mortgage statement

✔️ The different types of mortgage loans

There are several types of mortgage loans available to consumers. They include conventional fixed-rate mortgages, which are among The most common, as well as adjustable rate mortgages and inflatable mortgages. Potential buyers should research the right option for their needs.

🎯 Fixed rate mortgages

Fixed rate mortgages offer borrowers a fixed interest rate over a fixed term usually 15, 20 or 30 years old. With a fixed interest rate, the shorter the borrower's payment term, the higher the monthly payment. Conversely, the longer the borrower takes to pay, the smaller the monthly repayment amount.

However, the longer it takes to repay the loan, the more interest the borrower ultimately pays.

- Benefits

most big advantage of a fixed rate mortgage is that the borrower can expect their monthly mortgage payments to be constant. This makes household budgeting easier and avoids unexpected additional costs from month to month. Even if market rates increase considerably, the borrower does not have to make higher monthly payments.

- Disadvantages

Fixed rate transactions are generally slightly higher than variable rate mortgages. If interest rates go down, you won't benefit.

Warning to :

- Fee if you want to leave the agreement early – you are bound for the duration of the fix.

- The end of the fixed period – you should look for a new mortgage agreement two to three months before it ends or you will automatically be transferred to your lender's standard variable rate, which is usually higher.

🎯 Variable rate mortgages

With adjustable rate mortgages, the interest rate can change at any time. Make sure you have savings so you can afford an increase in your payments if rates go up. Variable rate mortgages come in a variety of forms:

➤ Standard Floating Rate

This is the normal interest rate that your mortgage lender charges buyers. It will last as long as your mortgage or until you complete another mortgage transaction. Changes in the interest rate may occur after an increase or decrease in the base rate set by the Bank.

Benefits

Free – you can overpay or leave at any time.

Disadvantages

Your rate can increase at any time during the loan.

➤ Discount mortgages

This is a discount on the lender's standard variable rate (TVS) and only applies for a certain period of time, usually two or three years. But it's worth shopping around. TVS differ between lenders. So don't assume that the higher the discount, the lower the interest rate.

Benefits

- Cost – the rate starts cheaper, which will keep monthly repayments lower;

- If the lender reduces their TVS, you will pay less each month.

Disadvantages

- Budgeting – the lender is free to increase their TVS at any time

- If the Bank's base rates increase, you'll likely see the discount rate increase as well.

Pay attention to fees if you wish to leave before the end of the discount period.

➤ Rate Capped Mortgages

Your rate normally changes with the lender's TVS. But the cap means that the rate cannot exceed a certain level.

Benefits

- Certainty – your rate will not exceed a certain level. But make sure you can afford refunds if it hits the cap level.

- Cheaper – your rate will go down if the TVS goes down.

Disadvantages

- The ceiling tends to be set quite high;

- The rate is generally higher than other variable and fixed rates;

- Your lender can change the rate at any time up to the cap level.

➤ Offset mortgages

These work by linking your savings account and current account to your mortgage so you only pay interest on the difference. You still pay off your mortgage every month as usual, but your savings act as an overpayment that helps liquidate your mortgage early.

✔️ How to choose a good mortgage?

The mortgage market is incredibly competitive and it can be difficult to understand exactly what is on offer. There are many different suppliers and a wide range of products and prices available. It is therefore a good idea to speak to your bank as well as a number of independent mortgage advisers.

Lenders (usually banks) and brokers must advise you when recommending a mortgage. They will assess how much mortgage repayment you can afford, looking at your income as well as your debt repayments and daily expenses. This means you should end up with a mortgage that meets your needs.

Although lenders and brokers must offer advice in almost all cases, you may be able to choose to reject the advice and find your own mortgage deal based on your own research. If you choose your own mortgage without notice, this is called an "application". execution only ».

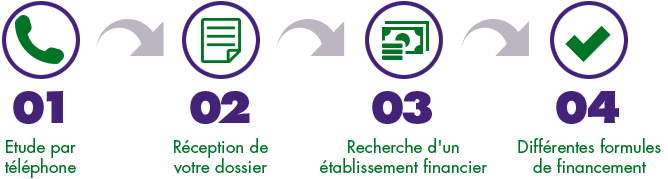

✔️ How to apply for a mortgage?

Applying for a mortgage is often a two-step process. The first step usually involves some basic research to help you determine how much you can afford and what type(s) of mortgage(s) you may need.

The second step is where the mortgage lender will carry out a more detailed verification of suitability and, if not already requested, proof of income.

🎯 First step

Typically, lenders will ask you a series of questions to determine what type of mortgage you want and how long you want it for. They will also try to determine, without going into too much detail, your financial situation.

This is generally used to give an indication of how much a lender might be willing to lend you. They should also give you key information about the product, their service, and any fees or charges, if any.

🎯 Second step

This is usually where you start your application. The lender or mortgage broker will begin a “ discovery of the facts » comprehensive and detailed seedability assessment, for which you will need to provide evidence of your specific income and expenses, and " resistance tests » about your finances.

This could involve a detailed questioning of your finances and future plans that could affect your future income. They will also assess the impact on your repayments if interest rates rise in the future.

If your application has been accepted, the lender will provide you with a “binding offer” and mortgage illustrative document(s) explaining the terms of your mortgage.

This will be accompanied by a “ reflection period » of at least 7 days, which will give you the opportunity to make comparisons and assess the implications of accepting your lender's offer. Some lenders may give you more than 7 days to do this. You have the right to waive this cooling-off period to speed up the purchase of your home if you need to.

During this cooling-off period, the lender generally cannot modify or withdraw its offer, except in certain limited circumstances.

✔️ What is the difference between a simple loan and a mortgage loan?

The term " ready » can be used to describe any financial transaction. Transactions in which one party receives a lump sum of money and agrees to repay on payment of interest.

A mortgage is a type of loan used to finance a property. A mortgage is a type of loan, but not all loans are mortgages.

Mortgages are loans guaranteed ". With a secured loan, the borrower promises security to the lender in case they stop making payments. In the case of a mortgage, the security is the house. If you stop making payments on your mortgage, your lender can take possession of your home.

🎯 In summary…

A mortgage loan is a loan used to buy a house or to refinance a mortgage. You make regular payments on a mortgage until it is paid off after a certain number of years.

More specifically, a mortgage is the legal document that allows your lender to take the house if you do not repay the loan as agreed. In some states, this document is called a trust deed.

Once you've paid off the mortgage, you own the house, or " free and clear ". The lender's legal right to repossess your home disappears.

When comparing these offers, remember to look at withdrawal fees, as well as exit penalties. Before you leave, here is a training that allows you to master trading in just 1 hour. Click here to buy it

For all your concerns, leave me a comment

Leave comments