What is Crowdfunding?

What is crowdfunding? This question constitutes the main concern that this article seeks to answer. In this article, we will explore the concept of crowdfunding, a financing method participatory which is increasingly popular with entrepreneurs in Africa. Crowdfunding makes it possible to raise funds from a large audience, using dedicated online platforms.

This method of financing can help entrepreneurs to carry out their projects and develop their business, by offering them an alternative to traditional sources of financing.

In this article, we will explain how crowdfunding works, the advantages and disadvantages of this method, as well as the best practices for a successful fundraising campaign. financing in Africa. But before we start, here's How to get out of debt?

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Let's go !!

⛳️What is crowdfunding?

Crowdfunding, also known as crowdfunding, is a way of collaborative funding which allows entrepreneurs, creators or project leaders to raise funds from a large number of people.

This method of financing is often used for cultural, artistic, social or environmental projects, but it can also be used for entrepreneurial and commercial projects.

Unlike traditional financing methods, participatory financing allows project promoters to raise funds directly from the community interested in their project, without going through traditional financial intermediaries such as banks or venture capital investors.

This approach also allows contributors to invest small amounts in projects that are important to them and participate in their success.

Crowdfunding has become increasingly popular in recent years thanks to the emergence of online crowdfunding platforms, which facilitate the fundraising process and allow project promoters to reach a large audience of potential contributors.

???? How does crowdfunding work?

In this type of financing, two parties come together. The saver who wishes to invest a certain sum of money in a project in which he believes. And the bearer of this project who does not have the necessary funds to implement it.

Both meet on internet via a dedicated platform. Projects are presented by their sponsors and savers choose to finance those that interest them up to what they wish to invest.

Several participatory financing methods exist: donation (with or without consideration), the loan (with or without interest) and capital investment.

???? The different forms of crowdfunding

Crowdfunding can take many forms. We distinguish three main forms of crowdfunding:

✔️ Donations

To make a donation is to offer something to a third party without consideration. By making a donation to a project leader, the Internet user contributes to the development of this event without expecting anything in return.

However, the investor is usually rewarded symbolically. Indeed, if it is a film for example, his name may appear in the credits. A promotional item may be assigned to it. This form of crowdfunding also makes it possible to advertise this project, so that the promoter can claim subsidies.

✔️ Crowd equity

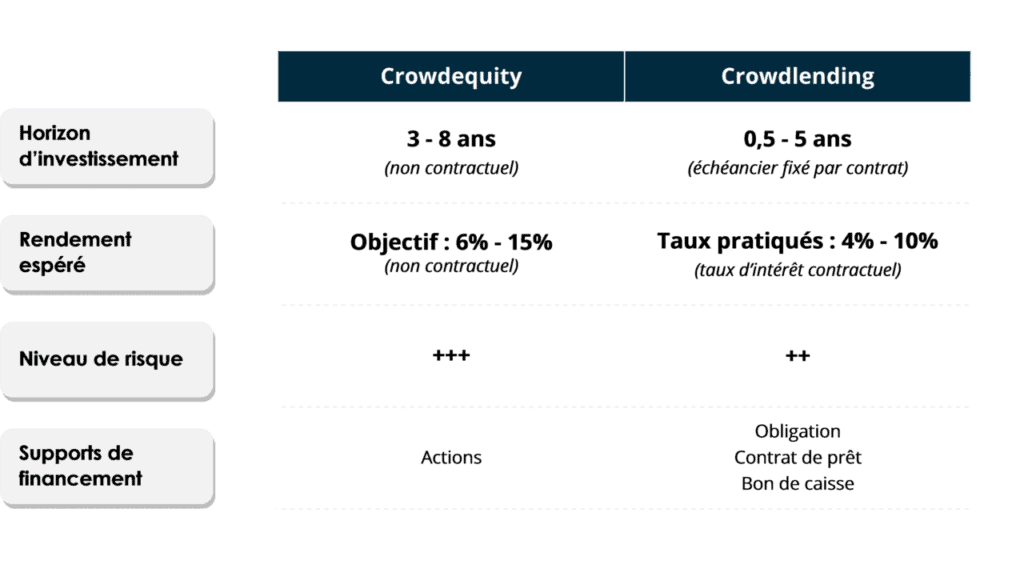

Crowd equity is a method of crowdfunding that appeared in 2014. With this form of financing, investors receive in return a portion of the company's shares. In some cases, this form provides tax benefits for its investors. Indeed, by supporting a project in crowdequity, the investor holds part of the company's capital.

To benefit from this type of financing, certain conditions must be met. Crowd-equity campaigns are reserved only for Sociétés en Actions Simplifiées and Sociétés anonymes.

This risk-taking is used in particular for large-scale projects in view of the larger amounts.

✔️ crowd lending

Crowd-lending is a subcategory of crowdfunding. It consists of financing projects submitted under the platforms by loans subscribed by the public.

Crowdlending is launched on crowdfunding platforms when banks can't follow this kind of investment. As such, the budgets of local authorities benefit by embarking on this method of crowdfunding.

???? Advantages of crowdfunding

Unlike other means of financing, crowdfunding has a multitude of advantages.

✔️ First advantage: lower cost market research

The first advantage of Crowdfunding is above all financial. It allows a project leader to carry out a kind of market study at a lower cost.

This financial advantage is one of the main reasons for a project promoter to resort to crowdfunding. In addition, it allows investors to benefit from advice and support. Some can be very beneficial.

✔️ The gift

Philanthropic crowdfunding or crowdfunding by donation is driven by community power and the crowd that mobilizes around a project that has seduced them.

The gift in the through crowdfunding requires less work upstream than for other methods of financing (loans and capital investment). It is simple because contributors do not need to complete any administrative document, a bank card is enough. As a result, the duration of the financing process is short.

✔️ Low risk

In fact, the project leader does not risk being diluted. He will therefore retain his decision-making power and does not undertake to repay a loan.

In crowdfunding, communication is a significant advantage. During the campaign, the project leader will have to talk about his idea to attract contributors. Apart from the financial aspect, the crowdfunding also finds meaning in this period of intense communication.

???? The Disadvantages of Crowdfunding

Although having advantages, crowdfunding also has disadvantages.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

✔️ Very expensive energy expenditure

You need to invest a good part of your time in communication. Especially at the time of the campaign when effective communication to arouse the motivation of the public to finance the project is necessary.

In fact, not having succeeded in a campaign of through crowdfunding can be degrading for the image of the project. Indeed, the campaign crowdfunding can be perceived as a measure of credibility by your customers, your community.

✔️ The very high cost

He's more expensive than a bank loan. When you submit your project on a crowdfunding platform, you pay a commission to this platform, which acts as an intermediary. This commission varies according to the platform and levied in the event of success.

In addition to these costs, it is necessary to take into account the communication expenses. All this while you do not have the assurance of being financed. If successful, in Crowdlending you will pay interest on the amount received. However, only projects that successfully collected will be commissioned.

✔️La dilution of shares

It may happen that you no longer remain the sole owner of the project. You lose your decision-making power.

The dilution of shares essentially occurs when we are in the context of a Crowd-equity. To do this, you have to think carefully about the financing arrangements so as not to lose control of your business.

✔️ Theft of ideass

Many people can have their ideas stolen. The reality is that the submitted projects are accessible to everyone and increase the risk of theft.

✔️ Financial risk

The project leader is exposed to a financial risk; he must communicate, feed and manage his campaign crowdfunding. This whole process has a cost and it should not be overlooked. The submission of a project on a platform of through crowdfunding donating is free.

⛳️ How to benefit from crowdfunding

Benefiting from crowdfunding for your project requires rigorous preparation and a convincing presentation of your project. Here are some key steps to maximize your chances of success:

⚡️Choose platform

There are many crowdfunding platforms available, each with their own terms and characteristics. You will have to choose the one that best suits your needs and your project.

⚡️Define the amount to be raised

You must determine the amount you need to finance your project. It is important to be realistic and consider the costs associated with the crowdfunding campaign, such as platform fees and rewards for contributors.

⚡️Create a campaign page

You will need to create an attractive campaign page that clearly explains your project, its goals, and the rewards available to contributors. This page should be well-designed and compelling to attract contributors.

⚡️Prepare a presentation video

A presentation video can help explain your project in a more dynamic way and pique the interest of potential contributors. The video should be short, captivating and informative.

⚡️Promote your campaign

Once your campaign is live, you will need to promote it on social media, to friends and family, and in the media to attract contributors. The more visibility you have, the more likely you are to succeed with your campaign.

⚡️Manage the campaign

You will need to closely monitor your campaign, answer questions from potential backers, and ensure rewards are delivered on time. If your campaign reaches its fundraising goal, then you can collect funds from contributors and implement your project.

It is important to note that each crowdfunding platform may have additional requirements and steps to follow. It is therefore important to read the conditions of the platform before starting your campaign.

⛳️Some crowdfunding platforms

There are many crowdfunding platforms, each with its own characteristics and conditions. Here are some examples:

⚡️Kickstarter

Kickstarter is an online crowdfunding platform created in 2009. It allows project leaders to present their idea and solicit funds from a community of potential contributors. Funding is in the form of donations., and contributors receive in exchange compensation specified by the project leader.

To present a project on Kickstarter, you must first submit a proposal to the platform's team, which examines the quality and viability of the project. If the proposal is accepted, the project leader can then create a presentation page on the site.

This page must include a detailed description of the project, a provisional budget and a list of compensation offered to contributors.

When the crowdfunding campaign starts, the project leader must mobilize his community and use social networks to publicize his project and encourage people to contribute. It is also important to set a realistic fundraising goal, taking into account the costs of the platform and the production costs of the project.

Once the campaign has been launched, the project leader must regularly update their presentation page to inform contributors of the progress of the project and encourage them to share it with their network.

If the funding goal is reached, the project leader receives the funds collected, minus the platform fees. If the goal is not achieved, contributors are reimbursed and the project leader receives nothing.

⚡️Ulule

Ulule is a French crowdfunding platform that specializes in creative, innovative and solidarity projects. Founded in 2010, it has become one of the leading crowdfunding platforms in Europe with more than 29 projects funded to date.

Ulule offers two types of financing: donation financing and presale financing. Donation funding allows contributors to financially support a project without expecting anything in return.

Pre-sale funding, on the other hand, allows contributors to purchase project-related products or services before they go to market.

To benefit from financing on Ulule, it is important to present a creative, innovative and original project. The project must also be clearly defined and explained in the campaign page, with quality images and videos.

It is also important to offer attractive rewards to contributors, depending on their level of participation. Finally, it is recommended to promote your campaign on social networks and seek the support of your community.

⚡️KissKissBankBank

KissKissBankBank is a crowdfunding platform that was founded in 2009 in France. It allows project leaders to collect funds from individuals, in exchange for compensation.

Unlike Kickstarter, which is a massive crowdfunding platform, KissKissBankBank focuses on small-scale projects and creative projects such as movies, books, art projects, music projects, business projects, etc.

To start, project promoters must create a project page on the platform, which describes their idea, their funding objective, the counterparties offered, as well as details on the project itself.

Once the project page is live, fundraising can begin. Contributors can choose to donate an amount of money in exchange for rewards. KissKissBankBank uses a financing system “ all or nothing which means that project promoters must reach their fundraising goal to receive the funds.

Finally, once fundraising is complete, project leaders can start carrying out their project, and contributors will receive their rewards. KissKissBankBank charges a 5% commission on funds raised, as well as a 3% payment fee for credit card contributions.

⚡️Indiegogo

Indiegogo is another popular crowdfunding platform that allows project owners to raise funds from a large number of contributors, called “backers".

Founded in 2008, the platform has become one of the major players in the crowdfunding industry, with projects ranging from tech startups to artistic and creative projects.

Indiegogo offers two types of crowdfunding campaigns: crowdfunding campaigns all or nothing financing and the campaigns of flexible financing.

In an all-or-nothing fundraising campaign, the project leader must reach a predetermined fundraising goal to receive the funds raised. In a flexible fundraising campaign, the project leader can keep the funds collected, even if he has not reached his fundraising goal.

⛳️FAQ

Can all projects benefit from crowdfunding?

A: No, All crowdfunding platforms have selection criteria for eligible projects. It is important to read the conditions carefully before applying.

What is the percentage of commission taken by crowdfunding platforms?

A: It depends on the platforms, but in general they take a percentage of the amount collected ranging from 5% to 10%. It is important to read the conditions carefully to avoid unpleasant surprises.

How to properly present your project on a crowdfunding platform?

A: It is important to present a clear, well-structured project that arouses interest. It is also necessary to prepare an attractive and detailed presentation video. It is also advisable to offer attractive rewards for donors.

What happens if the funding goal is not reached?

A: It depends on the platforms, but in general donors are refunded if the fundraising goal is not met.

Are there any additional fees to pay apart from the platform commission?

A: Some platforms may charge additional fees for transferring funds or for using certain services.

How to ensure the security of transactions on crowdfunding platforms?

A: Crowdfunding platforms have security measures in place to protect donors and project owners. It is important to read the conditions carefully to learn more about these security measures.

It's up to you to play, share, like and give us your opinion in comments

Leave comments