What is gross profit?

What is gross profit? Already understanding profit is one of the first and most important things any business owner needs to be successful. If you don't know the differences between the different types of profits and what each ultimately means for your business, it can be difficult to create a growth strategy that works.

Equally important, if you don't know how the different types of earnings work and what they mean for your business, you won't be able to give investors accurate, high-quality information about your business.

At best, not having this information will mean that fewer people will be interested in investing. At worst, your investors might not get the dividends due or your company might assume it has more money than it has.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

You need a solid understanding of what gross profit is, how it works, and what it means for your business if you want to be successful. Fortunately, that is precisely what this article will give you. Let's go

What is gross profit?

Gross profit, in simple terms, is the amount of profit you made in a given period after subtracting the cost of goods sold (COGS) from your total profit for the same period.

Article to read: How to sell crypto on Binance P2P?

This is different from simply subtracting all your costs and works the same for businesses selling a product and businesses selling a service.

For service businesses, you should subtract the cost of providing the services you sell, just as you would subtract the cost of making or purchasing products sold by other businesses.

Certain profits should be excluded from your gross profit calculation. The profits you count should only be the profits from the sale of your goods and services.

If your business, for example, sold a building that you used to operate from but no longer need, the proceeds of that sale should not be included in your gross profit calculation.

Examples of COGS

Knowing what to include in the cost of goods sold can be one of the trickiest parts of calculating your gross profit. After all, office supplies may be something your business needs to run.

But they're not exactly a direct cost required to sell clothes. But those same supplies could be a direct cost of providing accounting services.

When it comes to a lot of COGS, the type of business you are in can make a big difference between what counts as operational cost and what should be included in cost of goods sold.

Here are some examples of things that should be included in your COGS calculations:

- The shipping costs of the goods sold

- Raw materials used in manufacturing

- Parts used in manufacturing

- Time spent with customers

- Cost of materials used to provide a service

- For this last point, we want to make some clarifications.

For this last example, you need to consider the elements you use to provide a particular service. For example, a massage therapist has a certain cost associated with keeping the massage lotion in stock. Lotion, a non-optional cost for giving a massage, should be included in the COGS for this type of business.

What does gross profit tell you?

Gross margin is an important measure of the overall profitability of your business. It is thus a way to keep an eye on your costs to generate income.

Article to read: What attitudes to succeed in life?

Running a business always entails costs. Retailers must pay for the products they sell to consumers. Service providers must pay for the supplies needed for their service, and often must also pay for the training and equipment that makes the service possible.

If the cost of these things is high, your gross profits will decrease Consequently. If the cost required to generate revenue is low, your gross profits are higher.

This means that gross profit can also be used as a measure of a company's efficiency in generating revenue. The higher your gross profit on a good or service, the more money that good or service provides for your other operating costs and the more money your business potentially has for expansion or internal improvements and upgrades. equipment level.

Gross profit vs. Gross margin

Gross profit and gross profit margin can be used to get a picture of profitability. But they are not quite the same.

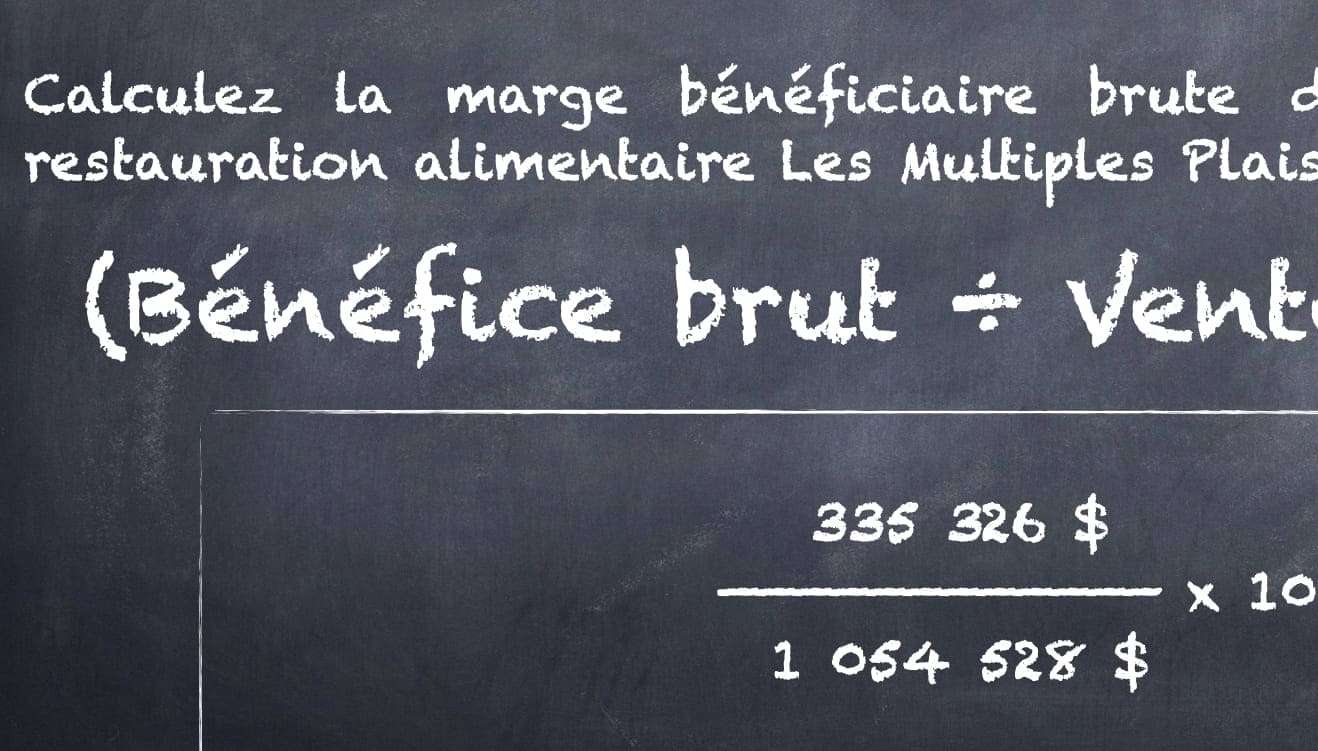

To get the gross profit margin, you must first have your gross profit. Once you have the gross profit, you divide that number by the company's revenue to get a percentage – the gross profit margin.

Remember that this is always different from net profit and net profit margins. Some potential costs and benefits are not included in gross profit or gross profit margins.

Example of gross profit

Having a gross profit example can sometimes help this all make a little more sense. Imagine a company that has a turnover of $15 000 and a CMV of $7 000 ; this company would have a gross profit of $ 8 000. Using the same figures, this company would have a gross profit margin of 53%.

Gross profit vs. net profit

Businesses use gross profit somewhat less often than net profit, which is generally the better understood and more commonly used of the two profit measures. However, it would be best for businesses and investors to know these two numbers and what they are used for most effectively.

Article to read: 10 Tips for Making Smart Investments

Gross and net profits measure slightly different things, and each can be used to give you a complete picture of a company's revenue and overall health.

While gross profit is a measure of the profit left over when you subtract the cost of goods sold, net profit is a measure of all the profit a business has earned after all of its expenses. This means that a company's gross profit is usually higher than its net profit because fewer costs are factored into the calculation.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

A company's net profit can also be referred to as bottom line, and more people may be familiar with this term, as it is commonly used by non-business professionals as well. Net profit is calculated by subtracting all costs incurred by a business during a given period from the revenue generated during that period.

Still not sure what the difference is? We will go into more detail in the next section.

How to Calculate Gross Profit and Net Profit

Remember that gross profit is the amount of money you earned minus the cost of goods sold. Net profit is the total profit generated after all costs have been subtracted from total revenue.

Revenue is the amount of money that has entered the business during a given period without subtracting any of the costs of the business at that same time.

What type of expenses should be included in net profit calculations?

In short, all of your company's expenses over a given period, whether it's a financial quarter, a year, or even a single week, should be included in net profit calculations. for this period.

Here are some examples of expenses that you might not consider or that are particularly important to get an accurate picture of your bottom line.

- Interest on any loan

- Amortization of company-owned equipment

- Administrative overhead

- Utilities for your locations

- Paie

You may have noticed that your cost of goods sold is used for both calculations. This is important because your gross profit and net profit are similar calculations, although you use them slightly differently and you can learn different things about the health of a business from these calculations.

Article to read: 1XBET: how to stop losing and still win?

Net profit, or bottom line, is generally considered more important than gross profit. But knowing your gross profit can tell you a lot about your company's ability to meet your net profit goals.

For example, if your gross profit margin is too low, you don't have as much revenue left over to cover your other costs. A better gross profit margin will make it much easier to have more net profit.

Leave comments