Everything you need to know about Day Trading

The day trader designates the market operator who engages in day trading. A day trader buys and subsequently sells financial instruments such as stocks, currencies or futures and options during the same trading day, which means that all positions he creates are closed on the same trading day. A successful day trader must know about which stocks to trade, when to enter a transaction and when to exit it. Day trading is growing in popularity as more and more people seek financial freedom and the ability to live their lives as they please.

It takes time and dedication to learn the intricacies of this fast-paced world of day trading. But with the right information and careful planning, you can set yourself up to earn a good living.

In this detailed guide, I'll dive deep into the world of day trading and demystify what we actually do and how you can get started. But before you start, here is a complete trading education for you.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Let's go

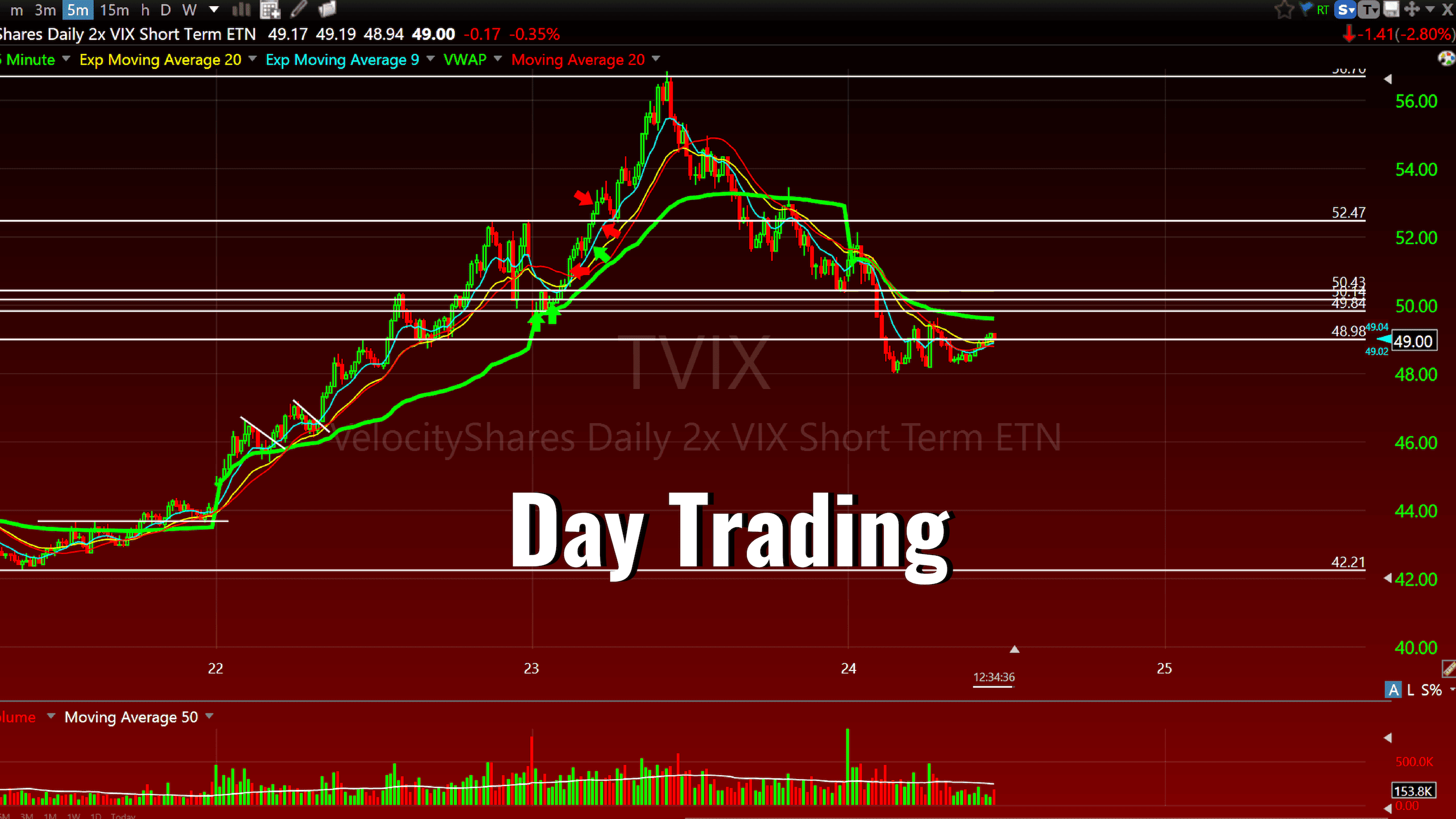

What is Day Trading?

Day trading is a speculative trading style that involves opening and closing a position on the same day.

Quick example: if you open a new position at 10:00 a.m. and close it at 14:00 p.m. on the same day, you have completed a day trade. If you were to close this same position the next morning, this would no longer be considered a Day Trade.

Day traders, or active traders, typically use technical analysis and trading strategy to try to make profits over a short period of time and will often use margin to increase buying power.

A successful day trader doesn't just pick any stock and try to trade it. There has to be some sort of strategy involved in the money management rules and settings.

Day Trader Goals

The main objective of a day trader is to take advantage of small movements in highly liquid stock prices. The more volatile the market, the more favorable the conditions for a day trader. A day trader must have a good knowledge of the stocks, the tools used and also the right platform to trade.

A day trader makes profit by making the difference between the bid price and the ask price. Sensing an imminent move in a particular stock in either direction, a day trader would buy or sell it above or below the bid or ask price.

There are two types of day traders: those who trade individually and those who work with a financial institution. A day trader who works individually often manages other people's money or uses his own money, but the limited scope of resources often prevents him from competing with the day trader who works with a company.

Day traders typically hold their stocks for a single day, and their trading style is very different from that of real-time traders. They close their positions at the end of each day. Due to the short-term nature of day trading, there is less risk because there is no risk of something happening overnight to cause a big loss.

How does day trading work?

Day trading works by capitalizing on a stock's short-term price movements through the active buying and selling of stocks.

Day traders look for volatility in the market. Without short-term price movement (volatility), there is no opportunity. The higher a stock moves, the more profit a trader can make or lose in a single trade.

This is why traders must exercise excellent risk management skills in order to keep the losers small while letting the winners run.

You can think of day traders as risk managers. We put capital at risk in order to try to make more money, but if we mismanage our risks, we will struggle to make money consistently.

Successful traders will often have pre-determined entry and exit points before they even enter the trade.

This helps remove emotion from the trade, which in turn prevents the trader from freezing their position (this has been proven to have a long term negative impact).

What you need before you start day trading

Before you start day trading with real money, there are three things you must do and have:

- Strong knowledge of day trading terminology and technical analysis

- A proven and profitable strategy

- Proof of profitability in a day trading simulator

#1 – Solid knowledge of day trading terminology and technical analysis

With years of day trading under my belt, I can confidently say that day trading is an extremely difficult skill to master, let alone master.

You can think of day trading as a professional sport. Your ability to make money is 100% based on your ability to perform day in and day out. Attempting to day trade without any training or education is a recipe for disaster and loss of capital.

The first step to learning day trading terminology and technical analysis is to read books and watch videos! This is the process of acquiring knowledge. But remember, just because you read a skydiving book doesn't mean you're ready to jump out of a plane!

One of the challenges of learning to trade is the overwhelming amount of information available. Often the things you learn will be contradictory.

The reason for this is that technical analysis or entry and exit requirements that work for one strategy may not work at all for another strategy.

It is not helpful for your long term success to learn a few 100 different strategies. It's best to learn as much as you can about a strategy that has proven to be profitable.

So, while you are looking at who you are going to learn from, it is always important to ask yourself, is this person actually profitable?

#2 – Develop a profitable day trading strategy or adopt a proven day trading strategy

It took me about 2 years to develop the strategy that I trade. As as a budding trader, you have two choices. You can either adopt a strategy already actively traded by other traders or create your own.

If you create your own, be prepared to spend months or even years testing and refining before you can trade with real money.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Most novice traders, rather than trying to reinvent the wheel, decide to master a strategy that has already proven profitable. After mastering this strategy, traders can decide to put their own twist on it by making a few changes.

Whatever your approach, it is important to have a specific setup, trading system, or methodology that you are comfortable with when you start trading.

It allows you to build proficiency in something, rather than trying to find opportunities for multiple setups at once, never really getting good at one setup.

The important thing is to consistently stick to one thing in the beginning and master it. If you try to trade 5 different strategies at the same time, how do you know if one of them is profitable or not if one of the others is costing you a lot of money?

#3 – Convert knowledge into skills by practicing in a day trading simulator

You may have taken a few quality trading courses, read a book or two, watched our daily trading reviews and feel ready to trade.

But the reality is, you're probably not ready. Novice day traders notoriously overestimate their abilities, start trading with real money and lose.

Understanding day trading intellectually and being able to react to opportunities and execute them effectively in real time are two different things.

This is where practice comes in.

Day Trading Tools – Everything You Need

What you will need to start day trading:

- Online broker

- Scanners

- Mapping platform

Best broker for day trading

Your broker is one of the most important decisions you will make. This is where all your money will be and you will rely on them to deliver fast executions at a reasonable price.

There are several types of stockbrokers, and most tend to serve a specific niche.

For example, Vanguard serves passive investors, tastytrade serves options traders and Lightspeed serves day traders.

Here are the brokers our mentors use:

- Ross – LightSpeed, TD Ameritrade and CMEG (Small Accounts Challenge)

- Mike – LightSpeed

- Roberto – LightSpeed

For day trading, here are our favorite brokers:

- Warrior Trading

- TDAmeritrade

- Capital Markets Elite Group (CMEG)

There are few things you need to consider when looking for a broker: trade execution, commissions, charting platform.

Inventory Scanner

There is a distinct difference between a stock scanner and a stock filter:

- Stock scanners constantly scan the market and broadcast the results in real time

- Action filters simply search the market for criteria that provides you with a static list of stocks, usually with data from the day before

A good stock scanner is necessary for most day traders, especially those who trade on very short timeframes. Most scanners can scan for periods as short as ticks and up to weeks, while updating results in real time.

How to start day trading?

Once you have learned a strategy and are trading it profitably in a simulator, you can now start considering trading on a live account.

Here are the steps you will need to follow:

- Open a brokerage account and transfer money

- Have a written trading plan that you can review every morning

- Do your watch list in the morning

- Redeem your plan and stick to it

- Review your transactions at the end of the day

One of the biggest tips we can offer to new traders on a live account is to slow down. Do not dive head first and negotiate the maximum size. Ease of access until you are comfortable.

Trading on a real account adds a lot more emotion and pressure to your trading which will lessen as you gain more experience.

Plus, you don't want to blow up your account and lose all your money on day one!

Day trading strategies for beginners

There are many different strategies to choose from, but the one we have had the most success with and find the easiest for new traders to learn is the bull flag pattern.

A bullish flag pattern is a high probability pattern that forms a flag-like pattern on the chart. Below is an example of a flag template set.

Some characteristics to look for when trading a bull flag:

- A strong upward move in a stock that has a news catalyst (no buyback news)

- High relative volume

- Consolidation pattern after the strong upward move

- Followed by an upside breakout

If you are one of the experts in the field, then leave us your experience in the comments. But before you leave, here is training that allows you to master your personal finances.

I am really interested in working with this application