All about working capital

Working capital today is difficult to understand by some companies. Knowing that a business is like a locomotive, it needs fuel to move forward. Working capital is therefore this gasoline that the company needs.

It is he who gives the possibility to a company to produce value and to continue to develop. We have car brands that consume more than others, sometimes they break down.

It's the same thing with businesses. If you don't want to find yourself running out of gas in the middle of the road or breaking down, you'll need to take stock of your Need in funds.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

In this article we tell you everything about working capital (FR). But before we begin, here is how to get out of debt?

Let's go!!

🌿 What is Working Capital?

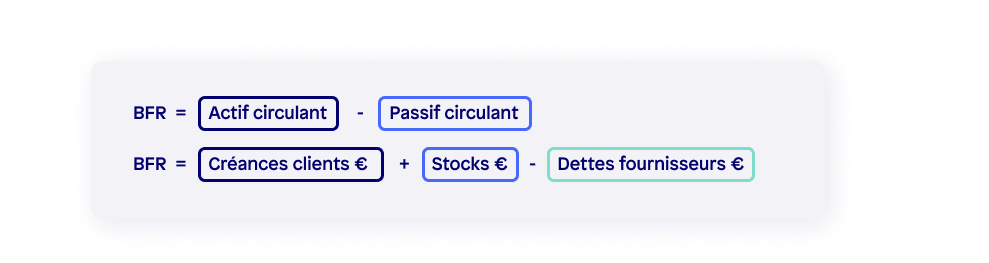

The FR is the correct measurement of financial health as well as the operational efficiency of a company. It represents the amount of current assets a company has to finance its short-term obligations and daily operations.

Current assets include cash, accounts receivable (money owed to the business by its customers) and inventory (goods for sale).

On the other hand, short-term obligations, also known as current liabilities, include accounts payable (the money the company owes to its suppliers), wages and salaries, and taxes. Working capital is calculated as subtracting current liabilities of current assets.

Un RF positive indicates that a company has sufficient assets to meet its short-term obligations and finance its operations. However a RF negative indicates that a business may have difficulty paying its invoices on time. This indicator is widely used when financial analysis.

🌿 How to effectively manage working capital?

There are several methods businesses can use to effectively manage their working capital. Here are a few:

✔️ Optimization of stock levels

Managing inventory levels is an important aspect of RF management. A business with excess inventory can tie up valuable resources that could be used more effectively elsewhere.

Conversely, a company whose stocks are too low may struggle to meet customer demand and miss sales opportunities.

✔️ Negotiation of supplier payment deadlines

Businesses can negotiate favorable payment terms with their suppliers to improve their working capital situation.

For example, a company may be able to negotiate longer payment terms in exchange for larger orders or volume discounts.

✔️ Improved collection of customer accounts

Accounts receivable management is another important aspect of working capital management. A business that is able to collect its accounts receivable in a timely manner will have stronger working capital.

✔️Accounts payable management

Businesses can also manage their FR by carefully managing their accounts payable. This may involve negotiating favorable payment terms with suppliers, taking advantage of early payment discounts, and using cash flow management techniques such as payment consolidation and supplier consolidation.

✔️Optimization of cash management

Effective cash management is crucial for managing working capital. This may involve implementing strategies such as reducing unnecessary expenses, optimizing cash balances, and implementing a cash forecasting process.

✔️ Use of financial instruments

Companies can also use financial instruments such as lines of credit or short-term loans to manage their RF.

These instruments can provide a temporary source of funding to meet short-term obligations and improve the company's RF position.

✔️ Implement supply chain finance

Supply chain financing is a financing method that involves using a third party to finance a company's accounts payable. This can improve the company's FR position by freeing up cash that would otherwise be tied up in accounts payable.

🌿 Why maintain a good level of working capital?

It is important for businesses to regularly review their working capital levels. Here are some reasons:

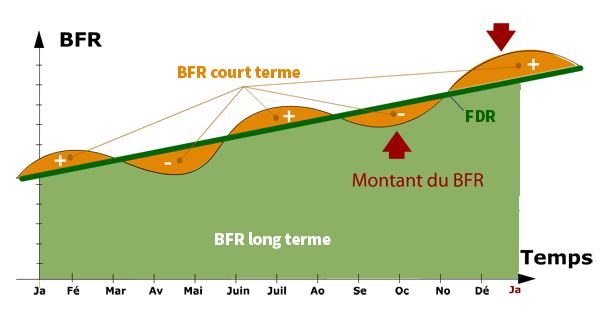

✔️ For businesses with seasonal activities

A business that operates in a highly seasonal industry may need to maintain a higher level of FR to ensure it has sufficient cash flow to meet its obligations during the low season.

A business with a long operating cycle may also need to maintain a higher level of FR to ensure that it has sufficient funds to cover the costs of its operations while waiting for its products to be sold and converted into cash.

✔️ For companies with a long cycle

Similarly, a manufacturing company with a long operating cycle may need a higher RF than a service company with a shorter operating cycle.

Furthermore, a company with a high level of risk may need more normative working capital to ensure that it has sufficient resources to weather potential storms.

🌿How to calculate working capital?

Calculating working capital is quite simple. Once you have found the FR, you can interpret the result obtained:

✔️ Positive working capital

Qualifies a resource surplus. This therefore means that your company has additional resources allowing it to finance the various needs it may experience. At this point, you need to compare your FR to your working capital requirements to ensure your funds can manage and cover your needs.

✔️ Negative working capital

This means that your business is in difficulty and that it does not have the necessary funds to cover all of its needs.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

At this point, she will have to try to finance herself with short-term cash flow. In this situation, we suggest that you carry out a capital increase, which will increase your available resources in the company.

✔️Working capital is zero

This shows that your company can fully finance its investments. But regarding its future needs, she won't be able to bear it.

So, it's not a very good posture it will have to fight with processes allowing it to increase its resources such as, for example, taking out a long-term loan. By doing so, it will be able to cover this need and continue its activities in favorable conditions.

⛳️ What is normative working capital?

The normative working capital is the minimum level of working capital that a company is expected to maintain in order to meet its financial and operational needs. It is calculated based on industry standards and specific company circumstances.

Several factors can influence a company's FRN, including the nature of its activities, the length of its operating cycle and the level of risk associated with its activities. Maintaining an adequate level of normative working capital is important for the financial stability and the long-term success of a business.

A business with insufficient working capital may struggle to meet its short-term obligations. And not being able to take advantage of opportunities for growth and expansion.

On the other hand, a company whose working capital is excessive can waste resources that could be better used to generate profits or finance other investments.

🔰 Methods for determining normative working capital

It is calculated based on industry standards and specific company circumstances. There are several methods that can be used to calculate normative working capital, including the following:

Industry references

This method involves comparing a company's working capital against industry benchmarks to determine if it is at an appropriate level..

For example, a company in the retail industry can compare its working capital to the industry average to see if it is above or below the norm.

The operating cycle

This method consists of calculating the operating cycle of the company and determining the amount of working capital needed to finance this cycle. The cash cycle is the time it takes to turn raw materials into finished goods and then into cash.

The working capital ratio

This method consists of calculating the working capital ratio, which is the ratio between current assets and current liabilities.

A working capital ratio of 1,0 indicates that the company has an equal amount of current assets and liabilities, while a ratio greater than 1,0 indicates that the company has more current assets than liabilities, and a ratio less than 1,0 indicates that the company has more liabilities than assets.

The Cash Conversion Cycle

This method involves calculating the cash conversion cycle. That is, the time it takes for a company to convert its raw materials into cash. The cash conversion cycle is calculated by subtracting the number of days it takes to sell inventory from the number of days it takes to pay accounts payable.

The operating cycle approach

The cash cycle approach calculates normative working capital. This is based on the time it takes for a business to convert raw materials into finished goods and then into cash.

This method takes into account the company's specific operating cycle and the level of risk associated with its operations.

Fixed percentage of sales method

The fixed percentage of sales approach calculates FRN as a percentage of the company's expected sales. This method is based on the idea that a certain amount of working capital is required to support each sales unit.

Industry average approach

The industry average approach calculates normative working capital based on the average working capital levels of other companies in the same industry. This method is based on the idea that companies in the same sector have similar working capital needs.

It is important to note that there is no one-size-fits-all approach to calculating the FRN. Businesses should consider their particular situation and choose the method that best meets their needs.

🌿 Why is normative working capital important?

Maintaining an adequate level of normative working capital is crucial to the financial stability and long-term success of a business.

A business with insufficient working capital may struggle to meet its short-term obligations and be unable to seize opportunities for growth and expansion. This can lead to financial difficulties or even bankruptcy.

This may result in lower investment returns and reduced shareholder value. Therefore, it is important to maintain an adequate level of normative working capital for several reasons:

Financial stability

A business with insufficient working capital may struggle to meet its short-term obligations and risks financial distress. This can lead to difficulty obtaining financing, difficulty paying bills on time, and potentially even bankruptcy.

Operational efficiency

Working capital is used to finance the day-to-day operations of a business. A business with insufficient working capital may struggle to meet its operational needs and be unable to operate effectively.

Growth and expansion

A business with sufficient working capital will have the resources to seize opportunities for growth and expansion. This can lead to increased profits and shareholder value.

Investor confidence

Investors and financial analysts often use working capital to measure the financial health and stability of a company. A company with a healthy level of FRN is more likely to attract investment and generate investor confidence.

It is therefore important that companies carefully manage their normative working capital. This will enable them to achieve a healthy balance between sufficient liquidity and efficient use of resources. This can help ensure the financial stability and long-term success of the business.

???? FAQ: All about working capital

✔️What are the consequences of insufficient working capital?

The consequences of insufficient FR can include financial distress, difficulty obtaining financing, difficulty paying bills on time, or even bankruptcy. It can also lead to operational inefficiencies and difficulty taking advantage of growth opportunities.

✔️Is working capital calculation necessary?

Just as a good driver carries out a technical inspection of his vehicle after a certain period, a good business manager should assess financial health of his company to be sure that he will be able to meet his commitments within the expected deadlines. For this, one of the best tools is the determination of working capital.

We finished. We hope working capital holds no secrets for you. Leave us your opinion in comments.

Leave comments