All about Shadow Banking

Behind traditional finance hides a vast opaque financial system called “shadow banking. ⚫ This network of institutions and activities partly escapes traditional regulations. His growing influence worries regulators, especially since he played a key role in the 2008 crisis. 🔻

Shadow banking, or “shadow finance“, brings together speculative hedge funds, high frequency trading companies and complex investment vehicles. Its operation is not well known to the general public. 🔍 Yet it circulates massive financial flows across the planet.

In this post, find out what shadow banking really is, its scale, its key players and the potential risks it poses to global financial stability. But before we start, here's How can you better finance your future retirement?

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Have a good dive into the mysteries of shadow finance!

📍 What is shadow banking?

Shadow banking designates all the players and financial activities that take place outside the banking system traditional regulated. 🏦

These include institutions like hedge funds, money market funds, high frequency trading firms. Shadow banking also includes financial instruments such as unregulated OTC derivatives. 📉

Unlike commercial banks, entities in the shadow banking generally does not collect deposits and do not have access to central bank refinancing. 💵

Their activities are much less supervised by the authorities and have greater regulatory flexibility. This situation exposes the financial system to increased risks of instability.

📍 How big is shadow banking?

Shadow banking represents a significant part of the system global financial. According to the FSB, in 2020 it totaled around 50 trillion dollars in assets, or almost half of the traditional banking system.

In the USA, its weight is even greater. Shadow banking holds more than $15 trillion in assets there. It largely dominates traditional banking.

Article to read: Buying new or old real estate ❓

In Europe, the UK is home to the largest shadow financial center, with over £3 trillion in assets. Next come Switzerland, Luxembourg and Ireland.

Although difficult to assess precisely, the growing influence of shadow banking does not no doubt. Its potential risks worry regulators, especially as its interactions with the traditional banking system are increasing.

📍 Who are the key players in shadow banking?

Shadow banking brings together a wide variety of institutions. Here are some of the most important:

- Speculative hedge funds 📉, very active in futures markets and risky derivatives.

- Money market funds 💵, which offer services close to banks but without public guarantee.

- Brokerage companies and high-frequency trading 💻, whose activity is not very transparent.

- The alternative investment funds ⚖️, with complex strategies that escape conventional regulations.

- The structured entities 🏢, such as ad hoc vehicles used by banks to remove risky assets from their balance sheets.

Powerful institutional investors such as pension funds 👴👵 also occupy a prominent place.

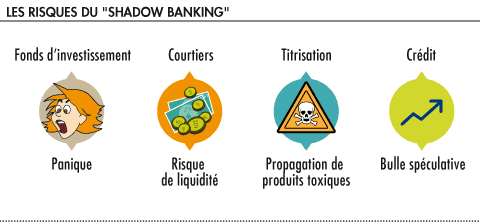

📍 What are the risks of shadow banking?

Although it makes it possible to diversify the sources of financing, shadow banking is not without danger. Its main risks are:

- Un excessive leverage 📈📉, shadow entities not being subject to the same capital requirements as banks.

- Un lack of transparency 🔍, many activities escaping information publication obligations.

- Payment suspensions chain in the event of a crisis ⛓, no lender of last resort being provided unlike the traditional banking system.

- A spread of risks 💥 to the regulated banking sector, due to the growing links between the two systems.

- Personalized increased opportunities of dirty money laundering 💰, due to the lack of monitoring of certain obscure financial circuits.

- Personalized major systemic risks 💥💥 in the event of a sudden collapse of this opaque system, as shown by the 2008 crisis.

📍 What are the recent regulatory developments?

Following the financial crisis, regulators sought to better regulate shadow banking, with still limited results.

The FSB developed recommendations in 2011 to monitor the shadow banking system and limit its excesses. Some have been implemented, such as the obligation to report derivatives transactions.

Article to read: Neobanks and the reduction of bank fees

But many regulatory blind spots remain. The necessary international coordination comes up against the divergent interests of major countries. There is still a long way to go towards effective regulation of shadow banking!

📍 What was the role of shadow banking in the 2008 crisis?

The shadow banking system played a central role in triggering and spreading the financial crisis of 2007-2008.

Many shadow entities such as ad hoc structures (SIVs, conduits, etc.) were linked to the subprime US mortgage market that triggered the crisis. They were buying the securitized bad debts by the banks.

When the subprime market collapsed, these vehicles were unable to refinance their positions and went bankrupt. The contagion then spread to the traditional banking sector. 💥💥

Hedge funds have also amplified the crisis via speculation on CDS. Money market funds experienced massive suspensions of redemptions, requiring public intervention.

This experience showed how dysfunctions in shadow banking could destabilize the whole system finance and the real economy.

📍 What is the future of shadow banking?

Despite the risks, shadow banking should continue to grow in the years to come.

Low interest rates and investors' search for yield should stimulate this unregulated system, more profitable but more unstable.

Technological advances such as blockchain could also encourage the emergence of new financial activities that escape traditional regulators.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

The challenge will be better integrate shadow banking in global financial supervision, without stifling innovation. An arduous task that will require more international cooperation!

🏁 Closing

The extent of shadow banking shows the need for better regulation international risky financial activities. The flaws in the system must be corrected to avoid new devastating crises like the one in 2008.

Shadow finance is not ready to disappear, but it must be better integrated into the overall regulatory network. Its transparency and monitoring must also be strengthened. Regulators still have their work cut out for them!

Article to read: Open a 100% online bank account

The world of finance is constantly evolving. The game of cat and mouse between actors in the shadows and the authorities is set to continue, between gray areas and attempts at regulation. One thing is sure: shadow banking has a bright future ahead of it in the years to come!

But before you leave, here is How to Create an Irresistible Business Offer

Leave comments