What are Peer to Peer payments?

Have you ever gone to dinner with friends and when the bill arrives you realize you accidentally left your wallet at home? Or do you stop at a cafe that only accepts cash and you don't have any on you? We've all been there ! Fortunately, there are payment systems or money transfer apps like Venmo, PayPal, CashApp, etc. which allow you to split bills or make payments easy and painless. Peer to peer payments are transactions that can be used for everything, from splitting a dinner bill with friends to paying the landlord's rent.

These payments allow the transfer of funds between two parties using their comptes bancaires individuals or their credit cards via an online or mobile application. They are becoming more and more popular among people of all ages as more and more of these types of platforms continue to emerge.

In this article, I present the prerequisites for understanding P2P payments. Read until the end.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

How do Peer to Peer payments work?

P2P payment accounts are generally relatively simple to set up. Whichever platform you choose, you'll create an account and then link your bank account or credit or debit card to it.

Some apps may require additional verification information and passwords to enhance security. Once your account is set up, you can search for other users by their username, email address, or phone contacts.

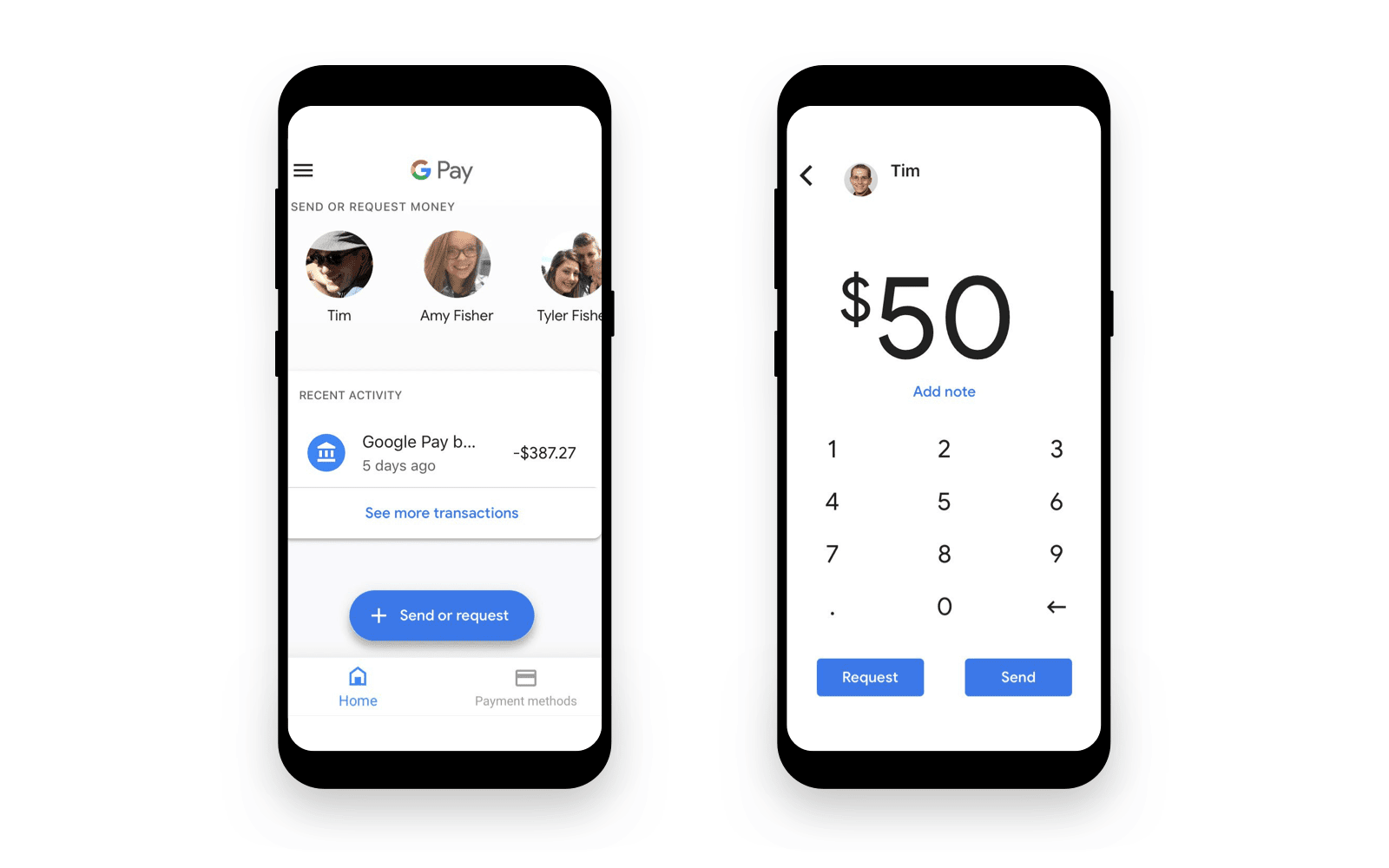

Sending and receiving money is usually just a few clicks away. You choose who you send to money, transaction amount, add a payment reason if you want, then submit the payment. Depending on the P2P payment service you use, the time it takes to transfer money can vary from a few seconds to three business days.

Many apps keep the money stored in the app until you manually release the money to your personal bank account.

How does the P2P payment app work?

P2P payment apps are used for everything from splitting the bill for dinner with friends to paying a landlord's rent. These payments facilitate the transfer of funds between two parties.

It will use their bank accounts or a payment method like a credit card, online banking or a mobile app for this purpose. Here is a detailed workflow of a Peer to Peer money transfer app:

Go through registration and login

Creating a P2P payments account is super easy! Regardless of the platform you choose, you must first register on the application by entering your personal information such as name, bank name, telephone number, address, city, etc. After that you have to enter a password or code Strong PIN.

Add a beneficiary

This is one of the most important steps in the peer to peer payments process. After completing your registration process, you must complete the KYC process. Next, you need to add the details of the person you want to pay. In this process, the user must need the name of the person to whom he wants to make the payment.

?? Set amount

The user must then define the amount he wishes to transfer. Along with this, the user can also write the reason for the payment. However, this thing can be optional.

Get 200% Bonus after your first deposit. Use this promo code: clever

Enter the password to confirm the transaction

The user must enter the password that he had set at the time of registration or he can also confirm the payment transfer via OTP. In addition, the user can also set a security question in case he forgets his password.

Received

After that, a payment receipt is automatically generated which you can download or print. This way you can have a record of your money transactions.

How fast are peer to peer payments? How much do they cost ?

A personalized peer to peer payment application allows instant transfer of funds without any geographical restrictions. Peer to Peer money transfer app solutions aim to make such money transfers that allow you to send money. Keep the following things in mind when using peer-to-peer payments. The same applies when you choose your platform for creating your P2P payments account.

The speed of the operation: Although transaction notifications are sent immediately, the money itself can take one to three business days to arrive in your linked account if you choose to transfer it out of the app. Some providers are faster and some also offer instant transfers for a fee.

Transaction fees. Generally speaking, you can make P2P payments from a linked bank account or directly from the peer to peer account for free. But some providers charge a fee – 2% or 3% to process payments drawn from a credit or debit card, for example – for other payment methods.

Enter data carefully. If you mistype a recipient's email address, phone number, or name, the money could go to the wrong person. Verify your recipient information before sending a payment.

The advantages of P2P payments

P2P payments are synonymous with ease of use, convenience and speed. Although some might not like the fact that they can no longer use the excuse “I forgot my wallet“, the immediacy with which you can repay your friends and family is a huge advantage.

For the most part, P2P payments work like withdrawing money from an ATM without finding one to reimburse the recipient. Some P2P payment services charge flat fees or low percentage fees. However, some P2Ps allow free payment. Research providers to see if any fees are associated with transactions.

P2P payments are becoming so mainstream that you might hear people say “I will make you a Venmo" or "I'll make you a PayPal“, instead of just saying “I will pay you back". Create your Venmo account from today

The potential security risks of P2P payments

While for the most part, P2P services are secure, there are always risks involved when sending money online. Whether you accidentally send money to the wrong user or risk a data breach, problems can arise.

The biggest problem that comes with a fraudulent or erroneous transaction is that it can be harder to get a refund, especially if you're using funds from the app and not your bank. Many P2P payment providers use precautions to reduce these security risks, from passwords and PINs to transaction notifications that confirm whether users have actually sent money.

To reduce the risk of falling victim to fraud, only transact with people you know. Find out what type of fraud your peer to peer payment system uses and research the quality of the company's customer support network.

The risks of using a peer-to-peer payment app should be considered, but shouldn't necessarily prevent you from using this easy and fast-growing payment method.

Some of the most common P2P payment apps

PayPal® – an online payment system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders.

Venmo – a mobile payment service owned by PayPal. Venmo account holders can transfer funds to others through a mobile phone app; both sender and receiver must live in the United States

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Facebook Pay – the process is simple, whether you're sending money to a friend on the apps you already use, including Facebook, Messenger, Instagram, or Portal.

Square, Inc. – a financial services and digital payments company that allows users to transfer money to each other using the Cash app for mobile phones.

Zelle– a fast, secure and easy way to send, request and receive with friends, family and others you trust. Lakeland offers Zelle as well as Digital Wallet for making contactless purchases with your smartphone or smartwatch.

Get 200% Bonus after your first deposit. Use this promo code: clever

Apple Pay ® – a mobile payment and digital wallet service from Apple Inc. that allows users to make payments in person, in iOS apps and on the web using Safari. Apple Pay works with select iPhone®, iPad® and Apple Watch® products.

Google Pay ® et Samsung Pay ® are also available on Android phones, tablets or watches and devices produced by Samsung.

Leave comments