How to do good financial planning?

A financial plan is a roadmap for your money and helps you achieve your goals. Financial planning can be done alone or with a professional.

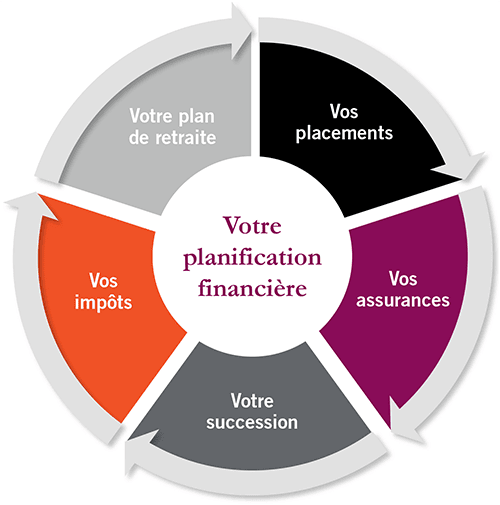

A financial plan is a complete picture of your current finances, your financial goals, and all the strategies you have set out to achieve those goals. Good financial planning should include details of your cash, your savings, your debts, your investments, your insurance and any other element of your financial life.

No one cares about your financial well-being more than you do. It is therefore important to have a financial plan for yourself. Having a solid financial plan will allow you to save money, afford what you really want, and achieve long-term goals like saving for college and retirement.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

In my opinion, financial planning is essential, especially for women because of the gender pay gap. It also helps you achieve your financial freedom.

In this article, I'll walk you through everything you need to know to plan for your financial future. Keep reading, then get ready to take steps to start your own financial plan.

What is Financial Planning?

Financial planning is an ongoing process that reduce your stress about money, will meet your current needs and help you build a nest egg for your long-term goals, such as retirement. It is important because it allows you to get the most out of your assets and helps ensure that you achieve your future goals.

It is not just for the rich : Creating a roadmap for your financial future is for everyone. You can make a financial plan yourself or get help from a financial planning professional. Thanks to online services such as robo-advisors, getting help with financial planning is more affordable and accessible than ever.

What to do first

Let's start by creating a list of things you'll need to move towards financial security. These items below are essential for your financial plan:

- A monthly budget to help you keep your expenses below your income

- A plan for repaying your debts and expenses (using your budget)

- An understanding of all your invoices and their due dates

- A fully funded emergency account

- Retirement savings even if you have a low income

- A diversified investment portfolio

- Multiple streams of income

- Savings for other things you want (for example, your short, medium and long term goals)

- The right type of insurance coverage (Life, health, disability, home, etc.)

What to do next

Don't think it's too early or too late to have a financial plan. On the contrary, now is the time PERFECT to start !

1. A plan for yourself

If you're single, it's important to have a financial plan that not only helps you achieve your immediate goals, but also ensures that your future is taken care of. It means doing all the things mentioned above without making the assumption that things will work out one way or another.

A big mistake? Assuming you meet someone who will take care of you and take care of your relationship finances.

If your relationship status changes or you're married, you'll be well equipped to plan your finances together if you already have things in place for yourself.

2. A plan for your wedding

If you are married or have a loved one, you should participate in your finances as a team. Discuss your budget and financial goals and make financial decisions together. Understand where your money is going and how much money you have in savings and investments. By the way, here is an article that shows you how to manage your finances when you are newlyweds.

– Should we have joint accounts or separate accounts?

Having joint accounts is great, but I also believe in having your own personal savings accounts. If you are a woman then it is important for you to develop your own sense of security and to have 'yours' that you bring to the table.

But don't feel obligated to keep your personal accounts secret. Remember that marriage and committed relationships are based on openness and honesty.

Whether you team up with your partner or go it alone, the path to financial independence isn't always easy and perfectly paved. But don't despair; It’s time to roll up our sleeves and get our hands dirty. That’s right, it’s time to learn how to create a solid financial plan.

How to create a solid financial plan?

Now let's see how to make a good financial plan. Below, you'll find ten steps to creating a solid financial plan.

1. Write down your financial goals

The first thing towards financial planning is setting goals. Having financial goals is the foundation of your financial success. After all, you have to know what you want to do to actually accomplish it. However, when it comes to setting goals, you want to make sure your goals are well defined and prioritized accordingly.

It's great to have great and noble goals ! But make sure to divide them into smaller pieces. This way, you aren't overwhelmed trying to accomplish them and you can easily measure your progress.

2. Create an emergency fund

It is also very important that one of your goals includes a plan for dealing with emergencies. You want to make sure you're prepared to weather a storm. Otherwise, you will find yourself in debt again.

3. Pay off your debts

For your financial planning to be solid, you must also think about paying off your debts. Unfortunately, you can't really jump-start your financial future if you have a ton of debt.

Between exorbitant interest rates, large minimum monthly payments, and the damage that many debts can do to your credit score, it's better to pay your debts first.

Create a debt repayment strategy and be patient but consistent as you strive to become debt free. Here is the infallible secrets to quickly pay off your debts.

Here is an affiliate link that shows you 30 TIPS TO SAVE AND SPEND LESS. I strongly recommend that you buy this training because as I told you in one of my trainings, it was this training that allowed me to quickly get rid of my debts two years ago.

4. Create an investment plan

The investment plan is also part of your financial planning. If you really want to build wealth, then you have to put your money to work for you. This is where investing comes in.

However, before investing your hard-earned money, it is important to have well-defined goals. Consider whether the investment is worth when you will need your money and your tolerance for risk.

Investing is a long-term activity and therefore risky. So you have to commit to it if you really want to see your money grow. Are you worried about needing your money at short notice? Well, that's what your savings accounts are for; put aside your emergency savings and your money for your short-term goals.

You also want to make sure you have a basic understanding (at a minimum) of any investment you're putting your money into (for example, the stock market, real estate, or small business).

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

Your investment plans should be included in your monthly budget where you allocate a certain percentage of your income towards your investment goals.

5. Get the right insurance

After working so hard to earn your money, the last thing you want is an unforeseen event to wipe you out. Insurance is basically your backup plan that will protect your assets in the event of life circumstances requiring a large amount of money to be resolved.

Your insurance coverage should include health, auto, disability, life, home or rental, and business. Basically, you want to protect anything of major importance and value to ensure you (and your loved ones) are financially protected.

Having the right insurance can turn what might otherwise be a major disaster into a mere inconvenience.

6. Create a retirement plan

To have the lifestyle you dream of in retirement, you must prepare yourself adequately. You'll need to figure out how much you'll need for your retirement, taking inflation into account of course, and how you plan to save and invest in advance for that time in your life.

7. Plan for taxes

Yes, taxes! Taxes are annoying, but they're definitely not going away anytime soon. So make sure your long-term income projections include taxes. Failing to plan for taxes can have a major impact on your cash flow.

Additionally, you definitely want to review tax-saving investment options and stay on top of any relevant tax deductions you can apply to help you save money on tax payments.

You may plan to sit down with a tax accountant or financial planner to ensure your tax plan is adequate. You should also check out our blog post on how to reduce your taxable income!

8. Create an estate plan

Estate planning is not something many people like to think about, but it is essential! It allows you to determine exactly what happens to your assets after you leave. It's about listing all of your assets, writing a will, and making it available to people who need to have access to it. A financial planner or an estate lawyer can help you organize things properly.

9. Review your plan frequentlyfinancial ification

Financial planning is only solid if it is reviewed regularly. Once you've defined and developed your financial plan, it's important to review your plan frequently and make any necessary adjustments if your goals or life circumstances change.

For example, Perhaps your insurance needs to change, your risk tolerance changes, or you get married or have children. At a minimum, you want to check your overall financial plan at least every six months.

When you check infrequently, it's easier for you to cope with unexpected life events, bounce back from setbacks, and achieve your financial goals.

Think about what you do to maintain your personal health. You brush your teeth and shower regularly to stay clean and avoid unnecessary illnesses because we all know that getting sick can lead to further health complications and you definitely don't want that. And also because you do it so often, it has become part of your daily health maintenance habit – well, the same goes for your finances!

10. Stay the course, avoid overspending and learn from your mistakes

Your path to financial independence will not always be easy. There will be difficult days, weeks and even months. Pursuing a Goal of Financial Independence Very Tied to Delayed Gratification Isn't Always Fun, but it's totally doable.

Have a solid plan for your finances, be disciplined, and avoid overspending. You'll discover how good you'll feel when you really make a concerted effort to stick to your budget.

While you're working on your finances, you can still make mistakes with your money, and that's okay. Sometimes you might not be able to resist the urge to buy something that's not in your immediate budget. And sometimes you'll want to tear your whole financial plan to shreds because it just doesn't seem like fun.

However, as long as you keep your reasons why, want to be financially free and make an effort to bounce back quickly from your mistakes, you will come out very well. It's about evaluating the mistakes you made, understanding why you made them, and developing a plan to avoid making them again. Then you will need to take these lessons and apply them to your future success.

Tips for Frequently Reviewing Your Financial Plan

Here are some tips to help you check your financial plans.

1. Establish a routine

Schedule time every week or at least once a month, for sure, to do a financial health check. Have a coffee with yourself or put on some good music and have a hot cup of tea at home and spend some time checking things out. It's a good idea to set a reminder on your calendar so you don't forget about this recording.

2. Set and review your financial goals

If you haven't already, it's important that you define your short-term and long-term financial goals so you know exactly what you're working towards with your money. Over time, you want to make sure to revisit and re-evaluate your goals to make sure they're still things you want to accomplish and that you're on track to achieve them.

3. Reconcile your bank accounts and bill payments

Check your bank account debits against bill payments you've previously scheduled or sent. Ensure that all pending bills/debt repayments have been paid or scheduled.

Compare your receipts with your credit card transactions and confirm the balance. Review your budget and compare your actual expenses to what you planned. Once a month, set your budget for the coming month.

4. Review your savings and investments

If you have automated transactions set up to make transfers to your savings or investment accounts, be sure to check them out. This would also include any automatic deposits you have set up to go into your retirement accounts etc.

If you haven't set up automation, make or schedule your manual transfers to your savings and investment accounts and be sure to check and ensure transactions were completed successfully.

Also plan to review your overall investment portfolio to rebalance and diversify it as needed and be sure to review your fees too!

5. Review your insurance policies

You also want to make sure you have the right type insurance for your life. This includes health, automobile, life, disability, home, personal property, business, etc.

Set a reminder twice a year where you sit down and evaluate the costs of your different policies and shop around to see what else is out there. Reconciling your accounts and planning your finances ensures that you are aware of everything that is happening with your money and that you are on track to achieve your goals.

6. Check your net worth

Your net worth can almost be described as the thermometer used to measure your financial health and you want to keep track of it.

Your main priority should be to pay off as much debt as possible, starting with your high-interest debt, grow your assets, and over time your net worth will begin to grow.

Many people start out with negative net worth when they start working on improving their finances, but over time and continuing to practice good financial habits, this will change.

Questions to ask when reviewing your financial plan

Here are some questions to help you through the process:

- What steps have I taken in the past month to get closer to my goals?

- What are the things that have taken me away from my goals?

- Was my spending aligned with my core values?

- What money mistakes have I made in the last month?

- Why did I make them?

- Are my financial goals still realistic?

- What big expenses are coming soon?

- Is my emergency fund fully funded with 6-9 months of spending based on the current basic needs I have today?

- Am I saving enough to retire comfortably based on my ideal retirement amount?

- Don't know your amount?

- Am I meeting my other short-term savings and investment goals

- Am I on track with my savings for my children?

- What steps can I take to make sure I have a better month next month?

Hint: Keep a journal in which you answer these questions, then review your past entries every few months.

It's a great way to stay motivated, especially as you see the progress you're making over time, and if you stay committed to improving your finances, you'll see progress.

In summary…

Remember, this is your journey and someone else's journey, so having a plan for success with your finances is very important. Planning ahead for the life you want is 100% worth it.

In order to accompany this article with a more practical guide, I came across an affiliate link that is highly recommended by financial consultants. If you also want to buy this training, then all you have to do is cliquer sur ce lien.

Leave all your concerns in the comments

Share on social networks

Leave comments