How to manage your cash effectively?

Managing your cash flow is a delicate technique. Cash management includes all decisions, rules and procedures which make it possible to ensure the maintenance of the instantaneous financial balance of the company at the lowest cost. Its primary objective is to prevent the risk of insolvency. The second being the optimization of the financial result (end product – end charges).

Briefly, Finance de Demain presents in this article how to manage your cash flow effectively. Let's go !!!

???? What is cash management??

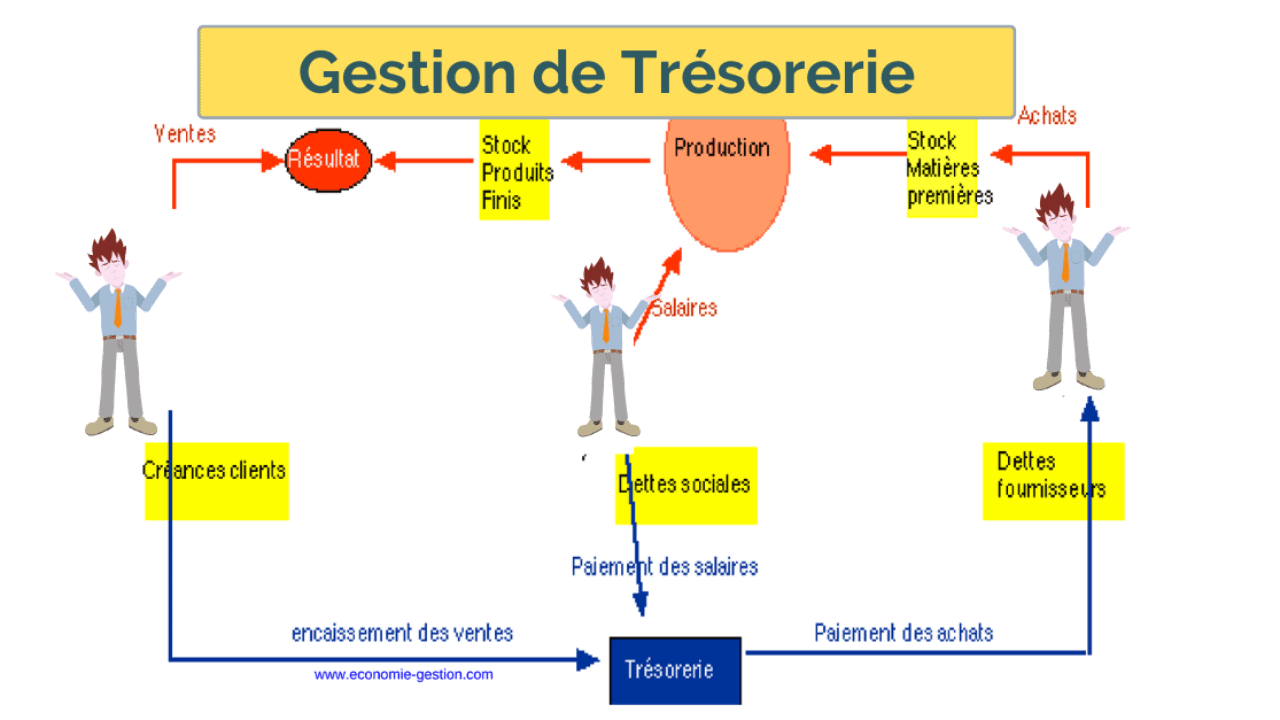

How to manage cash effectively? Managing cash means determining the balance of cash flows. That is to say, to ensure a balance between outgoing and incoming flows.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

The treasury function today integrates dynamic risk management, partly induced by the increasing uncertainty of the markets, without which there can be no real control of financial policy.

The core of the treasury function is cash management in value date. Its objective is to reduce the financial costs or to increase the financial products according to the situation of the company. The basic principle of value date cash management called “zero cash rule".

It consists of avoiding positive, low-interest cash balances or debit balances resulting in financial charges.

Thus for credit balances there is a opportunity cost. It is equal to the difference in rate between the investment that could have been negotiated and the basic remuneration of the account.

For debit balances, there is a explicit cost. It is equal to the difference in rate between the overdraft and less expensive financing.

Cash flow management corresponds to the traditional vision of the treasury function. It deals with the processing of cash receipts and disbursements. It is also interested in the movement of funds within a group or a company.

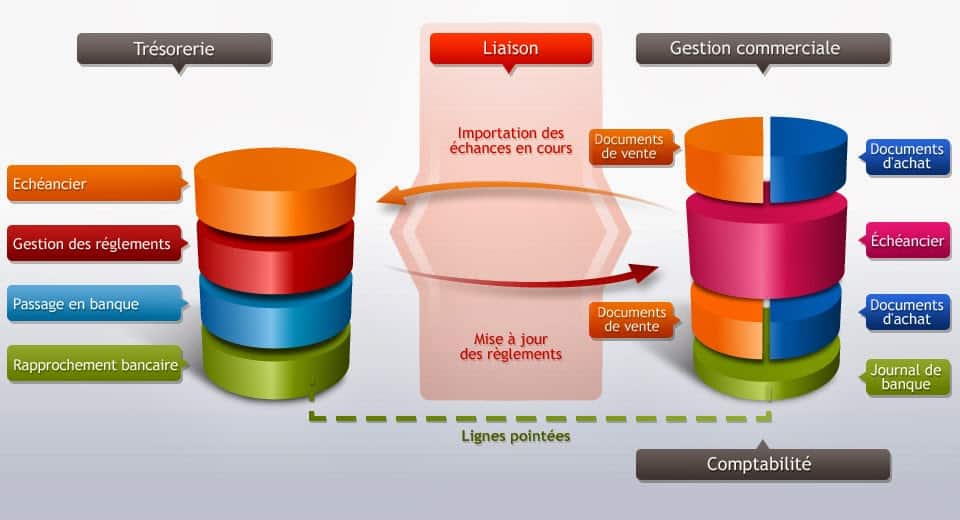

Thanks to the development of computer systems, it is often automated. IT provides businesses an indispensable tool to cash management. The automation of calculations provides speed, reliability and flexibility in establishing forecasts.

???? The approach to effective cash management

Cash management involves a two-step process:

✔️ The preparation of the cash budget

It is a provisional document summarizing the company's receipts and disbursements over a given period.

✔️ The development of the cash plan

It is a document resulting from the previous one and integrating the means of short-term financing and the possible investments.

The cash budget makes it possible to check globally, sthere is consistency between the working capital and the working capital requirement. A constantly deficit or surplus budget expresses a mismatch of the working capital to the working capital requirement.

This inadequacy should prompt a review of the assumptions on which the budgets were established upstream. These are mainly the hypotheses that allowed establish budgets for sales, purchases and investments.

If the cash budget alternately shows a surplus and a deficit, it reflects a situation that can be qualified as normal.

In our complete training, we go into detail with practical cases. This training has 2 modules.

1 Module: This module will allow you to make good cash flow forecasts. You will have in this file practical cases.

Unit 2: This module will allow you to control your different investments. it will allow you for example to know the favorable days to make a deposit or a withdrawal in a bank.

If you would like to have our complete training, download here

It's up to you to play, share, like and give us your opinion in comments

Leave comments