Financial markets for dummies

Are you new to finance and want to learn more about how financial markets work? Well you've come to the right place. Financial markets are a type of market that provides a way to sell and buy assets such as bonds, stocks, currencies, and derivatives.

They can be physical or abstract markets that connect different economic agents. Simply put, investors can turn to the financial markets to raise more funds to grow their business to earn more money.

To put it more clearly, financial markets are like a bank that maintains accounts for its customers and can use the deposits to fund other people and organizations and charge interest fees.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

The depositors themselves earn and see their money grow thanks to the interest paid to it. Hence, the bank serves as a financial market which benefits both depositors and debtors.

In this article, I present to you the BA BA of financial markets. For this we will talk about the role of financial markets, their structure and the different types of markets. But first, here is a training that allows you to earn 1000euros/Day on 5euros.com. Click here to buy it

The role of financial markets

Financial markets are virtual or physical platforms on which economic actors exchange financial products. On the one hand, these transactions make it possible to finance companies. On the other hand, investors can invest their savings and hope for financial or property gains.

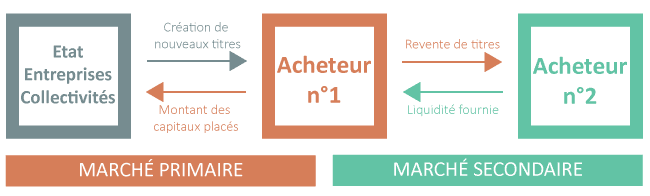

Shares, bonds and other debt securities are issued by Nations, public authorities and companies before being acquired by buyers. This is called the primary market.

These first buyers can then resell these securities in return for cash on what is called the secondary market. For example, when a company goes public or increases its capital, it is on the primary market. Once the shares are acquired, negotiations between investors are carried out on the secondary market.

Financial markets make it possible to complete transactions in a few thousandths of a second. This is what makes it possible to reconcile the financing needs and the investment needs of the different players. To summarize, financial markets play a fundamental role in financing the global economy. Here is what you generally need to remember:

- Financial markets provide a place where participants such as investors and debtors, regardless of size, will receive fair and appropriate treatment.

- They provide individuals, businesses and government organizations with access to capital.

- Financial markets help lower the unemployment rate because of the many employment opportunities they provide

How to understand how financial markets work?

Here are the important elements for understanding how financial markets work: market structure, market participants, liquidity, pricing and spread.

The structure of the financial market

Financial markets are generally subdivided into various categories based on the type of instrument being traded. Futures markets, for example, started out as a place to trade commodities like oil, metals and agriculture, but now include stock indices like the Dow Jones Industrial Average, the 100 FTSE and DAX.

The largest and most liquid foreign exchange market in the world is where investors trade global currencies and is open 24/24. Finally, through equity and debt markets, investors can trade assets including stocks of individual companies, options, and government bonds.

Market participants

The Financial Markets consist of various participants. It includes governments, central banks, major global banks, hedge funds and retail traders. Each of these participants has a different motive and interest than the others. These motivations can range from market speculation to commercial risk hedging.

For example, the merchant can hedge the exchange risk on foreign transactions, such as the acquisition of equipment or a sale in foreign currency. A central bank, on the other hand, can buy a currency to supplement its reserves.

Article to read : Understand the bank to better invest

Professional market players are generally divided into "buy side" and "sell side". The buy side is made up of hedge funds and pension funds. Their goal is to generate a return on investment for their investors and partners by investing funds in the market.

The supply is dominated by the major global banks, whose job it is to facilitate trade for investors.

Retail traders are usually non-professionals who trade with their own capital in order to get a return on their investment. They access the market through online brokers and can trade full-time or part-time to supplement their main income.

Liquidity and price

Market liquidity is directly correlated to the volume of transactions made at any given time. High liquidity means that an investor can easily place their trade at the desired price and indicates that there is a high number of matching trades to match.

Low liquidity, on the other hand, means that trading volume is low and it will be difficult to match one investor's trade with another.

The spread

The spread is the difference between the buy and sell price, often referred to as the bid price and the ask price. When an investor buys a security, they will pay the ask price, but when they sell it, they will pay the bid price. Therefore, in the investment process, the investor loses the spread.

It is in the investor's interest to keep the spread as low as possible when trading gold for example. This can be achieved by investing through a reputable broker or bank, as well as investing in the most liquid markets.

The different types of financial markets

There are so many financial markets, every developed country is home to at least one, although they vary in size. Some are small while others are internationally known, such as the New York Stock Exchange (NYSE) which trades billions of dollars daily. Here are some types of financial markets that one can have.

1. The stock market

The stock market trades in shares of ownership of public companies. Every stock has a price, and investors make money with stocks when they perform well in the market. It's easy to buy stocks. The real challenge is choosing the right stocks that will make money for the investor.

There are various indices that investors can use to monitor the stock market. If you are an investor then know that you can use indices such as the Dow Jones Industrial Average (DJIA) and the S & P 500. When stocks are bought at a lower price and sold at a higher price, the investor gains from the sale.

2. The bond market

The bond market offers businesses and government opportunities to obtain money to finance a project or an investment. In a bond market, investors buy bonds from a company, and the company repays the amount of the bonds within an agreed time, plus interest.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

When organizations need to obtain very large loans, they turn to the bond market. When stock prices go up, bond prices go down.

Article to read : Differences bank checks, personal checks and certified checks

There are many types of bonds, including treasury bonds, corporate bonds, and municipal bonds. Bonds also provide some of the liquidity that keeps the economy running smoothly.

It is important to understand the relationship between Treasury bonds and Treasury bond yields. When treasury bond values fall, yields rise to compensate.

When Treasury yields rise, mortgage interest rates also rise. Worse, when Treasury values go down, the value of the dollar also goes down. This drives up import prices, which can trigger inflation.

3. The commodity market

A commodity market is where companies offset their forward risk when buying or selling natural resources. Since the prices of things like oil, corn, and gold are so volatile, companies can lock in a known price today.

Since these exchanges are public, many investors also trade commodities for profit only. For example, most investors have no intention of accepting large shipments of pork belly.

Article to read : Everything you need to know about the bank check

Oil is the most important commodity in most economies. It is used for transportation, industrial products, plastics, heating and power generation. When oil prices rise, you will see the effect on gas prices about a week later.

If oil and gas prices remain high, you will see the impact on food prices in the coming weeks.The commodity futures market determines the price of oil.

Futures contracts are a way to pay for something today delivered tomorrow. They increase a trader's leverage by allowing him to borrow money to buy the commodity.

4. The derivatives market

Such a market involves derivatives or contracts whose value is based on the market value of the traded asset. The futures contracts mentioned above on the commodity market are an example of a derivative product.

Derivatives are complex financial products that base their value on underlying assets. Sophisticated investors and hedge funds use them to magnify their potential earnings. In 2007, hedge funds gained popularity due to their supposedly higher returns for high-end investors.

Since hedge funds invest heavily in futures, some have argued that they reduce volatility in the stock market and, therefore, in the US economy. Hedge fund investments in mortgage loans risk and other derivative products caused the global financial crisis of 2008.

Conclusion

Financial markets create an open and regulated system for businesses to acquire large amounts of capital. This is done through the stock and bond markets. Markets also allow these companies to offset risk. They do this with commodities, currency futures and other derivatives.

Before you leave, here is a training that teaches you how to sell advice on the internet. Click here to buy it.

Leave comments