The functional approach to financial analysis

Do a financial analysis, it's "making the numbers speak". Financial analysis is a critical examination of financial statements in order to assess the financial situation of the company. To do this, there are two approaches. The functional approach and the financial approach. In this article Finance de Demain We present the first approach in detail.

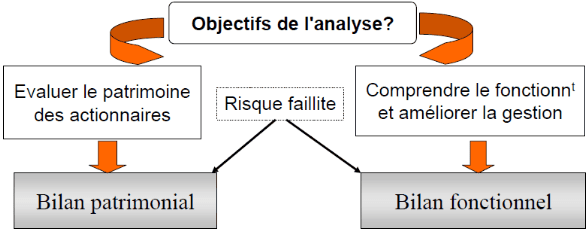

????The objectives of financial analysis

As a financial management tool, it is based on a purely technical vision based on the analysis and interpretation of results relating to the reading of accounting and financial documents.

It provides the information needed to maintain the financial balance of the company both in the long and short term. It generally allows decide on solvency of the company, its profitability and its future prospects. For this, this work requires a good knowledge of the target market and specific skills in finance.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

???? Who benefits from financial analysis?

Financial analysis is at the service of internal and external users to the company. The information used by all of these partners is accounting and financial information.

Depending on their expectations, each party will use the results of the financial analysis to make their own judgment on the financial health of the company. So :

✔️ Shareholders for example will be interested in potential benefits, to the remuneration of their contributed capital and to the capital gains generated.

✔️ Lenders short interest in liquidity and capacity of the company to meet these short-term deadlines.

👉 Employees are interested in the sustainability of the company, because any failure to do so results in the loss of their employment. They are true partners of the company, they have the right to participate in the profits and can become shareholders;

✔️ The manager quant uses financial analysis to measure the performance of its own management, to compare it with that of its direct competitors, and possibly to implement corrective actions. It also and above all allows the manager to assess the solvency of its customers.

✔️the state uses the results of the financial analysis to establish the bases of its tax revenues.

???? What is the functional approach based on?

The functional approach is based on the analysis of the functional balance through the assessment of the Working Capital Requirement (BFR), the Working Capital (FR) and the Net Cash (TN).

This approach to financial analysis favors the economic functioning of the company. This approach is based on an analysis of the activity, of the operations carried out, of the different cycles to which the companies are attached. The functional approach led to the establishment of the functional balance sheet.

The functional balance sheet is a particular representation of an accounting balance sheet. Items are reorganized and assembled there according to their function and degree of liquidity.

The functional balance sheet is a form of balance sheet in which uses and resources are classified by function. We are no longer talking about assets and liabilities here, but about uses and resources.

It makes it possible to analyze the activity of the company with a view to business continuity. This balance sheet is obtained after restatements and reclassifications of the accounting balance sheet, and also makes it possible to analyze the financial structure of a company by comparing its uses to its resources. It highlights different cycles:

- The sustainable or stable cycle: comparison between sustainable investments and stable financing.

- Operation: comparison between inventories, receivables and payables relating to operations.

- The non-operating cycle: comparison between miscellaneous receivables and payables;

- Cash : comparison between “asset” cash and “liability” cash.

???? Reclassifications and restatements of the balance sheete

From an accounting balance sheet, the functional balance sheet is obtained by making several restatements and reclassifications on different items. The following table highlights the various reclassifications.

| EMPLOIS | FREE |

| Stable jobs (investment function) Intangible fixed assets (in gross values) Tangible fixed assets (in gross values) Financial fixed assets (in gross values) | Stable Resources (funding function) Equity Depreciation and provisions (assets column) Provisions (liabilities) Stable financial debts |

| Current assets operating Stocks (in gross values) Advances and installments paid Operating receivables (in gross values) Prepaid operating expenses Out of scope Non-operating receivables (in gross values) Non-operating prepaid expenses Cash assets Availabilities (Bank and Cash desk) Marketable securities | Current operating liabilities Advances and installments received Operating trade payables Social and tax debts Other operating payables Deferred operating income Out of scope Tax debts Debts on fixed assets Other non-operating debts Non-operating deferred income Liability cash Current bank overdrafts and bank credit balances |

| TACTIVE TOTAL | TOTAL PASSIVE |

✔️ Reclassifications of the “investments” cycle

During the financial analysis, the fixed assets must be included in the assets for their gross amount, i.e. excluding depreciation and amortization. The latter, subtracted from the assets, must appear in the shareholders' equity in the liabilities.

For those financed by leasing, the original value (subtracted from the residual value) must be identified and added to stable jobs, in the same way as fixed assets owned by the company.

The cumulative depreciation carried out up to this date must be calculated and the amount entered into stable resources. Residual values must be included in financial debts. Accrued interest not due on loans must be deducted from financial assets and added to current non-operating assets.

✔️ Reclassifications of the “financing” cycle

The uncalled subscribed capital must reduce the amount of capital as it appears in the stable resources with impact on the assets. THE reimbursement bonuses obligations (to eliminate asset adjustments) must be charged in full to the bond issues to which they relate.

As mentioned below, accumulated depreciation carried out on fixed assets owned or leased must be added to equity. For fixed assets taken into account leasing, a financial debt must be entered in shareholders' equity in order to balance the entry in the assets of the leased property.

The provisions for unjustified risks which relate to the long term must be included in equity. Those which are not justified must be reclassified as operating debts or non-operating debts depending on their nature.

The partner current accounts, when blocked, should be treated as stable resources. They must therefore be included in equity. If they are free of reimbursement at any time, they remain current liabilities.

The accrued interest not due on borrowings must be removed from the item “borrowings and financial and similar debts” to increase the item “ non-operating liabilities ". The same is true with bank overdrafts. They must, for their part, be recorded as cash liabilities.

✔️ Reclassifications of “operating and non-operating” cycles

In the context of financial analysis, are generally considered as operating receivables advances and installments paid on orders, prepaid expenses, deductible VAT (possibly the VAT credit) and discounted bills not yet due (the opposite reasoning also applies to operating debts: advances and installments received, VAT or tax debts, and deferred income).

The post " other receivables is, in most cases, assimilated to non-operating receivables.

Debts to suppliers of fixed assets, income tax debts as well as Other debts are considered non-operating debts. In addition, dividends payable included in shareholders' equity must be reclassified in non-operating current liabilities.

✔️ Reclassifications of the “cash” cycle

Marketable securities, if they are liquid, must be treated as cash assets. The counterpart of discounted bills that have not yet matured constitutes cash liabilities.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

✔️ Reclassifications of translation differences

More complex processing is provided for translation differences:

If Conversion differences active: they are transferred to operating assets. If there is a reduction in the debt, we remove them from the assets and we subtract operating debts if there is an increase in the debt.

If Passive translation differences: they are removed from the liabilities and deducted from the operating assets if there is an increase in the receivable. In the case of a reduction in debt, we transfer them to operating debts. In summary, the table below groups together the various restatements and reclassifications to be made on the balance sheet.

| Posts | Restatements |

| Amortization and depreciation | § Eliminate from assets § Additions to own resources |

| Expenses to be spread over several financial years | § eliminate them from the asset § Deducted from equity |

| Redemption premiums and bonds | § Eliminate from assets § Deducted from equity |

| Uncalled shareholders-capital | § Deducted from financial debts (blocked accounts) § Additions to short-term debts (temporary deposits) |

| Current bank overdrafts and bank credit balances | § Deducted from financial debts § Additions to cyclical debts |

| Current accounts of creditor partners | § Deducted from financial fixed assets § Add them to circulating receivables (miscellaneous receivables) |

| Accrued interest on borrowings | § Additions to current assets (operating receivables) § Additions to outstanding debts |

| Accrued interest on capitalized receivables Discounted bills not due and assigned receivables not due Finance leases | § Original values of the asset is added to fixed assets § The equivalent of depreciation is added to equity § The equivalent of the unamortized part is added to the financial debts |

????Financial balance

The financial balance of the company is assessed through three dimensions. Financial analysis essentially aims to Working capital Net Global (FRNG), the Need in funds Net Global (BFRNG) and Net Cash (TN).

✔️ Global Net Working Capital

The FDR is a concept of fairness of a company's functional balance sheet. There are two levels of working capital. Overall net working capital and financial working capital. When nothing is specified, the notion of " working capital refers to overall net working capital.

To calculate the FR, two methods exist. The top of the balance sheet method and the bottom of the balance sheet method. From the top of the balance sheet, we have:

Overall Net Working Capital = (PF + Borrowings) - Fixed Assets

Proceeding from the bottom of the balance sheet, we have:

Global Net Working Capital = (inventories + receivables + miscellaneous current assets) - short-term debts

The table below presents the different possible interpretations of working capital.

| FRNG sign | Interpretations |

| FRNG>0 (positive) | The firm's stable resources are equal to the fixed assets. This would mean that the stable resources cover the long-term needs of the company. Financial balance is therefore respected and the company has, thanks to working capital, a surplus of resources which will allow it to finance its other short-term financing needs. |

| si FRNG =0 (null) | This shows that the stable resources cover the long-term needs of the company. Even if the balance of the company seems to have been reached, it does not have any surplus long-term resources to finance its operating cycle. This situation makes its financial balance precarious. |

| FRNG<0 (negative) | The firm's stable resources are less than fixed assets. Long-term needs are not completely covered by stable resources. It must therefore finance part of the long-term needs with short-term resources. This situation makes it run a significant risk of insolvency. The company must then take rapid action to increase its long-term resources to recover a surplus FRNG. |

✔️ The working capital requirement (BFR)

The (BFR) is the measure of the financial resources that a company must implement to cover the financial need resulting from shifts in cash flows corresponding to disbursements and receipts related to its activity.

It is usually called " working capital resource when negative. Its importance depends on the length of the operating cycle, the added value integrated at each stage of this cycle, the importance and duration of storage of materials raw/packaging, work in progress and finished products, and payment terms granted by suppliers or granted to customers.

The simplified algebraic expression of the BFR is as follows:

Working capital requirement = Current assets (stocks + trade receivables) - current liabilities (trade payables + tax payables + social security + other non-financial)

WCR can also be thought of as the difference between operating assets and operating liabilities.

Working Capital Need = (Inventory + Realizable Assets) - Short Term Debts

By distinguishing operating BFR from non-operating BFR (BFRHE), BFRNG becomes:

Global Net Working Capital Requirement = BFRE + BFRHE

Analysts generally want WCR to be presented in days of turnover. Thus, it suffices to divide the amount found by the CAHT and to multiply it by 365 or 360 days. Generally, in financial analysis, we distinguish three cases of working capital requirements.

BFR Interpretations

✔️Le BFR is positive

the operating uses of the company are greater than the operating resources. The company must finance its short-term needs either with the help of its surplus of long-term resources. It can also do so with the help of additional short-term financial resources, such as bank loans.

✔️If the BFR is zero

the operating uses of the company are equal to the operating resources. The company has no operating needs to finance since the current liabilities are sufficient to finance the current assets.

✔️the BFR is negative

the company's operating jobs are lower than the operating resources. The company has no operating needs to finance, its current liabilities exceeds its financing needs in operating assets.

It therefore does not need to use its working capital to finance any short-term needs.

???? Net cash (TN)

TN is an important accounting and financial indicator for a company. Its determination, its analysis and its follow-up make it possible to practice an effective management of the businesses.

The TN is all the sums of money that can be mobilized in the short term (we also speak of cash on sight). It must be determined:

- Upstream in the pre-creation or pre-business takeover phase

When a project leader plans to create his business, he must necessarily calculate the net cash flow. In general, this calculation is carried out when constructing the cash flow budget, the table making up the financial forecast.

Its determination makes it possible to verify that the project is viable and that the financial structure of the company ensures a certain durability.

- Throughout the life of the company

Net cash is a critical business item. We often speak of " nerve of the war since it governs all the reports and financial flows intended for the company's partners.

It can be monitored daily, weekly, monthly, quarterly or annually. It must be integrated into the forecasts in the dashboards. Algebraically, it is calculated in the following ways:

Net Cash = Working Capital - Working Capital Requirement

Or

Net cash = Cash - short-term financial debt

Cash resources represent all monetary asset items on the balance sheet that can be mobilized in the short term. They consist of assets held in banks, cash registers and Investment Securities (VMP).

✔️Net Cash Interpretations

After the calculations, three cases can arise:

NT >0: positive net cash is a sign that the company can quickly pay off a debt. This is a positive sign of good management. However, it should not be too high. In this case, it would be funds that are not used enough and that yield little.

when TN<0 : a priori, a negative net cash position is a bad sign of management. But, it is especially necessary to examine the reasons for this situation before issuing an opinion.

If the cash flow is negative because the WCR (Working Capital Requirement) is too high, it is a better management of the WCR that must be applied. If it is negative because the working capital is insufficient, it is the company's investment policy that must be reviewed.

TN=0: this situation in practice is hardly achievable.

You can also learn how to do it financial analysis using ratios. It's your turn

Your opinions in comments

Very complete article thank you Doctor

Good evening to you

Already we are honored for your loyalty to our site

Thank you for your opinion and don't forget to share. Our vocation to bring you added value