The financial analysis process: a practical approach

The purpose of a financial analysis of the company is to answer questions relating to decision-making. These decisions can be related to the management of the company, to the investment policy or even to questions related to financing. In this article Finance de Demain introduces you to the process of financial analysis in a practical approach.

But to start, here are some Advice and strategy to create and develop which will allow you to develop your company or your business very easily.

???? The stages of financial analysisre

The idea of the FA is not to comment on each ratio but rather to highlight the essential points necessary for understanding the business studied. Thus, the importance of financial analysis varies according to the objectives set and the user.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

This is how we commonly distinguish between internal and external financial analysis. Internal analysis is done by an employee of the company while external analysis is done by independent analysts. Whether it is carried out internally or by an independent, it must follow five (05) steps.

✔️ First step

This step makes it possible to collect both accounting and non-accounting information in order to reprocess it. It is actually a question of getting in touch with the various managers of the company who will be able to provide you with the requested documents.

All of this accounting documents are: the balance sheet, the income statement, the cash flow statement and even the annexes. These may also include other documents likely to help understand the financial situation of the company. In this category we can have management reports, different committees, etc.

✔️ Second step

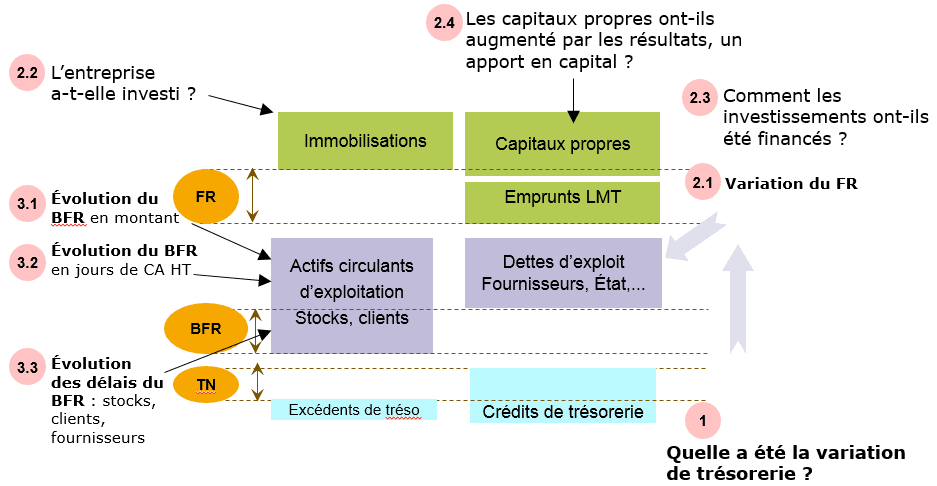

This step consists of drawing up the transition from the accounting balance sheet to restated balance sheet. The latter can be functional or financial depending on the approach adopted. The same applies to the income and expenses account (CPC) which must be restated.

The restatement consists in reclassifying the various elements according to whether they should be part of the operating, investment or financing cycle.

For example, if in current assets, we have a stock that has lasted for a year, then we send it to fixed assets. This operation of course has no impact on the total assets/liabilities but rather on the operating cycle. It automatically modifies the calculated ratios.

✔️ Third step

After restatements of the balance sheet, this step allows to present the financial balance sheet (assets or liquidity) or functional as such in large masses and the expense and revenue account restated. It is in fact the synthesis of the work done in the previous step.

✔️ Fourth step

This is the time to present the cash flow statement, justifying the calculations, if any, the most significant ratios concerning the financial structure; liquidity; business activity and profitability.

✔️ fifth step

This is the correct financial analysis. After calculating the different ratios in the previous step, it is necessary to comment on their evolution. Seek to explain the different variations of the ratios. Say if these ratios are favorable or unfavorable for the company? If they are unfavorable, then make suggestions to improve them.

And this, ratio by ratio or by block of ratios. This step must absolutely lead to a value judgment or an assessment of the financial situation (its strengths and weaknesses) of the company. To better approach this fifth step, the financial analyst must seek to answer the following questions:

- What are the results of the company in terms of turnover and margin?

- To achieve these results, what is the company's investment policy?

- How does it finance these investments?

- How does the company perform compared to other companies in the same industry?

???? What exactly should be analyzed?

For an effective approach to financial analysis, the financial analyst must examine the structure of turnover and margins. Analyze the investments made, the means of financing these investments and finally evaluate the profitability of these investments.

✔️ Turnover and margins

The analysis of the structure of turnover and margins occupies an important place in financial analysis. The detailed analysis of the turnover initially and the operating profit secondly makes it possible to respond to market concerns and business strategies.

Thus, you can discover scissor effects present since a company can very well experience an increase in its turnover and at the same time experience an explosion in its operating expenses.

Revenue analysis is an opportunity to learn more about the revenue lines of the company's activities and know its competitive position in the market. However, the analysis of the turnover also makes it possible to learn more about the evolution of the " dead point by separating fixed costs from variable costs.

✔️Investment analysis

In a company, there are two great masses of investments. The first mass of investments is that corresponding to fixed assets on the assets side of the balance sheet.

The information collected in this mass is important for understanding the company's strategy, in particular by comparing the amount of new investments with that of depreciation charges. The second mass of investments corresponds to stocks. Thus, the financial analysis must analyze the working capital requirement of the company.

✔️Financing analysis

The analysis of the company's financing must be carried out dynamically over several years. It can also be done statically on the last exercise available. In a dynamic approach, the essential working tool is the cash flow table. Flows from operations are the cornerstone.

???? How to analyze the funding cycle?

The first thing to do when analyzing funding is to calculate the Capacity self-financing (CAF) of the company. The CAF designates all the internal resources generated by the company as part of its activity which allows it to ensure its financing.

It can also make it possible to repay loans taken out, finance investments, increase equity or even distribute dividends. To calculate the CAF, two methods exist: the subtractive method (from the gross operating surplus) and the additive method (from the result of the financial year).

✔️ The subtractive method

This method of calculation follows directly from the definition of CAF. This is a calculation of the CAF according to its origin. Thus, the CAF is calculated by making the difference between cashable income and cashable expenses relating to the normal activity of the company, that is to say which do not do not fall under operations financing or investment.

A cashable product (respectively a cashable charge) potentially generates revenue (respectively expense). Conversely, a calculated product (respectively an expense) does not generate a monetary flow.

In practice, to the gross operating surplus (EBITDA) are added the transfers of operating expenses and the other cashable income from normal activity and the other cashable expenses from normal activity are subtracted.

SELF-FINANCING CAPACITY = Gross operating surplus + Transfers of operating expenses + Other exploitation products - Other operating expenses + Shares of profit on joint operations - Shares of profit on joint operations + Financial products - Financial expenses + Exceptional products - Exceptional outgoing expenses - Employee participation in the results - Income taxes

Here are some questions to ask when analyzing the different cycles.

✔️ The additive method

This second calculation method is faster than the first and therefore more widely used. This isa calculation of the CAF according to its allocation. The following video presents the financial analysis process.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

The CAF can also be calculated from the net result to which the calculated expenses are added (allowances for depreciation and provisions) and from which the calculated products of reversals of provisions and depreciation are subtracted.

It takes plus eliminate the bottom line, the impact of financing and investment operations appearing in the income statement.

First, the investment subsidies transferred to the income statement, which are calculated products, must be subtracted.

Secondly, add the net book value of the assets sold and subtract the proceeds from the sale of the assets.

The second thing to do when analyzing funding is to analyze ratios. These are the ratios of general liquidity, financial independence, obsolescence, financial independence and financial autonomy.

This is to assess the balance of its financing structure as well as its repayment capacity. Financial ratios are indicators used to conduct financial analyzes of companies.

However, if you want to take control of your personal finances in six months, I highly recommend this guide.

It's your turn

Leave your opinions in comments

Leave comments