Why does banking governance need to be strong?

Why does banking governance need to be strong? This question is the main concern that we develop in this article. Before any development, I would like to remind you that banks are full-fledged companies. Unlike traditional companies, they receive deposits from their customers and grants in the form of loans. In addition, they face several stakeholders (customers, shareholders, other banks, etc..).

This multitude of stakeholders increases agency relations and therefore agency conflicts. It is therefore from this precise moment that governance intervenes to reduce agency conflicts within companies.

In this article I present to you the major challenges of banking governance. In other words, Finance de Demain tell you why banking governance must be solid.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Let's go !!

???? What is corporate governance?

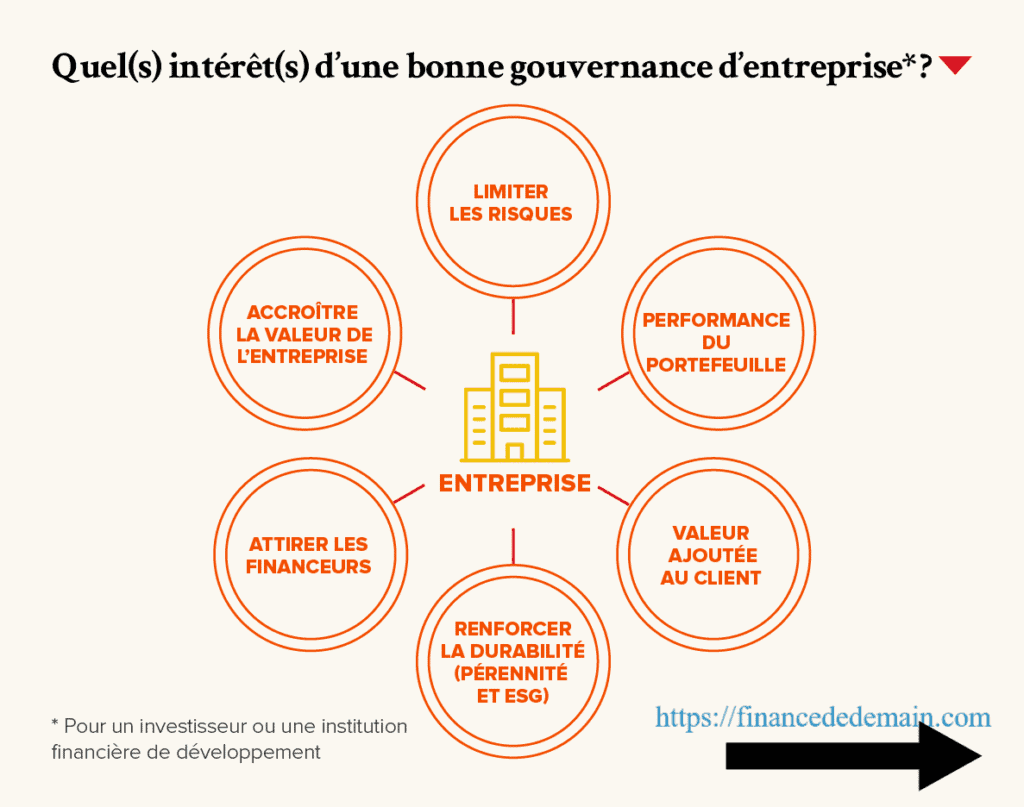

Expression governance refers to the way a company's business is conducted. In the company, corporate governance refers to taking into account the interests of stakeholders in the decision-making process.

Thus, good governance would ensure a sustainable and effective process of creating values for all. In fact, it is important to remember that corporate governance finds its explanation from the moment when the interests of stakeholders diverge.

A company is above all a contracts node » including managers, employees and financial investors. For this there are naturally conflicts between these parties to the contract.

Conflicts can oppose either the shareholders to the managers, the shareholders between them (minority versus majority), or financial creditors (banks and bondholders in particular) to shareholders.

In banks, these conflicts are increasingly accentuated because there are several types of agency relationships. For example, we have the following agency relationships: manager/shareholders, bank/clients, shareholders/clients.

La banking governance must cover issues of power, control, transparency, liquidity management and legitimacy of the institution.

It affects both issues of conflicts of interest between stakeholders and those related to the maintenance of trust between them.

Article to read: What are the Islamic banking risks?

Banks must be able to assess the risks inherent in their activities, and this, especially in a situation of growth or competition. This again requires banking and financial expertise on the board.

In addition, banks must seek to balance social goals with financial goals in order to satisfy its multiple stakeholders.

???? The particularity of banks compared to other companies

Banking companies have their own characteristics. The particularities of banks lie in their activity, the existence of transaction costs, the importance of risk diversification, the degree of importance of innovation at the level as well as at the regulatory level.

In reality, several factors justify the interest of a solid governance system within banks.

✔️ The nature of banking activities

The bank plays a role of financial intermediation between economic agents. It collects the deposits of its customers to replace them with other customers and thereby creates money.

For this, it uses its capital to secure transactions which it does as a multiple of it. It has a fiduciary duty vis-à-vis its clients and a duty of security vis-à-vis its shareholders, clients and the market.

The bank's activity therefore requires permanent solvency and liquidity. This is the first reason why banking governance must be solid within banks.

✔️ The importance of risk diversification

Banks, unlike traditional companies, face many risks. These include liquidity risk, counterparty risk, etc.

For this reason it is important to carry out risk diversification because you don't put all your eggs in one basket. This diversification consists of choosing a combination of different investments to reduce the risk associated with your portfolio.

In theory, diversification allows you to reduce the risk in your portfolio without sacrificing potential return. An efficient portfolio generates a certain return lowest possible risk.

Once your portfolio is fully diversified, you need to take on additional risk to increase its potential return.

Successfully diversifying your portfolio requires better coordination of activities in the bank. This is the second reason why bank governance must be solid.

✔️ The level of importance of banking innovation

Innovation refers to the execution of new combinations. It may concern the manufacture of a new good, the introduction of a new production method, the opening of a new outlet; the conquest of a new source of raw materials or products…

In recent years, banks have increasingly resorted to open innovation. According to Chesbrough (2003), this innovation model based on partnership approaches was initially experimented with by non-financial firms.

This type of innovation is based on the partnership between the bank and its partners.

Article to read: What are the Islamic banking risks?

Finally, innovation is a strategic necessity for banks that want to remain competitive. According to Madan and Soubra (1991) innovation allows banks to increase their profits by reducing transaction, research and marketing costs.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

During the crisis period as currently with COVID19, banking innovation offers competitive advantages to certain banks. For implementation to be possible, everything depends on the governance system implemented in the company.

Thus, good governance would create added value for all. This is the third reason that explains the need for strong banking governance.

✔️ Why banking governance must be strong? The bank is a crossroads of several stakeholders

Unlike traditional companies, banks bring together a multitude of stakeholders whose governance must take them into account.

Stakeholders are all the natural or legal persons who are concerned and who can influence the decisions of a company. They can be internal or external to the bank.

Article to read: All about the stock market

Internal stakeholders are part of the bank's workforce (managers, employees, etc.). As for the external stakeholders, we have: subsidiary banks, customers, suppliers, etc.

Active stakeholders take part in the decisions of the bank while passive stakeholders are subject to the decisions of the bank. The weight of each stakeholder has repercussions on corporate governance.

Active stakeholders will tend to prioritize their interests over those of others.

The majority shareholders for example will seek to impose their will to the detriment of minority shareholders. In this logic, the bank faces many agency conflicts.

Not only with internal partners, but also with external partners. This situation is even more accentuated in Islamic banks.

Article to read: Best Financial Strategies That Work Effectively

To deal with all these problems, a good governance structure must be put in place. This is the fourth reason why bank governance must be strong.

???? How to reduce conflicts of interest in banks?

In what we have just said, it is clear that banking governance must deal with several types of conflicts of interest. To do this job, banking governance has a number of mechanisms known as governance mechanisms.

Etymologically, a mechanism is an assembly of elements, some of which can move relative to others. This assembly does not therefore constitute a solid. Each element is independent.

Agency conflicts with creditors settle through mechanisms such as contractual guarantees, legal procedures for judicial settlement, the financial information market, or even informal mechanisms such as reputation.

Article to read: What does a financial analyst do?

These different mechanisms do not necessarily play equivalent roles and their importance depends on the nature and activity of the company.

In the governance system, this assembly can be broken down into two categories:

✔️ Constructed or “intentional” mechanisms

In this category we have the right to vote on the board of directors (CA), the characteristics of the CA (size, transparency, independence, etc.) and the committees (audit, remuneration, etc.).

Remuneration systems and the manager's profile also fall into this category. The main mechanism of bank governance is the board of directors.

✔️ “Spontaneous” mechanisms

This category of mechanisms is linked to market competition. Whatever they are, these mechanisms are intended to reduce agency conflicts between stakeholders.

Thus, for large listed companies, some authors consider that the dominant mechanism is the management market. Managers will seek to manage businesses well to maximize their reputation and value in this market.

Article to read: Differences between Islamic banks and conventional banks

Beside the executive market There is another spontaneous mechanism, regulation. Banking regulation is seen as the act of supervising and controlling banking activity, by subjecting it to compliance with various standards, in order to control risks in order to preserve the security of depositors, the stability of the financial system and the major balances. economic.

To achieve this end, banking regulation relies essentially on regulation and supervision.

La banking regulations consists primarily of setting the level of minimum resources, or equity ratio in the jargon, that banks must hold in order to be able to withstand a financial shock.

???? In summary…

Quality banking governance is an unprecedented necessity if we want to maintain the confidence of other stakeholders. According to a Basel committee report published in 2015, corporate governance aims to strengthen the collective responsibilities of the board of directors in terms of oversight and risk management.

Due to the nature of banking activities, governance is an important element for the soundness and development of banks.

Managing customer deposits, granting them credit and having access to confidential customer information increases the need for effective and efficient management; stronger regulation and supervision (El Marzouki and Benlechehab, 2017).

In addition, banks are more exposed to agency conflicts compared to other forms of business.

Leave your opinions in the comments. However, if you want to take control of your personal finances in six months, I highly recommend this guide.

Leave comments