All about NSF checks

Checks are a method of payment less and less used, but still in force. Checks are documents called title deeds that cover a certain amount of money. They can be bank checks, personal checks, certified checks, etc. There are punishable behaviors when said documents are drawn without funds, both by commercial law and criminal law, with penalties up to and including jail time. In this article, I tell you all about the bad check.

But before we start, learn more about banking jargon.

???? What is an NSF cheque?

By issuing a check in someone's name, you give them the right to withdraw money from your bank account without needing your presence. If at the same time, you do not have money in your account to justify the amount written on the document, then it is an NSF check.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

Therefore, an NSF check is a worthless piece of paper. A check can run out of funds for a variety of reasons.

Either inadvertently : the account holder wrote the wrong check, either before receiving a payment or unaware that the account could not cover the full amount. There are several situations in which you might reasonably believe that you have cash available:

- A payment you expected (like direct deposit from your job) didn't reach your account.

- A deposit or payment has not yet been released to your account.

- A purchase with your debit card created a hold on your account (perhaps more than you actually spent).

- Someone deposited a check you wrote a long time ago but forgot about.

Or voluntarily : Sometimes it's intentional. You know you have no money, but you write the check anyway (which is a bad idea).

???? What if we are faced with an NSF cheque?

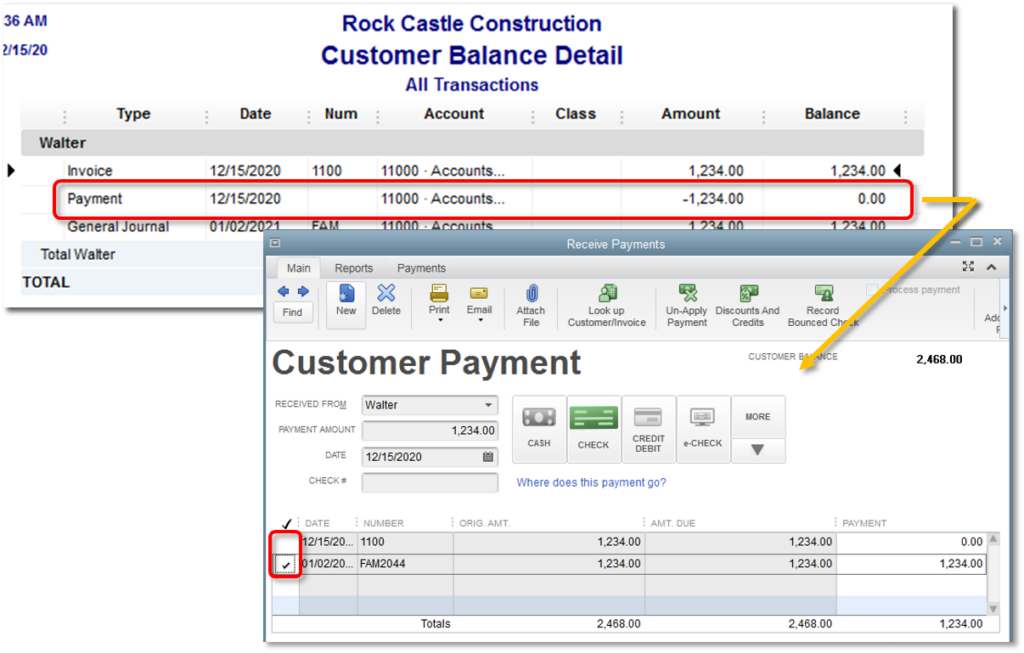

NSF checks can cost you money you don't have. You usually pay a fee to the person you wrote the check to (usually around $25). This behavior may cause that business or organization to refuse to accept your checks in the future.

Your bank also charges a fee for NSF checks. They return the check to a business unpaid and charge you an NSF check fee. Also known as an insufficient funds fee, this fee is often around $35. I recommend you to read this article to better understand insufficient funds charges.

Your bank may decide to pay the check as a "courtesy" and charge an overdraft fee (again, often around $35, or they may call it a loan and charge you interest). Learn more about how it works overdraft protection plans.

If you're counting, that's at least two fees you pay. There is also a good chance that your payment will be considered “ late ”, so you could also face late payment penalties. Here are my tips for dealing with bounced checks

(I.e. Preventive tips

When it comes to inadvertence, the unpleasant operation can be avoided in most cases. When receiving a check, it is convenient to ask the person who issued it on what date we can cash it (from what day and what is the limit). In this way you will organize your banking operations and get your money at the right time.

The above is convenient for both the person who cashes the check and the person who issues it. The former avoids the hassle of going to the bank unsuccessfully and the latter avoids the monetary penalty (commission) that his bank will charge for the failed transaction. It is important to keep in mind that there are fees on NSF checks. Visit your bank to find out more about these fees.

In the case of a major financial transaction, you can request that it be paid to you by certified bank check. Check out this guide to learn more about how certified checks work.

(I.e. Curative advice

When you have already had the unpleasant experience of going to the bank to cash a check without success due to insufficient funds, it is advisable to:

First contact the person who gave you the check to explain the situation and ask for solutions. You can also ask him to write you another check, make a deposit, a transfer or give you the cash as soon as possible.

You can also take legal action against these people when they refuse to pay you. If you are considering suing someone for this reason, it is advisable to first contact a specialist body for specific help and advice.

More information is provided there for each situation and they have experts to help solve the problem. If the lawsuit is won, the fraudster must pay you, not only the amount of the debt but also a supplement. This surplus is for damages and legal fees.

???? How Does a NSF Check Affect Your Credibility?

An NSF check does not show up on your traditional credit reports. However, companies like ChexSystems may keep a record of your banking activity.

If you don't have a strong credit history (because you haven't built up your credit yet), lenders, employers and insurers may turn to credit rating agencies. alternatives » to decide whether or not to do business with you. These agencies may include information about bad checks, which will hurt your chances.

In addition, a company to which you issue bounced checks may send your account to a collection agency. If that agency reports activity to the major credit bureaus, your traditional credit scores will suffer.

Before you leave, here is a training that allows you to master trading in just 1 hour. Learn more about Proptechs, green finance also.

FAQ

What is a bad check?

A bounced check (or bogus check) is a check issued by a drawer (the one writing the check) when they do not have sufficient funds in their bank account to cover it. When the beneficiary deposits the check with his bank, the latter notes the absence or insufficient funds and may refuse payment.

What are the consequences of an NSF cheque?

Issuing a bad check is a criminal offense punishable by fines and prison time. In addition, civil proceedings may be initiated by the beneficiary to obtain compensation for their damage.

The drawer will have his name registered in the National File of Irregular Checks (FCC) for 5 years. This will prohibit it from issuing checks to all French banks, unless expressly agreed by them.

Bank charges for bounced checks are also levied by the bank.

What does the drawer of a bad check risk?

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

- Fine of up to €375

- Ban on issuing checks for a maximum of 5 years

- FCC registration for 5 years

- Prison sentence of up to 5 years for repeat offense

- Reimbursement of damage suffered by the beneficiary

- Bank rejection fees

What are the penalties for the beneficiary of a bad check?

The beneficiary does not incur any criminal sanction if he deposits in good faith a bad check of which he was unaware of the irregularity. On the other hand, if he was complicit in the fraudulent issue, he is exposed to the same criminal sanctions as the shooter.

How to regularize your situation after having issued a bad check?

Several options to regularize:

- Give cash to the payee for the amount of the check

- Make a transfer to the beneficiary

- Request a payment deadline from the beneficiary

- Request a letter of waiver of prosecution from the beneficiary

- Submit a request to the prosecutor to request the lifting of the banking ban

In all cases, the drawer is advised to contact his bank and the beneficiary to find an amicable solution to resolve the dispute.

Leave comments