What is a decentralized exchange?

What is a decentralized exchange? You can use centralized and decentralized exchangers to trade cryptos. The former may be preferable when you are starting out or want to trust a well-known company. But the latter is the only option if you want to trade lesser-known cryptos and have full control over your crypto wallet.

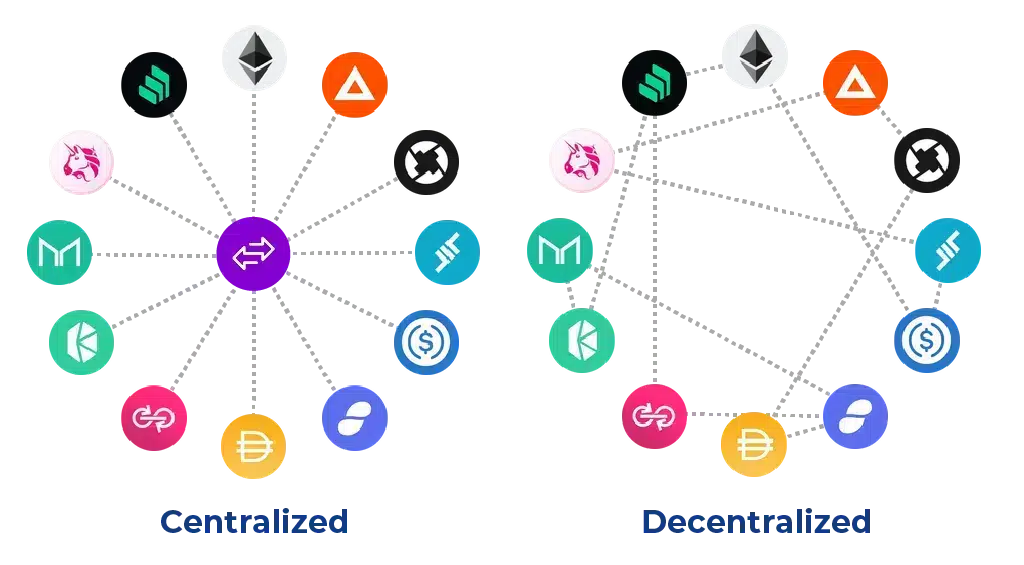

Cryptocurrency exchanges are platforms that allow users to trade cryptos. They are usually distinguished as centralized exchanges (CEX) or decentralized exchanges (DEX).

Most people invest in crypto on a centralized exchange. This is perhaps the most accessible and safest option for average users. But it is also important to understand decentralized exchanges, which you should use if you want to buy certain types of crypto and participate in different parts of crypto ecosystems.

Get 200% Bonus after your first deposit. Use this promo code: argent2035

In this article, we will basically talk about decentralized exchanges. We will see what they are and what they are not, how they work, their advantages and disadvantages. Let's go.

🥀 What is a decentralized exchange?

Decentralization is one of the core values of the crypto movement. Crypto transactions are conducted freely without the approval, regulatory oversight, or high fees of banks and other financial institutions.

This is one of the benefits of using and investing in cryptocurrencies. Each DEX is intended to bring the benefits of decentralization to buying, selling, and managing crypto portfolios.

A DEX is therefore a peer-to-peer market. A market where users can trade cryptocurrencies on a noncustodial basis without the need for an intermediary to facilitate the transfer and safekeeping of funds.

DEXs replace traditional intermediaries like banks, brokers with smart contracts. These smart contracts are based on blockchain technology that facilitate the exchange of digital assets.

Compared to traditional financial transactions, which are opaque and go through intermediaries who offer extremely limited insight into their actions, DEXs offer complete transparency on the movement of funds and the mechanisms facilitating exchanges.

Therefore, counterparty risk and systemic risk are reduced unlike centralized or traditional systems.

Following this logic, DEXs are considered a cornerstone of decentralized finance (DeFi). They serve as lego monetary key upon which more sophisticated financial products can be built through permissionless composability.

The most popular DEXs, such as Uniswap and Sushiswap, use the Ethereum blockchain and are part of the growing DeFi toolkit.

🥀 How does a decentralized exchange work?

At a centralized cryptocurrency exchange, you start by creating an account and meeting the KYC terms of the site. After depositing funds or connecting your existing crypto wallet, you can buy, sell and trade cryptocurrencies, make a quick transaction or build a long-term portfolio.

CEXs like Coinbase make it possible to trade fiat currencies against crypto (and vice versa) or crypto pairs. On the other hand, DEXs do not allow exchanges between fiat currencies and cryptocurrencies. Instead, they exclusively trade cryptocurrency tokens for other cryptocurrency tokens.

On a decentralized crypto exchange, you connect your cryptocurrency wallet to software on the exchange's site. If you want to buy or trade crypto assets, all you have to do is specify what you are looking for.

The decentralized application tells you the price, and if you approve, you accept the transaction. You never log in, provide a name or email address, or create an account.

DEXs do not match you with an individual seller. Instead, they employ Automated Market Makers (AMM), to offer you coins and tokens from a pool of liquidity.

This liquidity pool is an amount of cryptocurrency that other users have made available for a specified period. When you buy crypto on a decentralized exchange, you are buying from a pool of liquidity.

Those who have a wallet on Trust Wallet for example can buy their cryptocurrency on the liquidity pool of PancakeSwap, UniSwap or many others.

🥀 What are the advantages of a decentralized exchange?

Most of the strengths of decentralized exchanges come from their distributed architecture. Here are some key advantages (although some of them are also disadvantages):

Wide variety of tokens

If you want to find a booming token just at the start of its launch, exchanges are the place to get it. DEXs offer a virtually unlimited range of tokens, from the well-known to the most bizarre and totally random.

Indeed, anyone can create a token based on the Ethereum network and create a liquidity pool for a crypto or token. For this reason, in a decentralized exchange you will find a greater variety of projects: “verified” projects and " unverified ».

Low risk of hacking

Since all funds from a DEX transaction are stored in users' wallets, these movements are theoretically less susceptible to hacking. This is quite relative, as DEXs also reduce what is known as the “ counterparty risk ».

This risk is the likelihood that one of the parties involved, potentially including the central authority in a non-DeFi transaction, will default on the transaction.

Anonymity of users and transactions

No personal information is required to use the most popular exchanges / DEXs. On Trust Wallet, for example, you are only asked for your password when creating the wallet.

Decentralized exchangers: for the finance de demain

There are many economic movements that in the future could be transferred to blockchain and sooner or later could be managed through exchanges. For example: Peer-to-peer lending.

Fast transactions and anonymity allow DEXs to become increasingly popular in developing economies, where strong banking infrastructure may not be needed over time. Anyone with a smartphone and an internet connection can trade through a DEX.

However, DEXs don't just have advantages. They also have drawbacks. Here are a few.

Get 200% Bonus after your first deposit. Use this official Promo code: argent2035

🥀 What are the disadvantages of a decentralized exchange?

DEXs have democratized access to trading and providing liquidity through robust smart contracts. However, they also come with a set of risks:

Smart contract risk

Blockchains are considered highly secure for performing financial transactions. However, the quality of a smart contract's code still depends on the skill level and experience of the team that developed it.

Bugs, hacks, vulnerabilities and smart contract exploits can occur leaving DEX users vulnerable to loss of funds. Developers can mitigate this risk through security audits, peer-reviewed code, and good testing practices. Diligence is always required.

Liquidity risk

As DEXs become increasingly popular, some DEX markets have poor liquidity conditions. These conditions can lead to large amounts of slippage and a suboptimal user experience.

Due to the way the network effects of liquidity work, a significant portion of trading activity is still conducted on CEXs. Which often results in less liquidity on DEX trading pairs.

Risk of centralization

While many DEXs aim to maximize their resistance to decentralization and censorship, points of centralization can still be present. These include the DEX matching engine hosted on centralized servers, the development team having administrative access to the DEX smart contracts, and the use of low-quality token bridging infrastructure, among others.

Network risk

As the exchange of assets is facilitated by a blockchain, using a DEX can be prohibitively expensive or outright impossible if the network experiences congestion or downtime, leaving DEX users susceptible to market movements.

Token risk

As many DEXs offer permissionless market making – the ability for anyone to create a market for any token – the risks of buying low-quality or malicious tokens can be higher than in CEXs.

DEX users should consider the risks associated with participating in early-stage projects.

🥀 Other Disadvantages of a Decentralized Exchanger

Other disadvantages of DEXs include the fact that:

- The platform may be more difficult to navigate and use

- You could lose your money if someone hacks the DEX

- There may be possible additional fees for each transaction

- You could be alone in case of trouble

🥀 Examples of decentralized exchanger

Uniswap

Launched in 2018, Uniswap is the largest decentralized exchange in the world. It allows the decentralized exchange of numerous ERC-20 tokens on the Ethereum blockchain, without an intermediary. Its model is automated using smart contracts. Uniswap has no central entity and is managed by its community.

PancakeSwap

PancakeSwap is a decentralized exchange similar to Uniswap but built on the Binance Smart Chain blockchain. It therefore allows you to exchange various BEP-20 tokens easily and at a lower cost. PancakeSwap uses an AMM (Automated Market Maker) based liquidity model rather than a traditional order book.

CurveFinance

Curve Finance focuses on decentralized exchanges of stablecoins or cryptoassets whose value is pegged to traditional fiat currencies. Its algorithmic liquidity pool model is optimized for low slippage exchanges between stablecoins like USDT, USDC, DAI etc.

dYdX

dYdX is a decentralized trading platform offering high leverage on popular cryptoassets like Bitcoin. Its unique model allows peer-to-peer borrowing without an intermediary while keeping the borrowed assets on deposit.

🥀 Conclusion

DEXs are a fundamental pillar of the cryptocurrency ecosystem. They allow users to exchange digital assets in a peer-to-peer manner without the need for intermediaries.

DEXs have seen increasing adoption over the past few years due to the instant liquidity they can enable for newly launched tokens, their seamless onboarding experience, and democratized access to trading and liquidity provision. that they provide.

Get 200% Bonus after your first deposit. Use this official Promo code: wulli

Whether the majority of trading activity will migrate to DEXs remains to be seen. However, DEXs are expected to remain vital infrastructure for the cryptocurrency ecosystem and will continue to see improvements in transaction scalability, smart contract security, governance infrastructure, and user experience.

If you want to know more about how DEXs work, Leave us a comment so that we can improve this article.

Leave comments